Manufacturing Pricing Strategies: Tips, Types & Examples

May 5th, 2022 (Updated 03/10/2023) | 14 min. read

Global manufacturing companies are arguably facing a more challenging set of conditions than in other era in their collective histories. The prices of raw materials—including zinc, lithium, iron, copper, steel, lumber, and plastics—are on unprecedented rises, while investment in plant capacity is struggling to keep pace with the demand of growing global markets. Simultaneously, distribution and shipping costs have accelerated in recent times, meaning that manufacturers cannot simply shift production abroad where labor costs are less as a money-saving method. In that light, we are going to examine manufacturing pricing strategies in-depth in this article.

At Pricefx, for more than 10 years now we have assisted manufacturing industry clients from all corners of the planet in optimizing their prices to help build profit and coordinate their unique business objectives with a customized data-informed pricing strategy.

Of course, to set a customized pricing strategy for your manufacturing industry business, you will need to set goals of what you want to achieve for your organization. Once you have your goals framed, your pricing strategy options will reveal themselves to you.

In this article, we will analyze the key goals for a manufacturing pricing strategy and how to achieve/set them, check out some famous manufacturing industry pricing examples and tips for manufacturers to code resilience into their pricing in the current uncertain environment.

What is the Goal for a Manufacturing Pricing Strategy?

Of course, in putting in place a pricing strategy for your manufacturing company, the number one goal should be to maximize profit. Even though some pricing managers may suggest that increasing sales volume is required to increase profits, volume alone may not necessarily mean more profit. The optimum price for any product may not be the one that shifts the most units, nor may it always will be the price that has the most profit margin per item.

The optimum price will most often be the price that best complements your manufacturing organization’s unique set of business objectives.

Most often, that will be the type of manufacturing pricing strategy that leads to the greatest profit, but it may not always be the case.

Your best-selling price is usually derived from your costs and the current market conditions on the pathway to profit optimization.

Manufacturing Pricing Strategy – Price Setting

In determining your manufacturing company’s best-selling price, think of the price as made from five key components.

The five elements in your price to create your 5-layered manufacturing pricing cake are:

- Your Customers: Your customers’ ‘willingness to pay’ is a crucial factor in determining the ideal price to sell your products.

- Direct costs – Direct costs are the cost of the material and labor costs required to make your products. You have these costs for new products only when you manufacture them.

- Other Manufacturing overheads – depreciation of machinery, factory repairs, janitorial services etc. Continue even when you are not making your products.

- Non-manufacturing overheads – selling, marketing, salaries, administration etc. are ongoing even if your production plant takes a break or ceases to operate.

- Profit Margin – Profit margin is the percentage of sales that a manufacturing business retains after all expenses have been deducted.

Considering the above components in price setting in the manufacturing industry, the overwhelmingly popular strategy used in the industry is the cost-plus pricing strategy, although value-based pricing is increasingly becoming attractive to manufacturers.

We will learn more about cost-plus pricing and value-based pricing later in this article.

Complications in Setting a Manufacturing Industry Pricing Strategy

If only it were that simple. While in general the four key manufacturing pricing strategy elements apply, it does get a little more complicated in real life.

Imagine a perfect world where you can manufacture and distribute as much of your product as you can sell using a pricing strategy based on your direct costs. Your profit would depend on how successful you are at projecting unit sales volume at varying selling prices.

However, in most manufacturing companies, several factors complicate price setting. Usually, the quantity of a product that you can manufacture in any given period is limited by the capacity of your production plant, availability of raw materials or by your labor force.

Shipping directly to customers or manufacturing to increase the inventory on your warehouse shelves has a direct bearing on your production and therefore, your pricing.

You will need to factor in these types of factors in setting your pricing strategy and to maximize your profits.

