The Top 6 Retail Industry Pricing Strategy Trends

August 1st, 2022 (Updated 03/10/2023) | 8 min. read

By John Gilbo

Over the last few years, the rate of change of what we used to refer to as ‘normal’ in the retail industry has taken off in a way that few could have predicted. Just as we thought we were coming out of the enforced bricks-and-mortar store CoVID-19 slow-down and associated drift to online shopping, then, rampant inflation and increasing fuel and distribution costs due to the Ukrainian conflict took hold. From the shifting consumer buying patterns to the increased shipping costs and labor shortages and everything in between, it has become apparent that staying on top of your retail industry pricing strategy is more important and relevant than ever before.

At Pricefx, we have been analyzing retail sales data and setting automated pricing processes for our retail industry clients for more than a decade. During that journey, we have been assisting them to facilitate real-time price changes, make sound data-informed strategic decisions and remain ‘pricing nimble’ and proactive in protecting profit.

In this article, we will first look at the biggest shift in the retail industry – the move from bricks-and-mortar stores to online shopping before switching our attention to 4 retail pricing pitfalls to avoid, before outlining the Top 6 contemporary retail industry pricing strategy trends to investigate.

Price Pivoting as Markets Shift – The Offline to Online Shopping Revolution

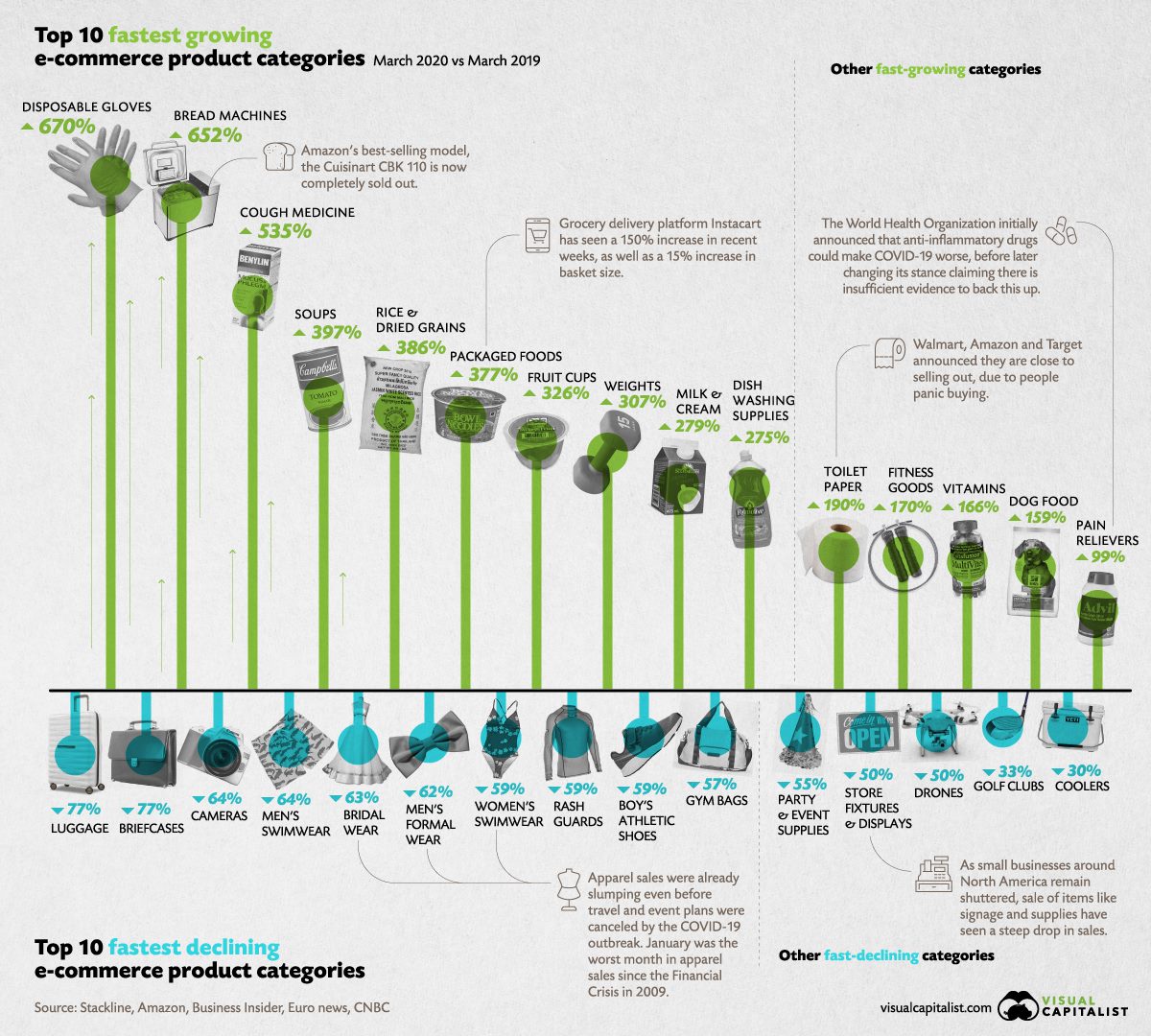

Since March 2020, significantly more sales have been made online due to shifting market forces created by CoVID-19, planning, the Ukrainian conflict, and associated supply chain issues.

In 2020-21, shoppers’ buying patterns shifted away from your bricks-and-mortar stores to your online stores and they may have taken advantage of an attractive free shipping offer you may have had in place. What’s more, it is a trend that is showing no evidence of slowing down anytime soon. Now your bricks-and-mortar stores are open again, but many of you may have noticed that the online shopping trend has remained.

Reacting quickly to constant retail industry changes that are occurring more frequently than ever has become critical as the risk of leaving profit at the checkout grows.

With that, as a retailer, you may have possibly watched your percentage of sales for products for free shipping rise from 10% of your total sales volume to as much as 50% or even higher when the pandemic was at its absolute peak. The extra shipping costs could be eating into your margins and raising your prices to cover the free shipping costs is now a profit protection reality.

By comparing off-line vs online product sales shifts between March 2019 with the first month of the pandemic in March 2020, the image above is deliberatively dramatic and provocative in demonstrating volatile product demand. However, it does serve as a reminder of how unpredictable market forces that can affect demand can be, and that staying permanently engaged with your retail industry pricing strategy has become more important than ever.

4 Pitfalls to Avoid in Setting Your Retail Industry Pricing Strategy

An essential element when implementing a successful retail pricing strategy is knowing the potential complications to avoid. Set up your business to avoid these four common pitfalls and you should remain best placed to hang in there tough and hopefully remain profitable in unpredictable times;

1. Avoid Price Strategy Stagnation: Companies that stand still with their retail pricing policies risk missing out on sales and new business. Change is the new retail business industry normal and failure to embrace that concept with your pricing strategy could be fatal to your organization.

2. Recognize Revenue and Profit Are Not the Same: Retail businesses earn from profit, not never-ending increased revenue numbers. While quality revenue numbers are a neat ego boost, profits and profit-based incentives will sustain your business over the long term. Consider introducing value or profit-based incentives for staff rather than revenue-based incentives if you haven’t already.

3. Resist Margin Oversimplification: Having a high overarching margin target such as 50% or more for your business may seem like a great idea, but in reality, that is very much yesterday’s way of thinking. Moreover, it is a way for many retailers to take on the inherent risks of underpricing some products and leaving critical profit opportunities on the table. On the other side of that same margin simplification coin, overpricing other products also becomes a possibility and missing the sale altogether becomes a threat.

A quality pricing software solution will provide retailers with the opportunity to recognize the value of their products compared to others, and then price according to their value and avoid falling into the ‘margin oversimplification trap.’

4. Avoid Bad Customers – Say “No Sale” if the Deal is Not in Your Organization’s Best Interest: You should not feel compelled to sell to every customer. Not every customer that finds a use for your products can recognize their value and is willing to pay you what they are worth.

Focus on developing a client base that knows the value of your products.

6 Retail Pricing Strategy Trends to Watch Closely

Of course, if your business is avoiding the 4 pitfalls we’ve mentioned above, you’re already ahead of the game when it comes to optimizing your retail pricing strategy.

However, if you are really looking to turbocharge the outcomes of your retail industry pricing strategy, make sure to look beyond your current industry surroundings and cohorts by paying close attention to these Top 6 developing retail industry pricing strategy trends;

1.Retail Supply Chain Bottlenecks to Continue: Following the trend that began during the pandemic and continuing the back of the effects of the conflict in Eastern Europe, your prices will continue to be offset by delivery issues, fuel and distribution costs, and product delivery delays in supply chains.

- Be proactive in assessing your delivery costs to protect profits and margins.

______________________________________________________

Learn More Tips Here on How to Manage Fluctuating Prices & Margin Erosion

______________________________________________________

2. Retail Workforces and Labor Costs to Continue to Drive Price Increases: Globally, retailers cannot find the staff they need to staff their warehouses, stores and drive their trucks. Consequently, many retailers need to increase salaries in order to attract the qualified people required.

- Your prices may need to be scheduled for ongoing updates against your wages as a result

3. One-stop shops selling multiple products in standalone locations are booming: Multi-product one-stop shops (Target, Walmart, Kmart, etc. – carrying groceries in combination with household, electrical, clothing, and other products) are continuing with their pandemic growth spurt and leveraging their competitive prices as leverage to drive profit.

- Consider diversifying your product range to draw in customers. There is a taste for one-stop shopping showing no signs of abating.

4. Home Gym Equipment & Outdoor Goods Stores are prosperous: Outdoor and home gym equipment stores like Dicks, Bass Pro and Academy Sports & Outdoors etc. are also following on their strong pandemic fueled growth. Many people are staying outdoors and still not returning to indoor activities as before the pandemic.

- Add New Revenue Streams – It may be worthwhile to mull over adding a sportswear section to your online clothing store or add protein drinks and sports supplement lines in grocery.

5. Same-Day Deliverers Hold the Retail Advantage: With supply chain issues continuing, same-day delivery gives some retailers a clear advantage.

Shipping delays and supply chain issues are more commonplace now — and with many local retailers have an opportunity to mix it with their big chain store cousins by getting products by offering same-day delivery.

- Local retailers are closer to customers and can set up the necessary systems to get products to customers faster and make more profit as a result.

6. Tracking Competitors More Popular Than Ever Before: Matching, beating, or pricing above your competition will continue to be a part of most retail business strategies (your price moves to be dependent on your retail business model, store locations, product types etc.). Given the unprecedented and ongoing inflationary conditions, as a general rule-of-thumb, prices are set to increase in retail worldwide for the foreseeable future as discounts, rebates and promotions decrease.

- Customers can get pretty upset to find out they paid the full price for a product when it was advertised for less elsewhere. So, monitoring and synchronizing all your pricing across different sales channels is critical.

Achieving Growth in Retail in Volatile Times

Pricing remains the best lever available to support your retail company’s earnings goals. However, in the current climate, it is essential that you are equipped with quality tools like pricing software like that of Pricefx to be ready to embrace change mid-stream and at short notice. Then, you can be more focused, flexible, and agile in your pricing reactions instead of being ill-equipped to plan for the unexpected.

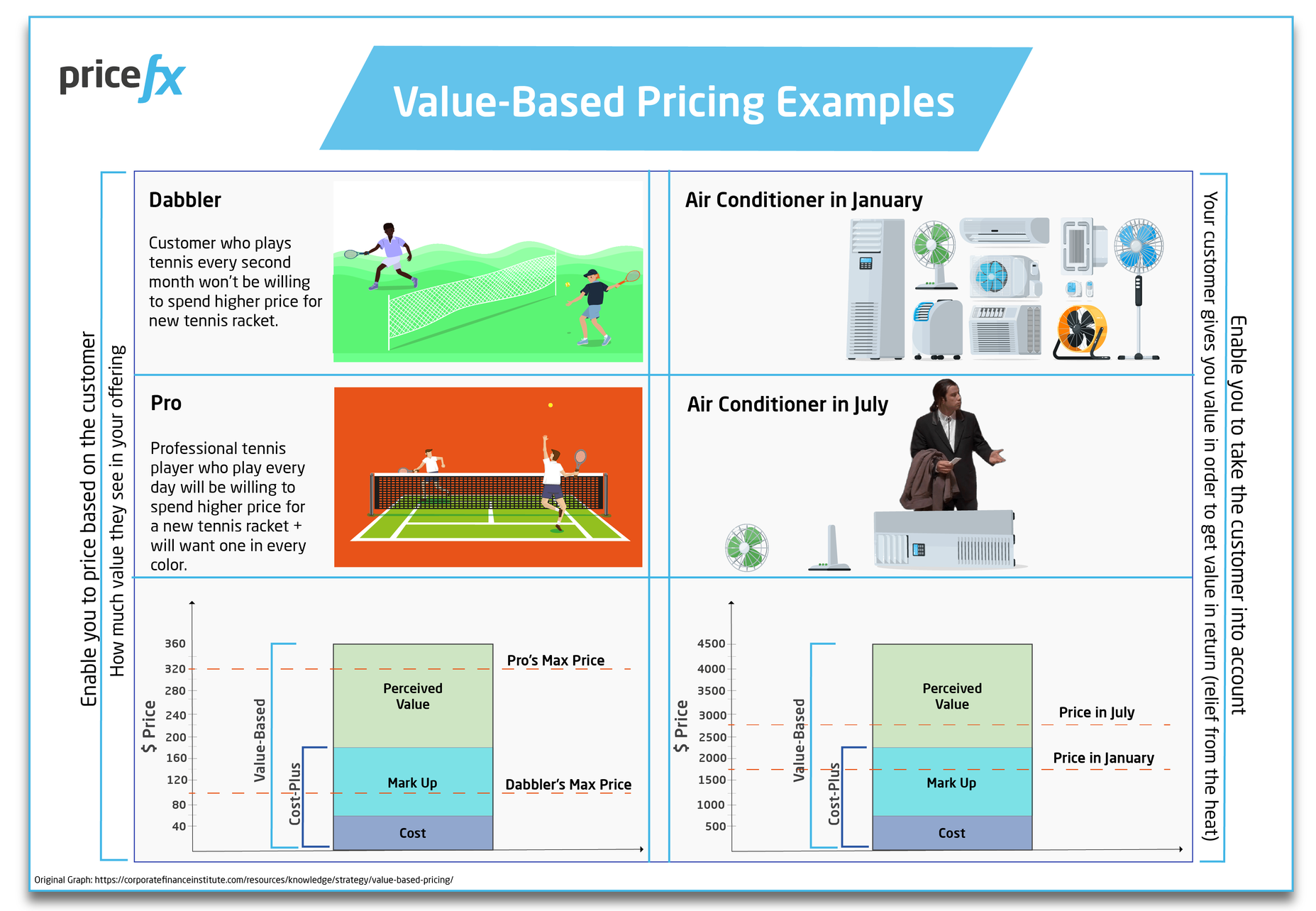

That level of digital maturity should boost your business agility to be able to adapt to whatever the world throws at you next. A sophisticated approach to pricing that enables more granularity and flexibility than you have ever achieved before can bring deep insights through advanced analytics and accurate forecasts. Moving towards dynamic and value-based pricing to protect margins and leverage differential willingness-to-pay, while optimizing your pricing processes to achieve greater flexibility, agility, and granularity.

Being proactive in the retail industry is now of the essence, at a time when it is important to be at the market’s helm, rather than at the mercy of it.

To learn more about becoming more targeted and building a business case for adopting pricing software in your organization, check out this handy article;