Cost Plus Pricing: Everything You Need to Know

June 24th, 2022 (Updated 03/10/2023) | 11 min. read

Knowing which pricing strategy to employ for your business can be confusing. Cost-plus pricing is considered the simplest of all. But could it bring the same benefits as more sophisticated strategies? Do the drawbacks pertain to your industry? Should you be considering a cost-plus strategy?

At Pricefx, we have spent a decade helping customers work out the best pricing strategies for their specific businesses and are in a good position to guide you on the merits, weaknesses and uses of a cost-plus strategy.

In this article we’ll explore what cost-plus pricing is, the benefits and drawbacks of using it, and when you should or shouldn’t be considering a cost-plus pricing strategy. We’ll also look at some companies using it to great success and why it works for them.

What is a Cost Plus Pricing Strategy?

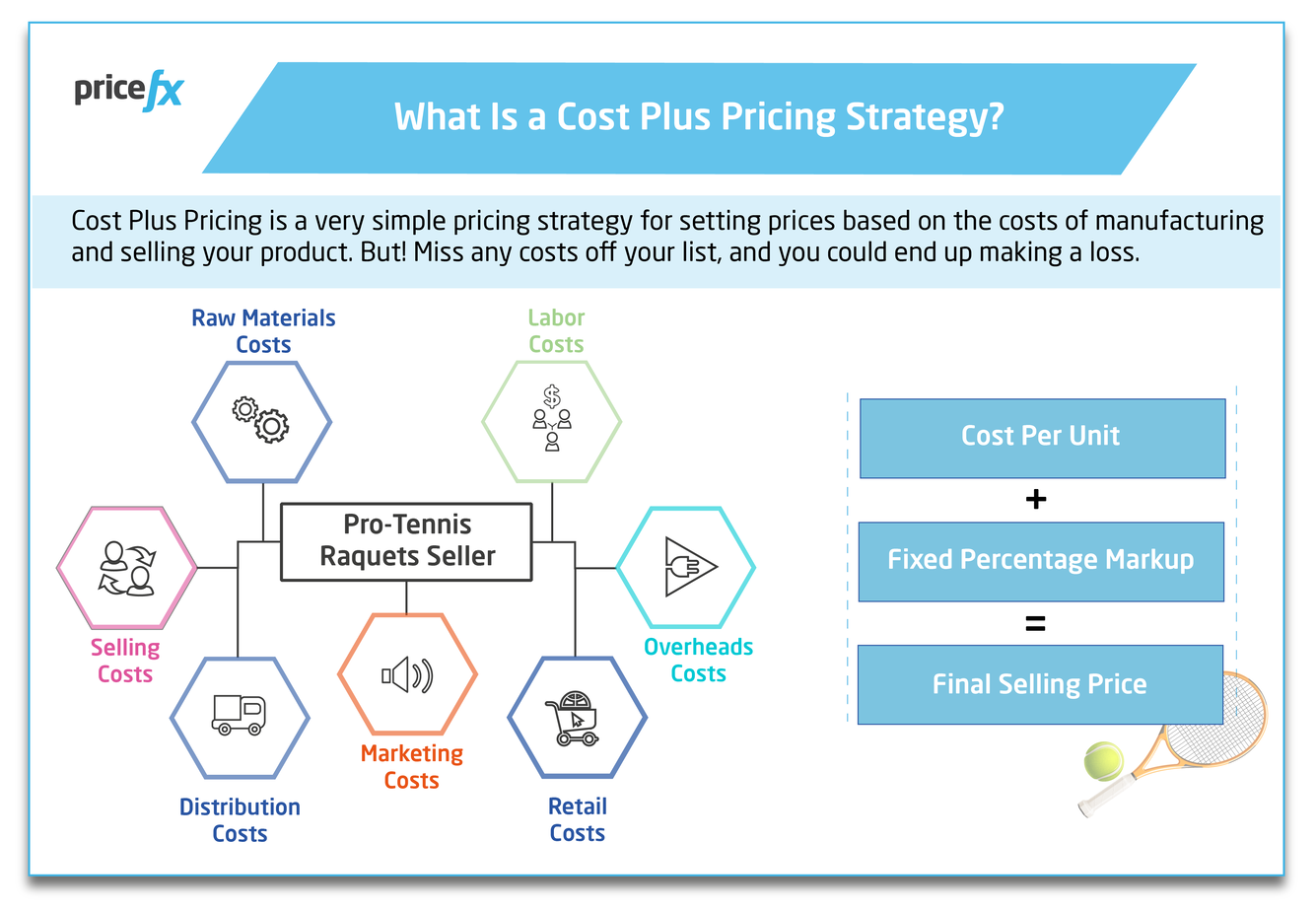

Cost-plus pricing (also called markup pricing) is a very simple pricing strategy for setting prices based on the costs of manufacturing and selling your product.

Let’s say you’re selling pro tennis racquets. You first calculate your cost per unit, then add a fixed percentage markup on top to determine a final selling price that ensures a profit.

In order to lock in the margin you’re hoping for, it’s important to have an accurate understanding of all business costs involved in the manufacturing and selling of your tennis racquets. You need to factor in everything from acquiring raw materials to getting the product into your customer’s hand, including raw materials, labor costs, and overheads, as well as marketing, selling, distribution and retail costs. Miss any costs off your list, and you could end up making a loss.

In most cases cost-plus pricing focuses entirely on internal factors and disregards external factors like consumer demand and competitor prices. However, some companies may take current market or economic conditions into account when setting their markup percentage. For instance, they might use a lower markup if demand is slow but place it higher at times when they feel they can command more.

How to Set Up a Cost Plus Pricing Strategy

Setting up a cost-plus pricing strategy couldn’t be easier; here is the formula:

Price = Cost x Desired Profit Margin

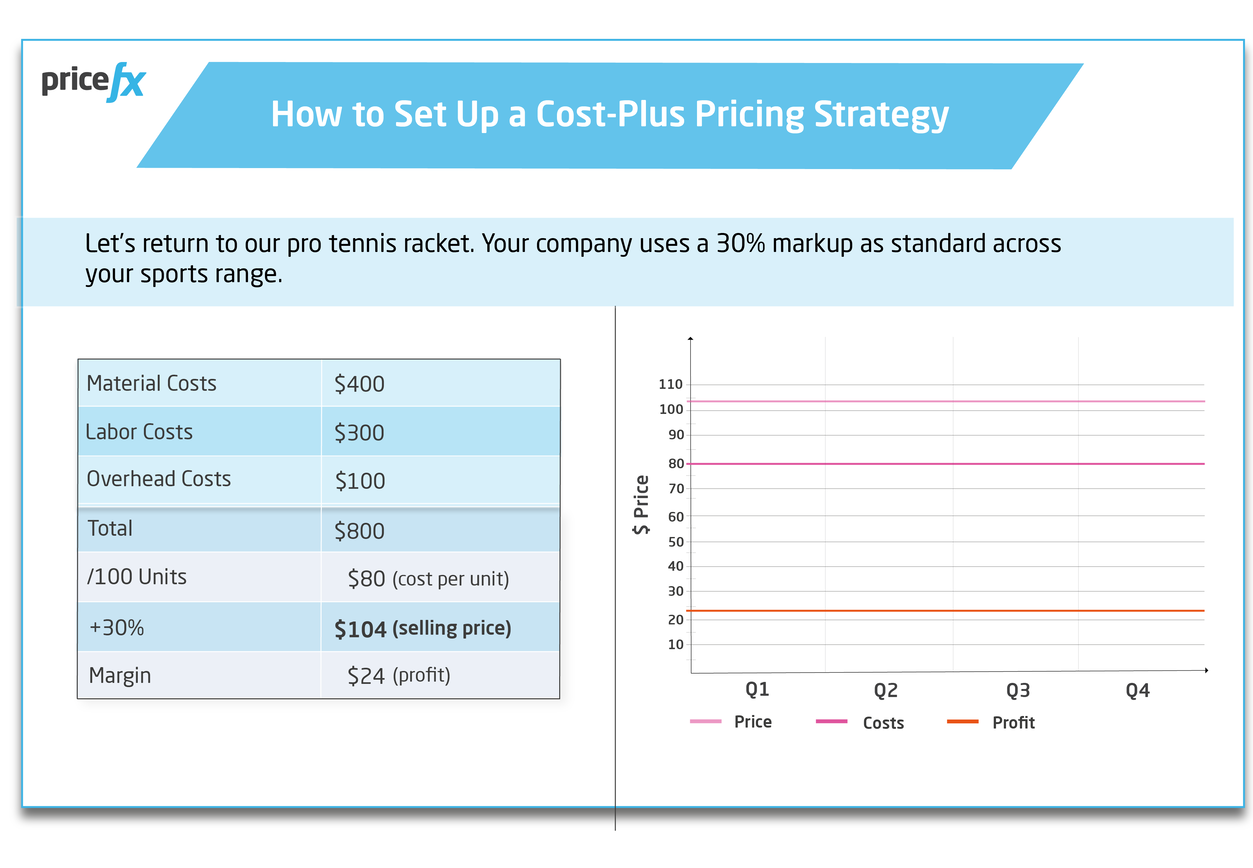

So, as we’ve learned, your first step is to determine the total cost of your product or service, making sure you include both fixed costs (those that do not vary by number of units) and variable costs (those that do).

When you have your total costs, divide the figure by the number of units, to work out your cost per unit. Then multiply your unit cost by the markup percentage. The result is your final selling price.

Let’s return to our pro tennis racket. Your company uses a 30% markup as standard across your sports range.

An alternative way of using cost-plus pricing is to work out your costs and then simply add the amount of desired profit you’d like to see per unit, keeping in mind what you think the market can bear.

Price = Cost + Desired Profit

The Benefits of Cost Plus Pricing

Done right, a cost-plus strategy ensures all production costs are covered. If your sales team knows that you’re using a 30% markup per unit, they’re able to offer 10% or 15% as volume incentives, without accidentally pricing your offering at a loss.

Not only is it safe, but it’s predictable as you can easily estimate revenue based on historical sales data. It’s also simple to work out and requires few resources. So if you’re not going to do extensive market research and the only data you do have to guide pricing decisions are your total costs, then a cost-plus approach is helpful.

Other pricing strategies would require you to calculate customer willingness to pay or to take competitor prices into account. Even if you plan to use such strategies in the future, cost-plus pricing can give you a safe starting point and get you to the market quicker.

A cost-plus strategy also makes it simple to ensure profit margins are maintained should production costs increase and makes it easy to explain and justify those increases to customers.

But, before you get excited… let’s move onto the drawbacks of such an approach.

The Drawbacks of A Cost-Plus Approach

One of the main attractions to cost-based pricing is that it removes the risk of selling at a loss. However, this does depend on you having factored in every cost from R&D right through to aftersales services. Miss anything, and you could be in trouble. But what if you predict high sales volumes, therefore choose a low markup but sales are lower than anticipated? Unforeseen return of unsold goods could mean your costs aren’t covered, which could deal a financial blow to your business. Of course, you can buffer against such unaccounted-for costs and demand fluctuations by increasing your margin, but where does that place you in the market?

Talking of price changes, companies relying on a cost-plus strategy have likely not seen the need to invest in pricing software, as the math is something you learn at school. Most are likely working out prices in Excel.

_____________________________________________________________

Learn About the Mistakes to Avoid When Migrating From Excel to Pricing Software

Click Here

_____________________________________________________________

This can be time-consuming (not to mention prone to error), but the worst part is that it means you’re working with historical costs from days, weeks, even months ago. If these suddenly increase (as they are wont to do), you’re swallowing those extra costs in your margin until you’re able to update your “system” with up-to-date costing figures.

Another major drawback of the cost-plus approach is that it doesn’t factor competitors into pricing decisions. Pricing your offering too low for the market would mean throwing away potential profit, and pricing too high could lose you sales and market share. You need competitive data to understand what the market can bear and where you wish to position yourself in it.

One cannot assume that one’s unit cost is competitive. Your tennis racquet may cost $80 per unit, but your competitor may be producing them for $40. With your 30% markup, your selling price is $104. The same markup would make their selling price just $52, but instead, they use their competitive data to retail at $72. Not only have they increased their profit by a $20 per unit but they’re still beating your price and likely stealing market share in the process. Then they offer off-season 20% discounts that still maintain over 30% profitability. If you’re in a busy market, especially one where competitors are employing more sophisticated pricing strategies, a cost-plus approach could find you losing the game.

This also highlights the importance of keeping production costs low. A cost-plus pricing arrangement gives your suppliers little incentive to streamline processes or cut costs. Instead, they’re focused on including every possible cost in their contract, possibly even inflating the odd figure here and there. Think about all those government guaranteed profit arrangements that hemorrhage billions of dollars annually on substandard workmanship. It’s important that your contractual arrangements include cost-reduction incentives.

But almost more dangerous is the lack of customer focus: a cost-plus strategy doesn’t take your customers into account.

It’s important to remember that customers care little about your costs or your margin. What matters to them is the value your offering brings them.

An inward-facing approach, a cost-plus strategy means you’ve no need for market research to work out exactly what your customer’s perceived value of your offering is and therefore the maximum you’d be able to charge them for it. Not pricing based on the willingness to pay of your various customer segments means you’re leaving money on the table with those willing to pay more, and possibly losing those customers whose willingness to pay doesn’t quite reach your cost-plus price point. That’s why so many businesses have moved to a value-based pricing strategy, with which they’re able to leverage price differentiation across their segments.

A lack of customer centricity also tends to run through an entire business.

Without the extensive customer research required for a value-based approach, you could see product costs overrunning because the engineering team is not prudently designing around the exact needs of your target market, but instead around its own idea of what it needs. (Or worse, is simply flexing its engineering muscles.)

More risky still, is that an inward looking approach can make you susceptible to external risks. A cost-plus strategy is anything but progressive. While your customers and the market continue to change, you need to beware that you’re not becoming passive in your attitude towards pricing as a company. It’s your most important lever to improving profits, so you have to be willing and able to adapt your strategy to changing conditions if you want to remain successful in the future.

Who Should Consider a Cost Plus Strategy?

The fact that cost-plus pricing doesn’t require extensive customer and market research makes it popular with small businesses or those for whom other concerns take priority. It’s useful if you don’t yet have the data for a value-based approach but want to launch a product quickly.

It works well for businesses wanting to pursue a cost-leadership strategy and can help them in their pricing transparency with customers to build trust and loyalty. Retailers and department stores often use a cost-plus strategy, placing different markup percentages on different products.

Wholesale retailer Costco uses its cost-plus model in its value positioning, stating that nothing in it stores will be marked up by more than 14% (or 15% for its private-label products), giving the company an average profit margin of just 2%. It’s able to do this because it sells products in bulk which increases average order size. Customers know to go to Costco for great deals.

Another company that makes price fairness their differentiator is clothing retailer Everlane. Living their value proposition of “radical transparency”, the company provides a detailed breakdown of material, labor, duties, and transport costs for each product it sells, along with its markup. Customers are able to easily verify that the company is sticking to its values of paying fair wages to its workers.

While a few organizations have leveraged it to their advantage, a cost-plus approach is not usually the best fit for most businesses as it doesn’t take competitors or customers into account.

Take a software as a service (SaaS) offering, for example. Their products likely provide significantly more value to customers than it takes to produce them. They’d achieve much higher profits with a value-based strategy (based on customer willingness to pay) and a tiered pricing model (offering pre-defined bundles of features at various price points) than they would using a cost-plus strategy where their price point is low compared to the value it offers and segments are all treated the same.

In practice, cost-plus pricing can be used as part of a wider, flexible pricing strategy.

Is Cost Plus Pricing Right For You?

Cost-plus is the simplest of pricing strategies. Not only does it ensure your costs are (predominantly) covered and that you’ll get a (mostly) predictable return, but it’s quick to implement and easy to justify.

It doesn’t, however, take customers, competitors, demand, or the general market into consideration. It’s and inward-looking strategy leading to pricing decisions made in a vacuum.

While appropriate to your costs and desired profit margins, your selling prices could be wildly off the mark compared to the competition. They could be well above or below what a customer is willing to pay, so you’re either leaving money on the table or customers under it.

What’s more, to remain competitive in a busy market, you need to be able to make efficiencies in processes and costs, but a cost-plus strategy actively discourages this. And as you never need to do extensive customer research, you learn nothing about their needs, wants, or perceived value of your offering.

Above all, cost-plus is a static approach to pricing, which, as we move forward into more tumultuous times, is a risk in and of itself. Agility in both business and pricing is your only stability for an uncertain future.

If you’re interested in learning more on implementing a cost plus pricing strategy in your business and optimizing how you use it with the assistance of pricing software, check out the handy article below: