How Does AI Work in Pricing Software? – Made Simple

May 27th, 2022 (Updated 03/10/2023) | 10 min. read

It is no secret that these days your data can lead to Artificial Intelligence (AI) powered algorithms helping companies just like yours price items based on price optimization, competitor pricing, inventory levels, and customer response to sales promotions. Using AI-informed pricing software can help grow profit margins, develop loyalty from price-conscious customers, and eliminate the hard manual work and take away mystery of setting prices. But what is more of a mystery is simply explaining exactly how AI works in pricing software – which is what we will do in this article.

As providers of AI in our price optimization solutions for more than a decade now as part of our native-cloud pricing software, Pricefx are perfectly positioned to discuss exactly how AI works in pricing software and explain what it can and cannot do, and why.

So, let’s first dive in to learn more about what can happen when you do, and when you don’t use AI-informed pricing software in your business to give you a framework into understanding how AI works in pricing software models.

What Happens When You Use AI in Pricing Software?

AI’s greatest asset in pricing software is delivering you with crystal-clear insights into your pricing and above all, driving the price optimization of your products.

AI assists by providing you with the opportunity to set more attractive prices, create better groupings (often referred to as ‘segments’ in AI speak) of your products and customers, create more alluring offers for clients, and predict market changes and customer reactions to a price shift.

Using this invaluable data, you can drill down into the data even further to optimize your operations and portfolio to better reflect what your customers want and are most importantly, break ‘valued-based pricing’ into play by unearthing each of your customer’s ‘willingness to pay.’

Offering the right product, at the right time, at the right price for each customer will be key to maximizing your sales and building profitability.

Whatever your company’s unique set of business objectives are (to become more profitable, to increase production and sales volume, set up regionalized or even seasonal pricing, or break new products into the marketplace etc.), AI-informed pricing software can be fine-tuned to help you achieve whatever you would like your outcomes to be through your prices.

What’s more, AI-informed pricing software can be used to help you understand which products/prices have worked in the past and, based on that, offer a prediction of what should work for your business in the future.

By providing a view of trends in customer behavior and AI-informed pricing strategy supports the development of new products and pricing strategies.

What Can Happen If You Don’t Use AI in Pricing Software?

Without using pricing software informed by AI, you are quite simply doing things in the dark without any realistic guidance on your prices.

Without AI, you will be unable to accurately forecast prices or upcoming price trends in responses to recessions, sudden increases in costs of production or distribution, shifting market forces or other events that may require predictive modelling and eventual price optimization techniques. Perhaps with the unlimited resources of thousands of workers running data entry and updating those prices 24/7/365 you might be able to do it, but that is not an entirely realistic scenario that any modern business would want.

And secondly, when it comes to price optimization itself, it’s almost impossible to manually integrate several different constraints at the time. Even if you’re super savvy with Excel, Tableau or some other form of Business Information System reaching some vague form of optimum price while accounting for some sudden, unexplained, and complex business roles for even three or four products (let alone tens-of-thousands of products), it will rapidly become a nightmare trying to perform pricing in Excel.

After all — imagine you run a supermarket chain with some stores in residential areas, some in city centers and spread over the entire country. You cannot expect employees to dash out of the store, quickly check competitor prices around your area, review the sales history of each store in your chain, then recalibrate the price of every product at each separate store location. I know we are ramming home a subtle point here, but you most definitely cannot ask your pricing employees to factor in aspects like store location, weather, different seasons, and the time of the day – like you can ask of AI-informed pricing software.

The Mechanics of AI in Pricing – Put Simply in 5 Steps

Breaking down a complex topic like the mechanics of how AI operates in pricing software as succinctly and straightforwardly as possible, 5 steps are involved;

1. Develop a Clean Set of Meaningful Data

The first step is to have a clean set of meaningful data (comprised of your company’s sales, product, and transactional data). Data cleaning is the process of fixing or removing incorrect, corrupted, incorrectly formatted, duplicate, or incomplete data within your dataset.

To transform that completed clean data set into a meaningful one, you may want to implement ‘feature engineering.’ What that means is from your clean data, create some more aggregated data, like grouping your customers by geography, products into large/medium/small sizes etc. The little bit of extra work with feature engineering may pay off big time with more accurate price optimization results eventually.

2. Setting Up a Predictive Model with Machine Learning

Next up, you will want to set up a predictive model to achieve your AI. And you build that predictive model with Machine Learning.