Boeing vs Airbus – A Famous Manufacturing Industry Pricing Strategy Example

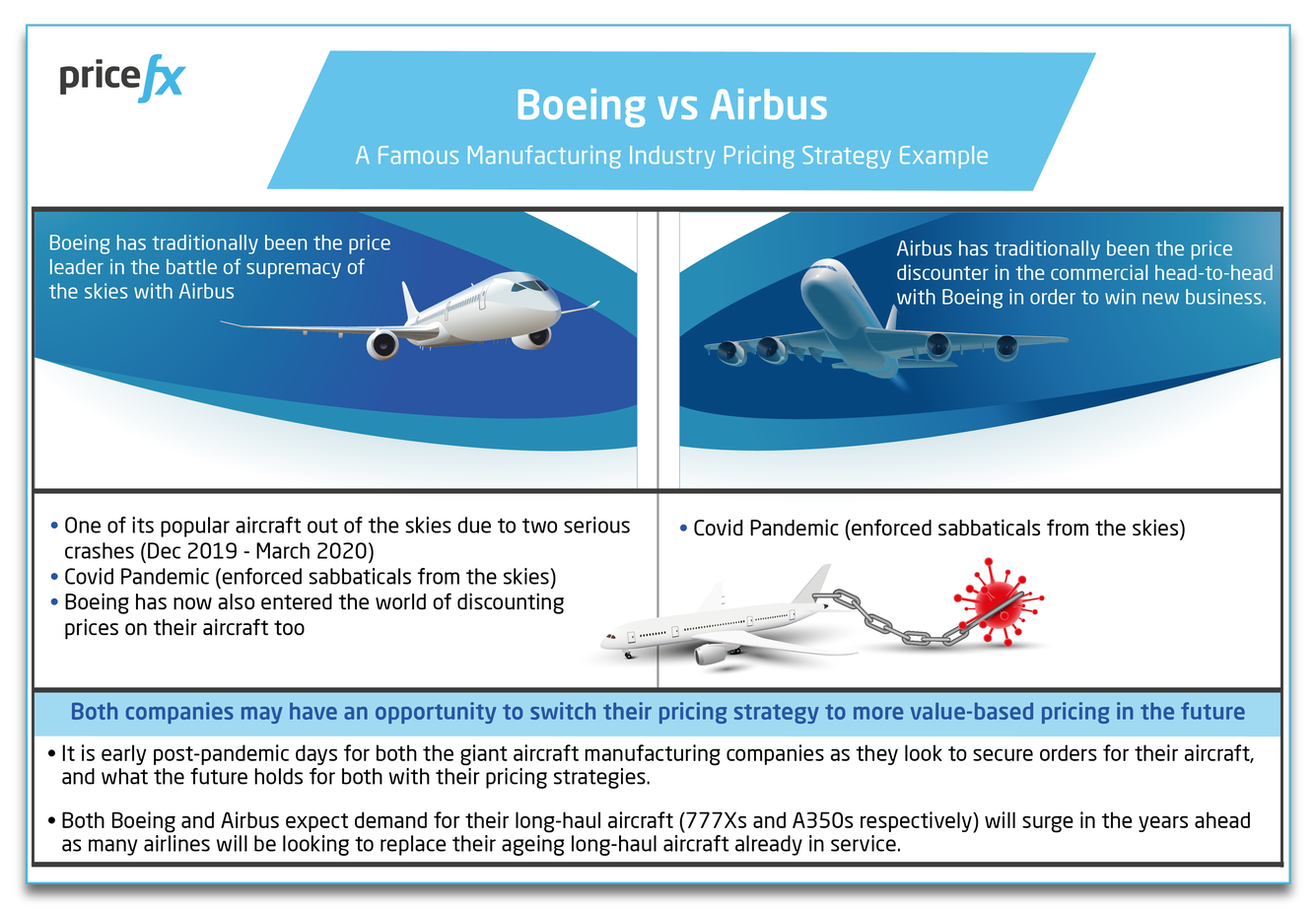

The Airbus-Boeing commercial aircraft duopoly is now almost 4 decades old, and competition between the two companies is intense, to say the least. 2020-2021 was practically a write-off for both companies due to the empty skies that accompanied the global pandemic. However, with the skies beginning to fill again, it’s interesting to examine the difference in pricing strategies between the two commercial aircraft manufacturing giants.

Perhaps as being the first major player in the commercial jet aircraft market, Boeing has traditionally been the price leader in the battle of supremacy of the skies with Airbus.

Airbus, for its part in beginning its commercial life as an aircraft industry disruptor, has traditionally been the price discounter in the commercial head-to-head with Boeing in order to win new business.

