Top Distribution KPIs to Safeguard Your Business

May 11th, 2023 (Updated 06/28/2023) | 7 min. read

In the wholesale distribution industry, monitoring distribution KPIs plays a vital role in enabling data-driven decision making and maintaining a competitive edge. Having well-defined Key Performance Indicators, or KPIs, not only allows companies to quantify and track progress towards their business objectives, but also helps identify new opportunities for growth, improve efficiency, reduce costs, and enhance customer service. In this article, you’ll learn about the top distribution KPIs so your distribution business can focus its attention on the areas most critical to its success.

At Pricefx, with over a decade of experience helping our customers accomplish their pricing objectives with our cloud-native pricing software, we recognize that even the best pricing tools have little applicable use when a business doesn’t know how to measure its progress. And in a mixed industry like distribution, the KPIs driving growth might be especially difficult to identify.

Before outlining the most important KPIs for distribution, we’ll revisit what KPIs represent and why they’re especially important to be aware of in this industry.

What Key Performance Indicators (KPIs) Do and Why They Matter in Distribution

Apart from enabling companies to stay on top of its financial goals, KPIs are reliable benchmarks to measure other kinds of wins and losses; in the case of distribution, this could relate to a distributor’s customer acquisition and churn, influence (or lack thereof) in a market or region, how much product has moved and how quickly, among others.

The distribution industry is unique because it’s in essence a composite of several industries. As the connector between manufacturers, suppliers, and retailers whenever moving goods from place to place is concerned, distribution considers both a handful of KPIs from the industries it touches and some KPIs that are unique to that industry.

With distribution’s special positioning in the market, measuring its progress can become complicated. In the next section, we’ll outline the top pricing and non-pricing KPIs for your business to keep in mind.

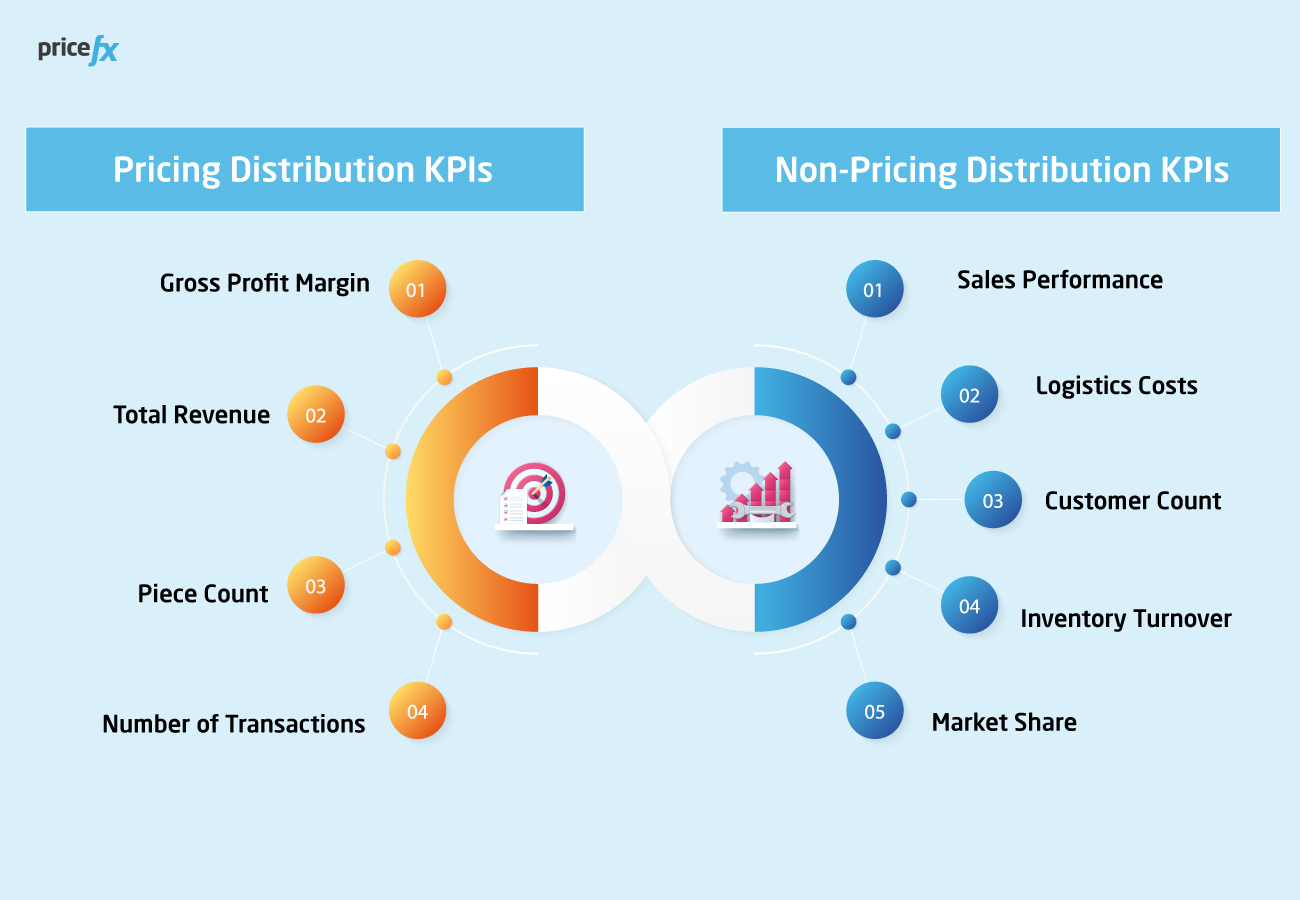

Pricing Distribution KPIs

The pricing KPIs relevant to distribution are mostly the usual suspects and aren’t unique to any specific industry. With that in mind, here are the top pricing KPIs in the distribution industry for you to be aware of.

1. Gross Profit Margin

Gross profit margin is one of the most standard KPIs across industries as it’s a pure indication of a company’s profitability. Expressed as a percentage, it measures what your company has made in pure profit after subtracting the cost of goods sold from net sales.

2. Total Revenue

Total revenue measures how much a company has made in sales by multiplying the price of a good by the number of goods sold.

3. Piece Count

Piece count is an expression of how many items a company has shipped over a period. This KPI is useful because it points to any slowdown or growth in the business.

4. Number of Transactions

This tracks the number of financial transactions made over time, specifically whether each has a positive or negative margin (in other words, whether it lost or made money for your company).

Non-Pricing Distribution KPIs

So, with all the pricing KPIs available to measure in distribution, what are some of the key KPIs to consider outside of pricing? As you’ve seen, there is no one master list of KPIs in distribution; each company defines its success a bit differently according to its business goals.

However, there are a few non-pricing measures which are always relevant in distribution that we’ll take a closer look at now.

1. Sales Performance

Sales performance is a KPI most frequently monitored by pricing, sales, and even marketing professionals. In wholesale distribution, it measures the total revenue generated by the business and focuses on product line, sales channel, and other segments. Sales performance is determined by tracking the number of units sold, the revenue of those sales, gross margin dollars and gross margin percentage.

An accurate measurement of KPIs related to sales performance is vital for identifying opportunities for growth and evaluating the effectiveness of pricing and marketing strategies.

2. Logistics Costs

Because much of a distributor’s business revolves around their warehouses and the art of receiving and delivering goods, having a KPI that measures your logistics costs is necessary. With many thousands or even millions of SKUs (stock keeping units), both stocking and non-stocking, to manage in distribution, this metric measures the expenses incurred in shipping and handling those goods.

Given logistics costs are an integral element of a distribution company’s overall expenses, monitoring them closely will offer valuable insights into areas of inefficiency and help to identify opportunities for cost reductions.

3. Customer Count

Tracking customer count is another crucial metric for companies operating in the wholesale distribution industry. This KPI measures the number of new customers gained and lost within a specified timeframe, which can indicate a business’s potential for growth and expansion.

By monitoring customer count, the cost incurred for acquiring new customers, and the long-term value of each customer, companies can use the customer count KPI to pinpoint areas in need of improvement in their customer acquisition and customer service strategies.

4. Inventory Turnover

Inventory turnover addresses the rate at which a company sells off its inventory. Holding inventory is inevitable in wholesale distribution but comes at a cost (most referred to as a carrying cost, calculated by dividing the total inventory value by the cost of holding the goods for a long time), so inventory turnover speed is crucial.

A high inventory turnover rate is normally considered a good thing, as it can point to strong sales or efficient inventory management. However, companies should pay attention here; if the inventory turnover rate is too high, this may also be a sign of potential stockout issues.

On the other hand, when the inventory turnover rate is too low, this may indicate overstocking, which would add to existing carrying costs and potentially reduce a distributor’s ability to continue to place orders suppliers, as capital is tied up in inventory on the shelves.

Companies should aim to strike the right balance in their inventory turnover rate to ensure the most effective (and profitable) management of their inventory.

5. Market Share

Tracking market share is a crucial KPI for all key stakeholders in the wholesale distribution industry across all levels of management, especially in the C-Suite. This metric measures the percentage of total sales that a company has in a specific market for a given product or service.

By monitoring market share, companies can assess their performance compared to their competitors, identify opportunities for growth, or know when to allocate additional resources to win greater market share.

Expand Your KPI Tracking Capabilities with Pricing Software

In summary, distribution KPIs are simply a vehicle to track the health of a business operating in the wholesale distribution space – and with intense competition prevalent in the industry, it’s crucial to have a comprehensive understanding of your business’s performance to be successful.

To take your KPI tracking capabilities to even greater heights, consider checking out our article below on key pricing KPIs and discover how your distribution business can use pricing software to capture deeper insights into its pricing performance with pricing waterfalls: