Chemical Industry KPIs to Focus on in 2024

February 15th, 2023 (Updated 01/22/2024) | 9 min. read

By Garth Hoff

The chemical industry has been through a period of significant volatility with expectations for this to continue in the short to medium-term, on the back of massive disruptions to supply chains, and an ongoing war in Europe has pushed chemical companies to the limit. While during CoVID-19, the plastics industry was bolstered by increased demand, other chemical industry sectors struggled and maintaining production was sometimes challenging. But if as predicted the world falls into recession as economists foretell, how will the chemicals industry fare in the months and years ahead? With that backdrop we will examine in this article the traditional and less well-known chemical industry KPIS (Key Performance Indicators) to focus on in 2023 to help drive your company’s pricing, and as a result make your business as profitable as it can be.

At Pricefx, over the last 12 years we have been assisting our customers to track price moves and trends in real time. In partnership with a range of chemical industry clients, over this time we have developed advanced and innovative technological solutions that can assist in giving today’s modern chemical organizations a range of the kind of pricing tools they require to proactively engage with the rate of market change currently underway in the industry.

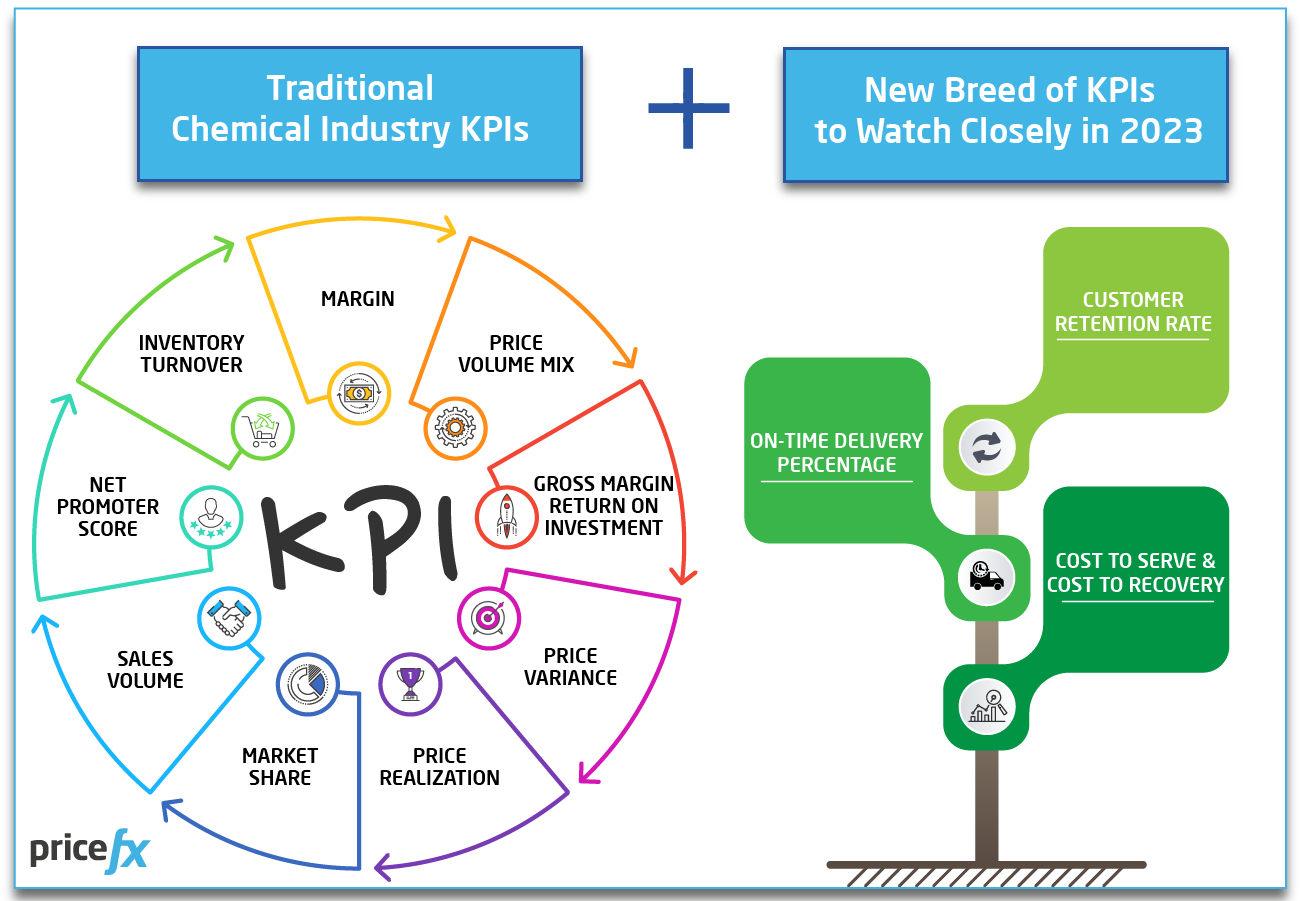

Chemical companies are under pressure from shifts in historical supply and demand patterns in sectors including automotive, industrial, consumer goods, high-tech, medical, and agricultural. In that current landscape, let’s remind ourselves of the traditional set of KPIs that chemical industry players need to watch closely now while also taking the time to also look at some of the more unconventional KPIs that could assist your business in 2023.

Don’t Forget Your Traditional Chemistry Industry KPIs

Tracking and maintaining your KPIs should be ingrained as a regular part of your company’s routine to make sure that you remain on the right track to achieving your company’s unique set of business solutions and objectives. In the chemical industry (just like any other), pricing is a critical aspect of business success.

Key to your chemical company’s profitability for the year ahead will be protecting margins, optimizing prices, staying informed, remaining nimble, and underpinning your strategy with the right technology.

While it is great to get creative in examining the KPIs your company needs to track in 2023, don’t forget the basic set of traditional set of chemical industry KPIs to optimize your pricing strategy, monitor your business outcomes and drive your organization’s growth. Don’t throw the baby out with the bathwater in the rush to get to the ‘next big trend.’ Most of these traditional chemical industry KPIs are as relevant as they ever were;

- Margin: This KPI measures the difference between the cost of goods sold and the revenue generated by the sale of those goods. By monitoring and optimizing margin, chemical companies can ensure that they are pricing their products appropriately to generate the desired level of profitability.

Using an automated price list management tool is one of the great ways to ensure that your prices are keeping pace with the price fluctuations in your raw materials and product ingredients and that your margin is not leaking out between the cracks with snail-like manual price list updates.

2. Price Volume Mix: Also known as PVM, it measures the impact of changes in price, volume, and product mix on revenue and gross margin. By understanding how changes in these variables impact business performance, chemical companies can make more informed decisions on pricing strategy.

For example, in 2022, demand for carbon black (a raw material used in automotive tires, wires, toners and printing inks) skyrocketed as supply from traditional suppliers such as Ukraine and Russia fell away due to the ongoing European conflict.

Prices increased dramatically as a result as more expensively sourced carbon black from China bridged the demand gap.

3. Gross Margin Return on Investment (GMROI): This KPI measures the return on investment for each dollar of gross margin generated by a product. By monitoring GMROI, chemical companies can identify products that are generating the greatest return on investment and optimize pricing to maximize profitability.

4. Price Variance: This KPI measures the difference between the actual price of a product and the target price. By monitoring price variance, chemical companies can identify pricing discrepancies and take corrective action to ensure that they are pricing their products appropriately.

5. Price Realization: This KPI measures the percentage of target price achieved by the company. By monitoring price realization, chemical companies can ensure that they are achieving their desired pricing levels and take corrective action if required.

6. Market Share: This KPI measures the percentage of total market sales that a company holds. By monitoring market share, chemical companies can understand how their pricing strategy is impacting their competitiveness in the market and make necessary adjustments.

7. Sales Volume: This KPI measures the number or amount of sales in any given period. By monitoring sales volume, chemical companies can understand how changes in pricing strategy are impacting demand for their products.

8. Net Promoter Score (NPS): This KPI measures customer satisfaction and loyalty. By monitoring NPS, chemical companies can understand how changes in pricing strategy are impacting customer perceptions of their products.

Use NPS to gauge, for example, how successful your company has been in communicating the price rises in your fertilizer products due to potash and ammonia shortages and make necessary adjustments to maintain positive customer relationships over the long-term.

Of course, being proactive in announcing how, why, and when price rises occur is key to maintaining a healthy NPS number.

Likewise, when prices begin to fall, do not forget to announce that to your customers too to have an NPS that other chemical businesses will envy.

9. Inventory Turnover: Lastly but not least, this KPI measures how quickly a company is selling its products. By monitoring inventory turnover, chemical companies like yours can understand how changes in pricing strategy are impacting product demand and make necessary adjustments to optimize pricing and drive business growth.

The New Breed of KPIs to Watch Closely in in 2024

In combination with your traditional Chemical Industry KPIs you may need to get granular when tracking several new and additional factors that before long may also evolve into additions to your old staple set of chemical industry KPIs, like these for example:

1. Customer Retention Rate: The 2020 Global Buyer Values Study for Chemicals by Accenture interestingly unearthed that customers are willing to switch chemical suppliers and materials if they find that their needs are not being met to a standard that matches their expectations.

This developing trend means that many chemical companies are at risk of significant levels of revenue depletion simply due to customer unhappiness. Firstly, make certain that your business is tracking your customer retention rates (some of you may do so already but simply call it by a different term – ‘customer churn’ for example).

For example, many chemical companies have experienced some very severe and abrupt price changes in the past few years that were completely unanticipated.

Producers all through the supply chain are pushing for more certainty and understanding around future prices going forward. So, as your customers begin seeking reassurance about how their prices will change in the future, you should remain engaged in the conversation.

You may have zero certainty about what your prices will be, but 100% certainty in your ability to remain open and transparent about it.

Whatever nomenclature your company uses, ensure that your business is focusing on protecting key customer relationships and winning over new customers to prevent customer churn. Using data and analytics to understand why your customers are loyal or not and to develop strategies to gain new business.

As a rule of thumb, retaining customers is far less expensive than finding new ones.

2. On-Time Delivery Percentage: What percentage of your products are arriving to your customers later than they are scheduled to? If your products are being delivered late, how late do they arrive? Since the pandemic, inflation, supply chain disruption and other ongoing crises, on-time delivery has become a key metric to gauge chemical customer satisfaction levels.

Maintain your on-time delivery percentage as high as possible to keep customers coming back.

3. Costs to Serve and Cost Recovery: Cost recovery focuses on customer specific cost to serve like freight, packaging, warehousing, and other services. Freight, or distribution costs, are just one of these. Make a point of monitoring unpredictable distribution costs such as truck, ship, and railway shortages, container and wooden pallet availability, fuel price fluctuations, and workforce shortages, as they may lead to increased costs for your business.

Chemical industry companies should remain vigilant and pass on increased costs to meet organizational margin and earnings goals. However, (as we intimated above) doing so with full and open transparency is key to keeping customers ordering and coming back to your business for supplies when their stocks have diminished.

The Best Way to Track Your Chemical Company’s KPIs in 2024

To effectively track both the traditional and new breed of KPIs, chemical companies should implement a robust pricing management system that can collect and analyze data from across the organization. This will enable them to gain a holistic view of your pricing performance and make data-driven decisions on pricing strategy. Additionally, a pricing management system can allow chemical companies to automate pricing processes and ensure that pricing is consistent across different channels and regions.

However, with the amount of data available to your business nowadays, it is sometimes hard to define what to measure (what data set is good or bad, clean, or unclean) and how to measure your data efficiently.

As an award-winning pricing software solution, Pricefx has more than a dozen years of experience in helping to facilitate chemical companies in finding their sole source of data truth, and once they have it, optimizing prices at the ‘sweet spot’ level to maintain each company’s customized and unique set of business outcomes.

To learn more about getting your data ready for high octane pricing performance, check out this handy video:

Investing in appropriate automation and pricing technology will not only make your chemical company more resilient to prevail in uncertain times, but stronger for when things get better when we come out on the other side.

If you would like to learn more about the best features that the Pricefx pricing software solution offers chemical industry organizations, click on the image below to learn more in this handy article:

Happy Pricing!