Then, along came two major events that forced Boeing to rethink their price leader pricing strategy.

Boeing had one of its most popular aircraft (the Boeing 737 MAX) out of the skies between December 2019 and March 2020 due to two serious crashes. Then, along came the pandemic and we all know what happened after that with many airlines taking enforced sabbaticals from the skies.

What that meant for Boeing is they have now also entered the world of discounting prices on their aircraft too alongside Airbus.

It is early post-pandemic days for both the giant aircraft manufacturing companies as they look to secure orders for their aircraft, and what the future holds for both with their pricing strategies.

Both Boeing and Airbus expect demand for their long-haul aircraft (777Xs and A350s respectively) will surge in the years ahead as many airlines will be looking to replace their ageing long-haul aircraft already in service.

It may mean both companies may have an opportunity to switch their pricing strategy to more value-based pricing in the future.

Time will tell for Boeing and Airbus, but the point is that being able to pivot and flexibly switch between pricing strategies as circumstances change is critical for any manufacturing company.

Tips for Manufacturers to Increase Pricing Flexibility in Uncertain Times

As discussed above, disruption to the status quo has become the new normal for the manufacturing industry. We have compiled some tips for maintaining flexibility in your pricing strategy as a pathway to securing profitability and growth in the anticipated increasingly volatile times ahead.

Set Up Flexible Supply Chains

Constant supply chain disruption is adding to the complications and costs of manufacturers globally.

Manufacturing companies are being required to rethink supply chains to enable adaptation to whatever disruptions that may rear their ugly heads.

Consider possibly diversifying your suppliers with a thought to mitigating the impact of international supply chain disruption and examine cost challenges where conflicts with suppliers may exist.

Alternatively, on occasion you may be able to turn supply chain disruption in your favor, particularly if you have a product of which you are an exclusive supplier. You can continue to charge a premium price for your products and even hold back supply yourself to maintain strong profit margins for your business.

Be Pricing Agile to Meet Price Volatility Head On

Be on the lookout for shortages and buy in advance to secure raw materials of production at reduced or discounted rates so you can meet demand and costs as effectively as possible. Watch for key products to target with specific upward price changes and leverage them to make the most of the good times.

Pricing software that will allow you to track and leverage real-time raw material index inputs will be critical to your success. The technology will allow you to pass on price increases to customers to protect your margins in addition to price decreases to preserve your business relationships.

Pivoting your pricing strategy easily will be enhanced by pricing software technology.

Maintain Competitive Advantage Through Increased Technological Efficiency

Manufacturing companies looking to maintain their competitive advantages and increase growth and profitability should seek to invest in the digital capability to empower efficient, accurate and predictive processes at every stage of the production process to pricing.

As you transition your factory floor toward a more digital future, keep your pricing in mind for a technology upgrade too. Snipping unrequired costs in production and analyzing the impact of your changes on your costs and price will be critical.

Value in manufacturing can be driven by understanding the parts of the production line that can be improved. You have worked hard to introduce efficiency, so why pass all of the savings on to your customers?

By using a value-based pricing approach, rather than a ‘cost-plus’ strategy, you can build in rewards for your business and staff while your customers are still rewarded with a quality product.

Embrace Change & Move into New Sales Channels

Never sold online before? Maybe now is a good time to consider it.

Wherever you have never worked before, whether its online or selling direct to your customers without your wholesalers or distribution middleman involved, embracing change, and moving into new sales channels may have positive impacts you might have never considered before.

Choosing a new sales channel may enable your business to reach new customers, build relationships and gather invaluable customer data in more diverse ways than you did previously.

If you are moving into selling online for the first time, ensure that your chosen pricing software solution will be able to be seamlessly integrated into your e-commerce platform to automate your price updates as required.

Become Acquainted with Value-Based Pricing

As former JC Penney and Apple boss, Ron Johnson once famously said; “Pricing is actually pretty simple…Customers will not pay literally a penny more than the true value of the product.”

Manufacturing companies may need to customize customer-specific dynamic pricing strategies to make the most of their clients ‘willingness to pay.’