Let’s clear up the confusion here straight out of the gates – AI and Machine Learning are not terms that can be used interchangeably and are not synonymous. They are different things entirely.

Machine Learning can be defined as the pathway to artificial intelligence. This subcategory of AI uses algorithms to automatically learn insights and recognize patterns from data, applying that learning to make increasingly better decisions.

Artificial intelligence does not require pre-programming like Machine Learning does; instead, it uses algorithms which can work with their own human-like intelligence to achieve the goals you want from your pricing system and that is what separates it from machine learning.

In other words, Machine Learning is simply a building block used to form your AI.

In short, predictive modeling is a statistical technique using machine learning and drawing on your company’s existing product, sales and customer data to predict and forecast likely future outcomes with the aid of historical and existing data. It works by analyzing current and historical data and projecting what it learns on a model generated to forecast outcomes.

3. Predictive Model Done – Now Set Up a Decision Tree

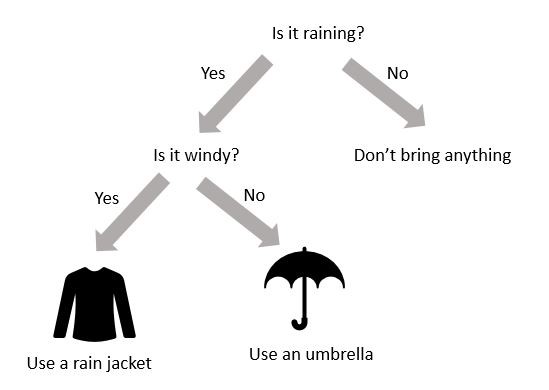

Once you have the predictive model all set up, you can dive begin asking your AI questions and getting highly detailed accurate pricing recommendations. Results are often displayed in the form of a decision tree – where you follow Yes/No branches to find the exact prediction for each set of attributes you are interested in.

A Simple Decision Tree Example – Bring an Umbrella or Not?

Naturally, with your pricing questions you can drill down a little further and into pricing specifics, for example, “How will a 15% increase in price impact my sales volume ——> for my larger B2B clients——-> in Mexico —–> in the Manufacturing industry ———>that are directly serving B2C > etc. etc. “

A decision tree can allow you to experiment with different price levels for the same product in one marketplace and/or region to see how sales volumes change with prices and which volume level of products can be sold within that optimal price range.

4. Setting Up Your Price Optimization Model

Great. Now we can do some predictions based on what we have set up in the predictive model, it is time to plug in to the price optimization part of AI.

The optimization must be set up depending on your company’s precise pricing strategy, your business objectives and what you are trying to achieve.

Real-World AI now becomes possible and multiple agents work together to solve competing problems and define outcomes that are usually beyond the capacity of individual systems.

For example, you are involved in the Food and Beverage in the United States, and you want to simultaneously;

- Increase sales volume on your 10lb bags of coffee to lower production costs.

- Have a standard 20% profit margin on your smaller bags of coffee

- Implement a 15% profit margin on your packets of 1000 tea bags and;

- Apply all those pricing rules in all 48 of the 50 states (except for Alaska and Hawaii where a flat 30% profit margin on all your products applies to cover the extra shipping costs).

The good news – all those business outcomes can be built into a single pricing rule by your AI-informed pricing software system to calculate your prices automatically.

__________________________________________________________________________________

To learn more about Price Optimization Software and if it is right for your business, check out this handy article;

__________________________________________________________________________________

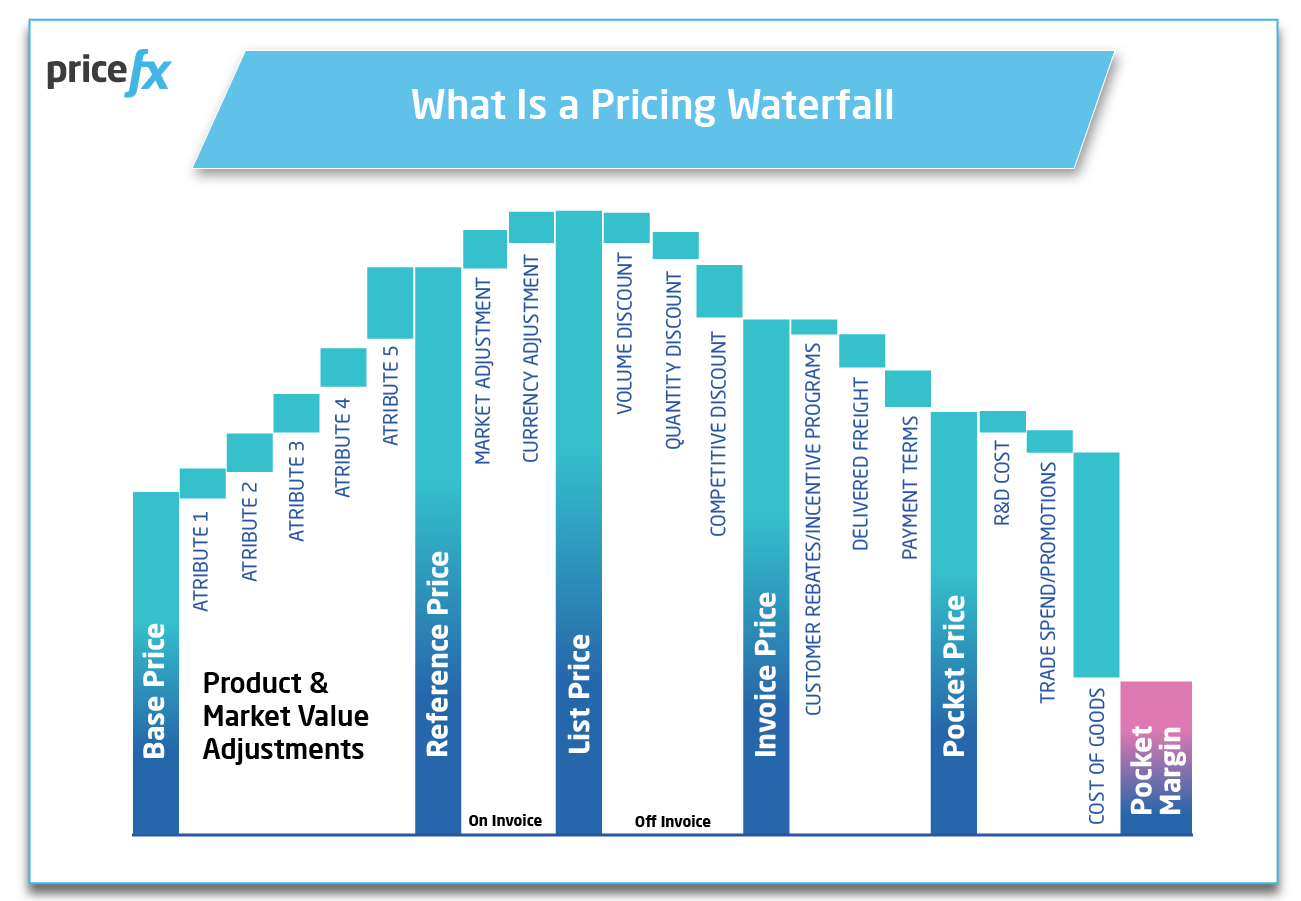

5. Setting Up a Pricing Waterfall

The price waterfall is an easy-to-understand visualization tool that offers incredible pricing insight, and even more so when optimizing your prices using AI. You can see in the waterfall graphic below how distinct factors influence your price and display visually the cumulative effect of all discounts and rebates on your company’s profitability.

Being able to optimize multiple elements of your pricing waterfall at the same time can be a powerful tool. In most cases, the price waterfall chart starts with list price, but it can start with any base price that discounts and rebates/incentives are applied to. (Discounts are price variations applied before the invoice price. Rebates and Incentive Programs are price variances that are applied after the invoice price.)

The price waterfall shows the discounts arriving from list price to invoice price and then any further rebates to determine the pocket price. Variable costs can also be added to the end of the price waterfall to show visually just how much pocket profit is left over after all your organization’s discounts and rebates have been factored in.

I Now Know the Power of AI in Pricing – Where to Now?

Now you know AI’s immense power and the rudimentary nuts and bolts of how it works in pricing software.

What’s more, you have discovered along the learning journey that AI-informed pricing software like Pricefx is great for helping your organization understand which prices/products have worked in the past and, based on that, offer a prediction of what should work in the future.

But buyer beware, there are diverse types of AI used in pricing software and not all types offer the same level of pricing power. Be sure to check out our upcoming article “Not All AI are created equal”.

Meanwhile for those interested in how Artificial Intelligence vs Machine Learning are used in Price Optimization Software, check out the article link below: