Increase Revenue vs Decrease Cost: Which Boosts Profit More?

December 15th, 2022 (Updated 03/09/2023) | 10 min. read

One of the big decisions organizations come up against in the pursuit of improving profitability is whether it’s better to focus on reducing costs or increasing revenue.

Each strategy comes with its benefits and shortcomings. Cutting costs will certainly trim the fat off your operations, and raising revenue will improve cash flow, but which strategy is best for your company depends on many factors, like your long-term goals, your industry, and the condition of the market you operate in.

At Pricefx, we have been helping our customers work out the best pricing strategies based on the specific factors affecting their operations for a decade now and we often see them grapple with the issue of whether they should be reducing costs or increasing revenue in order to boost profitability.

In this article, we will explore the impact that reducing costs and increasing revenue will have on your business, how you might go about it, and the benefits and drawbacks of each.

So, let’s dive in.

Reducing Costs to Raise Profits

Reducing costs is a strong strategy for increasing profitability. If it doesn’t cost you as much to make and sell your products and your price remains the same, then you widen your profit margin.

In order to determine where cost-reduction opportunities exist, you need to evaluate your Cost of Goods Sold (COGS)—your direct costs attributable to the production of your products (including materials, labor, and overheads).

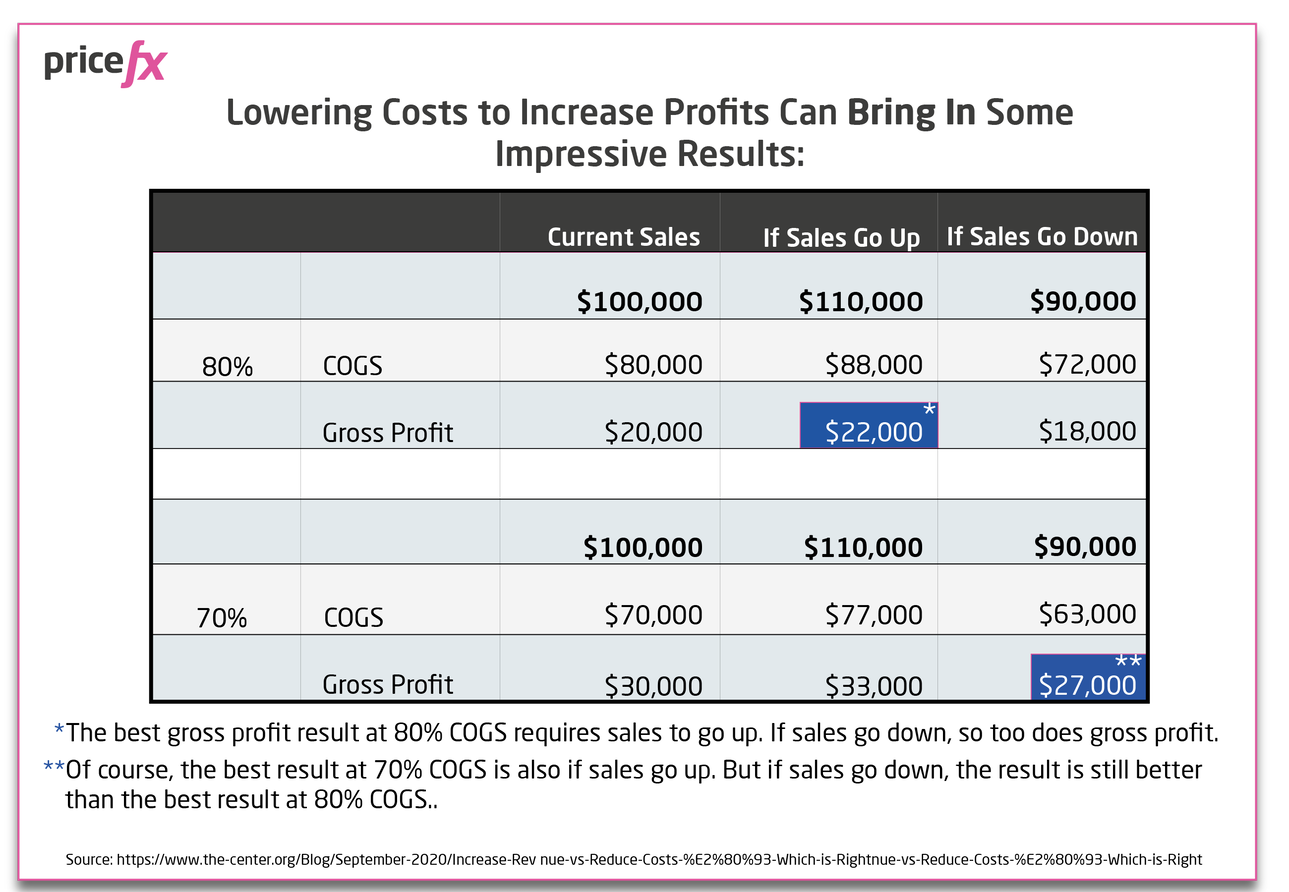

Lowering costs to increase profits can bring in some impressive results, as shown below.

However, the big caveat here is that your efforts must not negatively impact quality, sales price, or sales volume, else this could defeat the point.

How To Cut Costs to Improve Profitability

- Understand Your Costs: Ensure all historic cost data is accessible from one place and that you can drill down into the numbers to understand them at a granular level. If you’re spending more in specific categories (or more than similar companies), investigate as to why and take appropriate action.

- Get On Top of Your Variable Costs: Work out what percentage of sales your variable costs represent and benchmark against historic percentages to keep in line with selling activity. Invest in pricing software that will enable you to price dynamically based on real-time market indices to ensure you’re always passing raw material costs on to customers and not absorbing them in your margins.

- Get Tough on Fixed Costs: Don’t get lazy with recurrent costs and long-standing relationships with suppliers. Periodically test the market to see if you can get a better deal elsewhere. Work out where you can optimize your processes, supply chain, operations, staff, and facilities.

- Focus On Operational Efficiency: Invest in tools that will improve the efficiency of your business processes and reduce costs. Especially consider cloud software solutions to avoid the considerable expense of purchasing and maintaining your own hardware and explore automation tools to increase productivity and reduce manual labor.

Things To Consider When Cutting Costs to Boost Profits:

- Cost cutting is an effective way of widening your profit margin only if your prices and sales volumes remain constant. It’s important that you find ways of optimizing your processes, supply chain, and operations without impacting your quality, price, or sales. Much easier said than done.

- The problem is, cutting costs is often linked to a lowering of quality, which may result in you having to lower prices to keep sales volumes up, which defeats the point. It could eventually damage the reputation and perception of your brand, which could result in sales volumes dropping and market share eroding over time.

- The strategy of improving processes to reduce costs only really works for companies currently operating below maximum efficiency. If you have already negotiated the best possible prices and already use Enterprise Resource Planning (ERP) software to ensure optimized operations, then you will be unlikely to achieve cost savings that make the adjustments worth your while.

- If you’re working with very low or tight margins, then a cost-cutting strategy may not be for you because not only could it take longer to implement and see results from than price optimization projects but recouping the money you spend on them would require an increase in revenue, which cost cutting doesn’t bring.

- Another reason cost-cutting projects can struggle is due to the perception your team members have of the activity. “Saving the company money” doesn’t have quite the same allure as revenue-boosting strategies and can even conjure a negative sentiment.

Increasing Revenue to Raise Profits

Constant cashflow is an essential element of a growing business and that is why revenue generation projects often take priority—it’s the primary driver of profitability. The more you grow your revenue the more you can grow your profits.

One of the simplest ways of increasing revenue, of course, is to increase prices. In fact, even a slight increase will have a direct impact on your profit margins and the bottom line. But your customers aren’t necessarily going to like that, so here are a few ways to substantiate those higher price tags and grow sales:

How To Increase Revenue to Improve Profitability

- Build Pricing Power: One way of justifying higher prices is through successfully branding your offering as high end. Sony and Abercrombie & Fitch have achieved this and thanks to their premium market status are able to command considerably higher prices than their competitors while also increasing market share.

- Enhance Quality: Most customers want the quality of a product to match the price tag and many are willing to pay more for items they perceive as being high quality. It’s not just pricing power that allows Cartier to maintain high prices, it’s the company’s reputation for delivering superior watches.

- Focus on Repeat Custom: Upselling or cross-selling to current customers is more effective and cost-efficient than chasing new customers. Ensure your sales team is empowered to appropriately make recommendations to customers.

- Offer Discounts and Rebates: Discounts can be the incentive a customer needs to start purchasing and targeted discounts make existing customers feel like you care. Rebates are also a fantastic way of enticing larger orders and customer loyalty.

- Bundle Products: Bundling products to create savings for the customer can be a successful way of increasing sales without adding to overheads. You will want to make sure the bundles you create don’t negatively impact your portfolio elsewhere though.

- Data-driven marketing: By reaching more of the right kind of customers through accurate targeted messages, you can increase sales. Analyze customer personas and their transaction and sales data to understand your audience better.

Things To Consider When Increasing Revenue to Boost Profits

- For this strategy to work, it must be aligned with your revenue goals. You need to know what your revenue drivers are, how you define success for your business, and how you plan to get there.

- The activities involved in increasing revenue (e.g., ameliorating your marketing, product quality, brand reputation, pricing tools, sales processes) can all result in higher costs and therefore lower profit margins. It is a balancing act that requires a close eye. Does the lower margin provide sufficient financial cushioning? More dollars in the bank does not always mean a healthier or more secure financial situation.

- If you are operating in a competitive market or depressed economy, then increasing sales volumes or raising prices will be difficult but certainly possible.

The Power of the 1%

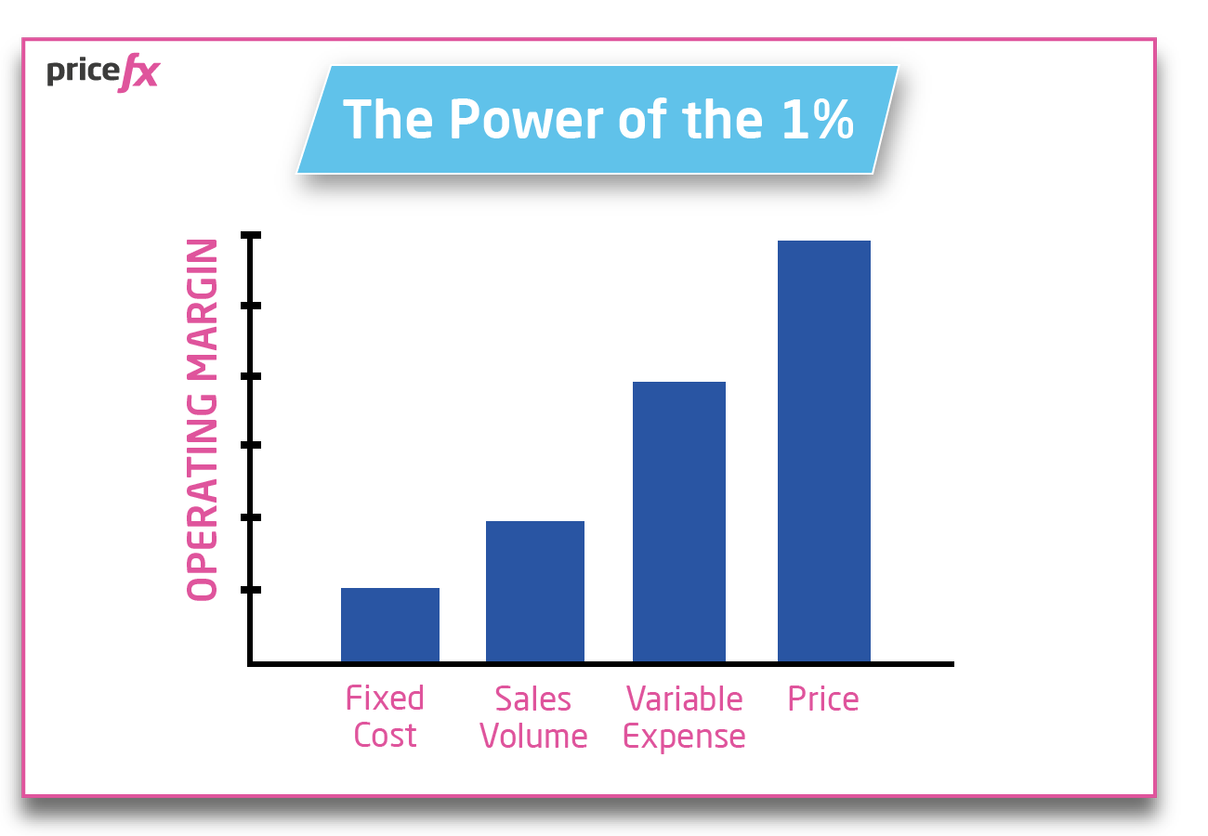

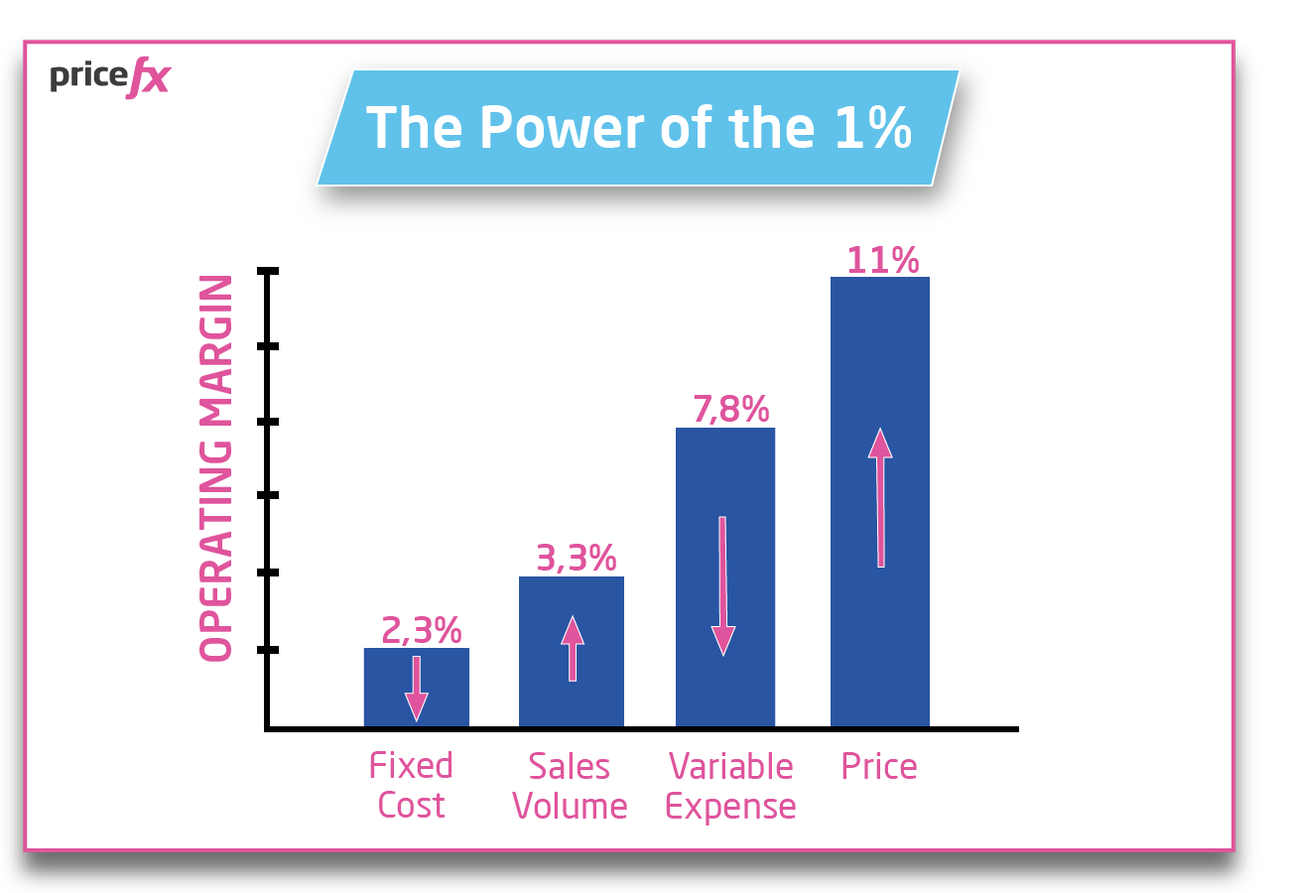

This concept was developed in a McKinsey & Company study that evaluated the Global 1200 companies and found a consistent challenge among them: margin performance.

The study looked at the four major operating drivers—fixed cost, sales volume, variable expense, and price—and the impacts they were having on the organizations.

The concept was simple:

How would a 1% improvement in one of these operating drivers impact operating margin?

The results were game-changing.

Keeping all things equal:

- A 1% improvement in fixed costs (i.e., driving it down by 1%) had a corresponding value of 2.3% on operating margin improvement.

- A 1% improvement in sales volume, saw a 3.3% improvement in operating margin.

- Things got really exciting with a 1% decrease in variable expenses (discounting, promotional expense, sales cost, etc.) resulting in a 7.8% improvement in operating margin.

- However, with price, a 1% improvement led to an 11% improvement in operating margin. That is 11% going straight to the bottom line with zero associated cost.

So, if you are a $1 billion revenue company, that 1% improvement in price equates to a $10 million annual improvement in operating margin, that is incredibly significant.

But, I hear you say, all things are not equal—you said so yourself above. And you are absolutely correct. If you increase your price by 1%, you could see a reduction in sales volume and customer loyalty could take a hit.

But at Pricefx, pricing software is our thing, and we know that price optimization is not just about increasing prices—it’s about streamlining your sales efficiency, taking the friction out of the buying process, enabling faster sales cycles, instilling greater discipline around price, managing discounting better, and greater visibility and efficiency across multiple waterfall expense elements.

When you have the right technology, you’re able to uncover untapped opportunities for margin improvement and seal off areas of erosion. You can price dynamically to ensure all cost increases are passed on to your customers and leverage willingness to pay to ensure you’re offering the right price to the right customer to maximize sales.

Increasing revenue becomes a much easier target and one that you can scale. There is only so much cost cutting you can do without digging a hole under your business.

Check out this great video explaining all of this:

So, Should I Decrease Costs or Increase Revenue in Order to Boost Profits?

It depends… (doesn’t it always?)

Whether you are considering raising revenue or minimizing costs, both can help you improve profitability, and it is up to you to decide which strategy works best given your unique challenges.

If you’re a small business with a limited portfolio, comfortably using a cost-plus strategy to price, not slick in your operational efficiencies, and you are able to reduce your costs without negatively impacting product quality, sales volume, or price, then cost-cutting could be for you.

If you’re a growing business, looking to get smarter about pricing and more resilient in your strategies, then increasing revenue is your path to success. You need that cashflow to grow. And with the right tools, you will be able to improve price in the context of your market and goals (e.g., not lose price-sensitive customers with price increases) and enhance processes (e.g., reduce sales cycles to win more deals), while gaining better visibility of your pricing and the insights that help you make data-driven pricing decisions.

If you’re interested in learning more about how price optimization software works and how it could help you improve profitability, you will enjoy the article below: