Not Using Pricing Software? – What Am I Missing Out On?

March 6th, 2023 (Updated 03/09/2023) | 7 min. read

In our recent article “The Cost of Inertia (Not Using Pricing Software)”, we took a direct and hard-hitting look at how many full-time employee positions that your company could save per year when rough economic seas or a recession hits, simply by choosing to implement a pricing software solution. However, your company might be doing fine without pricing software and making hay while the recessionary sun shines. But did you know that your business could be doing even better?

In a recession, where every penny counts, pricing software could help you cut costs by showing by identifying areas where you are overspending, identify new customer segments to leverage or even undertake price list update simulations to test the effects of your price changes before they are implemented.

At Pricefx, we have more than a dozen years of experience assisting our customers in achieving payback from their pricing software and supplying them with the tools to track the success of their investment. What more, it’s articles just like these that you can use to help you go forward and get the managerial support that you need for your software’s implementation.

So, let’s dig in and look at a range of business improvements that your company could potentially be missing out on by choosing not to use next-gen pricing software.

Get Your Pricing Right & Don’t Miss These Benefits

Getting your company’s pricing right requires a little push in the right direction from technology. Consider these additional benefits your business could be missing out on by NOT adopting a next generationpricing software solution:

Proactive Price List Management Allows for Agile, Accurate Pricing & Prevents Margin Compression and Leakage

Manual price list updates (in Microsoft Excel for example) for your products are simply too slow to accommodate rapid rates of price fluctuation.

If you have tens of thousands of SKUs to update daily, weekly, or even monthly, the chances of them being completed on time are poor.

If your price list updates take up to 2 or 3 months to complete, rapid raw material and delivery price changes are leading to margin leaks for your company, and money is falling out between the cracks.

Using the Price Setting functionality of the Pricefx pricing software solution, giant European tire manufacturer Michelin plugged their margin leaks by cutting their price list recalculation time from 2 months to 20 minutes!

What’s more, with pricing software, it will become easier to anticipate the business impact of pricing changes. There will be clear visibility of where you are losing margin when items are priced too low, or where you are losing revenue because items are priced too high. Pricing software and how it enables superior price list management will improve the way that your organization understands your company’s pricing ‘sweet spots’ for your goods and services.

Fast Reaction to Vendor Cost Increases

Imagine that one of your vendors increases their price and you see it immediately following the change. Naturally, you will be required to increase your price to reflect the cost increase.

By the time this cost increase is reflected in your own price, you have spent days, weeks or (gulp!) even months absorbing that increase in your margin and losing money. Surely, you would prefer to react quickly to a vendor cost increase, so you do not spend time absorbing that cost increase and have it eating into your margins.

With a pricing software solution, you can automatically and dynamically reprice across your entire portfolio based on real-time indices or vendor cost lists, reducing your lag time from months to minutes, and ensuring you are always passing costs on to customers and achieving your full profit margin.

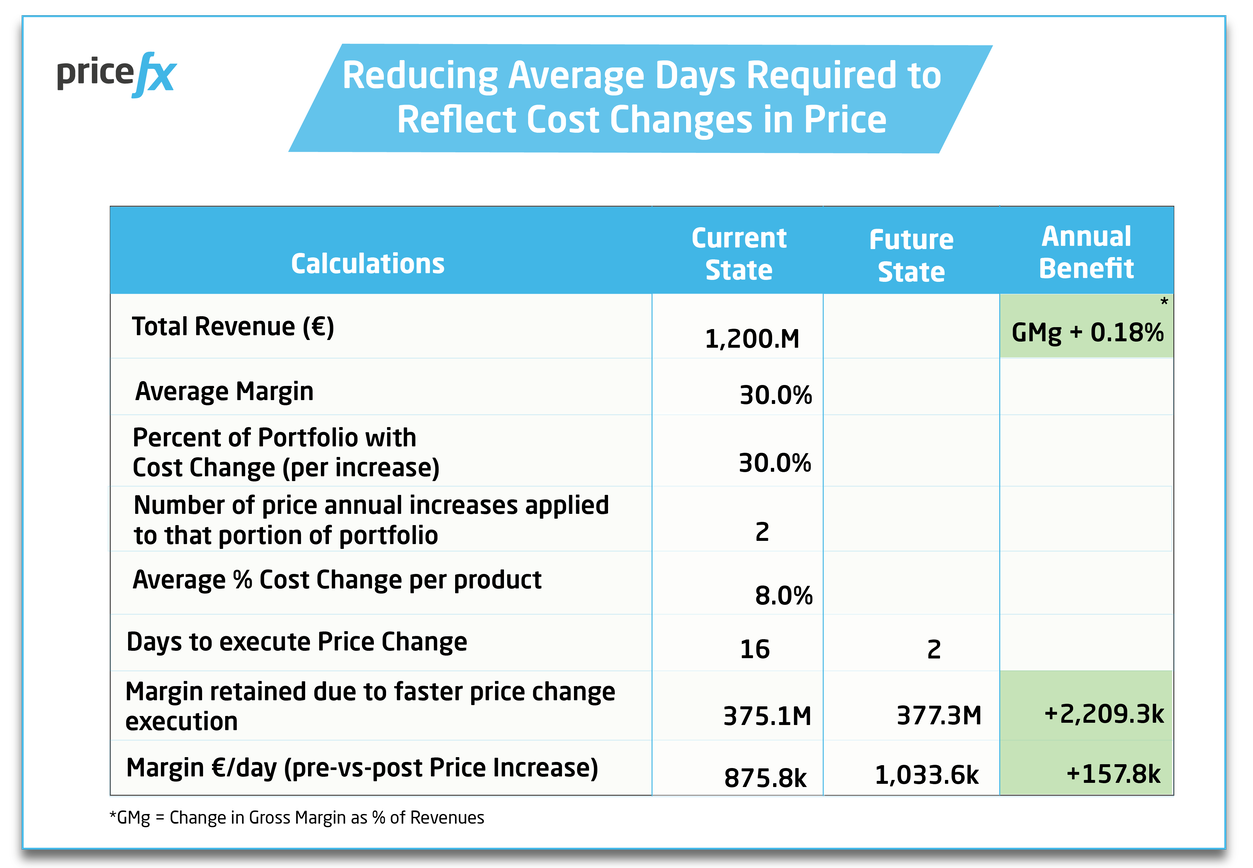

When we were software making the case for Pricefx to one of our customers, it became apparent that the organization concerned (with €1.2 billion in revenues) needed to react to cost increases on 30% of its products by 8% at least once, sometimes twice per year. On average, (prior to using our pricing software solution), it took their business 12 to 31 days to update their prices in response to vendor cost increases, costing them €157,800 extra per day, every day.

Do you want that to be the story for your company?

The price list impact simulation functionality of some pricing software even allows you to assess the business impact of an intended update of a price list before applying it to the market while considering all elements of the related price waterfall, including special price agreements. It provides a visual comparison of a simulated price list change scenario with the current status quo, as well as all relevant calculation outputs to evaluate intended changes.

Learn More About Price List Simulation Here

Competitive Positioning & Agile Pricing to Improve Margin & Revenue Numbers Quickly

An industry-level benchmarking tool, Pricefx Plasma tool allows for B2B enterprise companies to develop strategic insights in their pricing performance and processes compared to similar companies in terms of their scope, industry, size, and regions.

The technology allows for enterprise-level organizations just like yours, important insights to develop business advantages to enhance their pricing strategy and execution by precisely measuring their pricing performance against their competitors.

Powered by data-driven assessment of target setting and developing business opportunities, Pricefx Plasma does away with guesswork, anecdotical evidence, and poorly defined benchmarks in appraising your company’s pricing. Data is compiled from Pricefx pricing software users across 10+ industries and more than 100 companies. A set of more than 20 market-relevant performance KPIs reveal insights into your pricing and helps by calibrating your pricing performance against competitors or even between different departments in your own company and tracking your organization’s performance over time.

However, the illuminating pricing power of Plasma comes sharply into focus once you combine the insights available with the total Pricefx pricing solution.

Looking at just a few examples from the 2023 Pricefx M1 Metrics Database report:

- One Food & Beverage company reported year-on-year increases (from their pricing software go-live date) to both their Revenue (13.7%) and Margin (18.7%) numbers.

- Another discrete manufacturing company saw a 37.4% increase on their revenue figures just 12 months after their Pricefx software go-live.

- Yet another discrete manufacturing company saw their revenue (20.4%) and margin (37.7%) increase after 12 months of their pricing software go-live.

Want to do the numbers for yourself?

If you would like to get a feel for where pricing software could potentially take your margin numbers, check it out for yourself on our free Margin Lift Calculator:

Return-To-Investment (ROI) Time with Next-Gen Pricing Software

Due to its abbreviated time to implement, minimal maintenance costs and greater value through increased capability over first-gen models, Next Gen pricing software has a markedly shorter ROI time.

Return on Investment (ROI) times are calculated in a process whereby the initial outlay (annual subscription costs), the total cost of ownership (TCO) and the financial benefits provided by the software to your business are assessed.

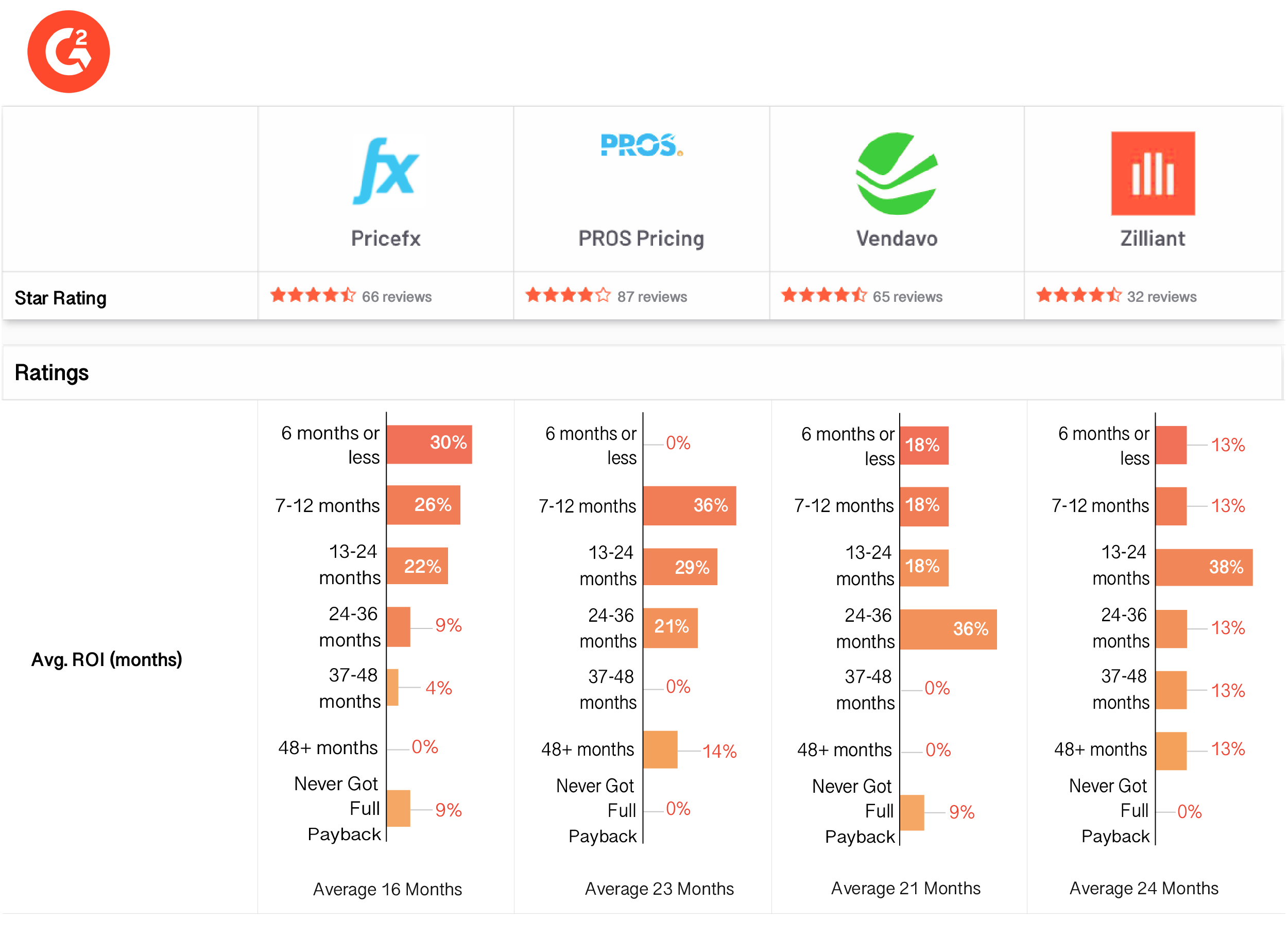

A study by peer-to-peer review site, G2, finds that 56% of Pricefx customers achieved ROI payback in 12 months or less, while 30% reached those results in 6 months or less. That is significantly faster than ‘legacy ‘or ‘first-gen’ pricing software providers.

Okay, So I Can Tighten Margins BUT How Much Does Next Gen Pricing Software Cost?

Now you know some more of the basic costs for your business of choosing NOT to implement a next-gen pricing software solution for your company.

Right now, your business could be losing millions of dollars annually through revenue and margin leakage because of bad data, decisions based on inaccurate analysis, inability to react swiftly, and poor communication.

We understand that investing in award–winning next-gen pricing software like Pricefx is no small decision, and naturally, you still want to know what the bottom line is and if your business can afford the upfront outlay.

Check out this handy article on the cost of a pricing software solution:

However, if you are ahead of the game and you have done your cost calculations, talk to one of our pricing experts today to get started.