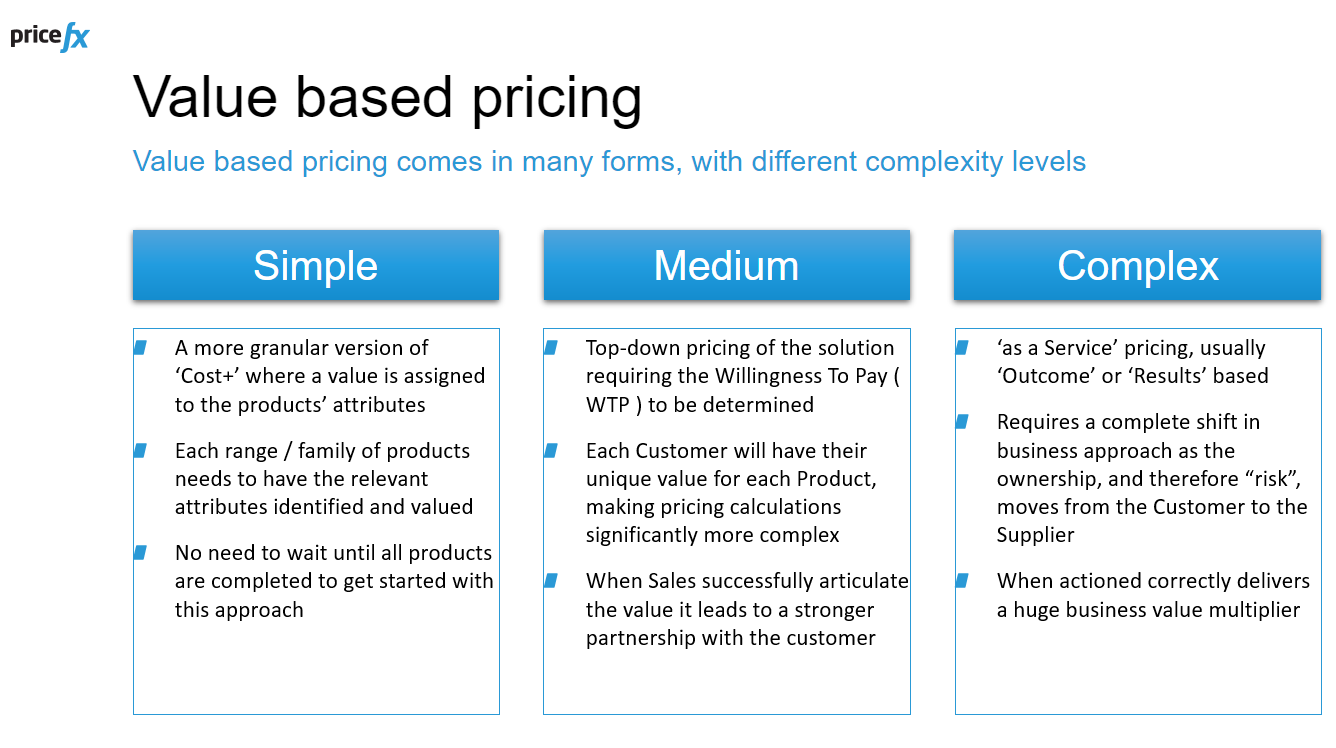

Having the correct pricing technology in place to achieve value-based pricing in the manufacturing industry will make value-based pricing easier to set up and maintain over the long term. Value-based pricing is not a simple one-line formula that can be executed for every product or service.

While value pricing is a fantastic undertaking to command higher prices for opportunities that drive higher value to your customers, you’ll likely require technological leg-up to achieve it.

Become More Profitable by Introducing Automated Pricing Processes

Give your sales teams more confidence to defend your prices during price negotiations with a 360° view of customer accounts and the guidelines provided through that holistic perspective. With strong CPQ capabilities your company’s quotation process will improve with automated approvals and workflows enabling winning more deals.

CPQ-supported salespeople take 27 % less time to produce a typical quote than those not using a CPQ solution. Shorter sales cycles can empower you to send prospects 49% more contracts, proposals, and quotations, faster and more accurately.

Automated rebate management will rein in your discounts and rebates, and help you become more selective with attractive and profitable win-win promotional offers. More creative discounting will help your manufacturing business build mutually beneficial relationships.

Embrace Changes to Your Current Pricing Status Quo

The bias of maintaining the status quo and preferring that things stay as they are or remain the same is a death knell for most manufacturing companies in the current volatile economic environment.

If you have just a few products or a rigid customer base, then maintaining your company’s pricing strategy in Excel may be sufficient for you. But on the flip side, Excel is not an analytics tool and cannot interpret rapid changes or set prices in real time.

AI-informed and data-driven pricing software will assist in staying on top of rapidly changing market conditions and execute price changes quickly. The rapid insights will help you identify your best and worst performing products immediately, examine opportunities for profitability quickly and potentially mitigate problems and margin leaks before they occur. It certainly takes less time to press one button to execute a price change in pricing software than go through ten-of-thousands of lines of data updating prices item-by-item in Excel.

To learn more of the advantages of pricing software directly compared to Excel, check our recent article: ‘Excel vs Pricing Software – 5 Reasons Switching Could Benefit Your Business’.

Best Pricing Strategies for Manufacturing Companies

Establishing your company’s pricing strategy for your manufacturing business can increase your earnings in addition to ensuring you earn as much back on your products as possible while continuing to maintain customer loyalty.

It’s worthwhile remembering that while you might be a fan of a particular pricing strategy, circumstances may occur that you consider employing a combination of different pricing strategies across your different product or customer segments.

In fact, depending on your company’s unique business objectives or product lines, employing a range of pricing strategies could be in your organization’s best business interests.

Popular pricing strategies used in the manufacturing industry include:

- Competitive Pricing Strategy – A competitive pricing strategy is a pricing method that involves setting the prices of your businesses’ products in relation to the prices of your competitors.

- Cost-Plus Pricing Strategy – Cost-plus pricing is sometimes also referred to as markup pricing and is a favorite in the manufacturing industry. It’s a pricing strategy whereby a fixed percentage or fixed amount is added on top of the production of a single unit. The resulting number is the selling price of your product.

- “Equipment As a Service” Pricing – A hot and trending pricing strategy in the manufacturing industry is Equipment as a Service (EaaS). What this means is that traditional manufacturing industries are now introducing pricing models for services (liters of clean water cleaned by your water filters, cost per flying hour on your jet engines etc.). In other words, even in manufacturing, pricing beginning is turn towards ‘pay-per-use’ models. This is in direct comparison to traditional cost-plus product pricing models in order to generate more value from your manufactured products.

- Supersession Pricing – Supersession Pricing is a form of pricing whereby your once-premium priced products are replaced by a new model (and therefore sold at a higher price and literally ‘supersede’ older products) to become the new premium-priced product due to seasonality, fashion, or better functionality. The older products may decrease in price, although it is not always the case. The auto spare parts industry is a prime example of one using supersession pricing. Due to engineering changes in new car models, old spare parts can become obsolete and need to be replaced by new, upgraded and frequently, higher-priced versions.

- Value-based Pricing – Value-based pricing is a strategy of setting prices primarily based on a consumer’s perceived value of a product or service —also known as customers’ willingness to pay—to determine the price it will charge. Because it revolves around customers’ priorities, it’s occasionally called customer-focused pricing but that tends to over-simplify and underestimate the value of your products value to you as a manufacturing business.

In our opinion, value-based pricing could be aptly re-named the ‘win-win pricing strategy.’

Your customers do not care how much something costs you to make or your competitors’ price tag.

They care how much value they are receiving from your product at your price, opening up your company’s side of the value/profit equation.

That’s Great – I have a Manufacturing Pricing Strategy in Mind, But What’s Next?

Now you know many of the intricacies and considerations behind manufacturing pricing strategies.

You may have already considered or determined the best pricing strategy that might suit your manufacturing company. What’s more, it has probably become clearly apparent that using the granularity and flexibility that next generation pricing software like Pricefx provides will be critical to the success of your organization’s pricing strategy.

But how should you get started in implementing your manufacturing business pricing strategy? What happens in the future when your needs change? Have you got the right pricing software partner who is flexible enough to support your constantly evolving needs?

To learn more about how to implement a customized pricing strategy for your manufacturing business, check out the handy article below: