What is Value-Based Pricing? Benefits, Drawbacks & How to

May 24th, 2022 (Updated 01/04/2024) | 13 min. read

By Iain Lewis

The power of a value-based pricing strategy to boost profit and revenue has caught the attention of pretty much every organization. But actually, adopting it is a different story. For many, the jump from cost-plus to value-based is just too wide. Will it be worth the effort?

At Pricefx, we’ve spent the past decade helping companies successfully make the jump and we’ve seen how their value-based strategy has delivered incredible ROI, so we thought we’d share some of our expertise in value-based pricing with you.

In this article, we’ll take a deep dive into what value-based pricing really is, the benefits it brings, the drawbacks it presents, and how it’s being used by companies in various industries to maximize profits and revenue. We’ll also look at which types of company should be considering a value-based pricing strategy and which should not.

What Is Value-Based Pricing?

Value-based pricing is a customer-focused strategy that involves setting prices based not on your costs or competition, but on your customer’s perceived value of your offering—how much it is worth to them.

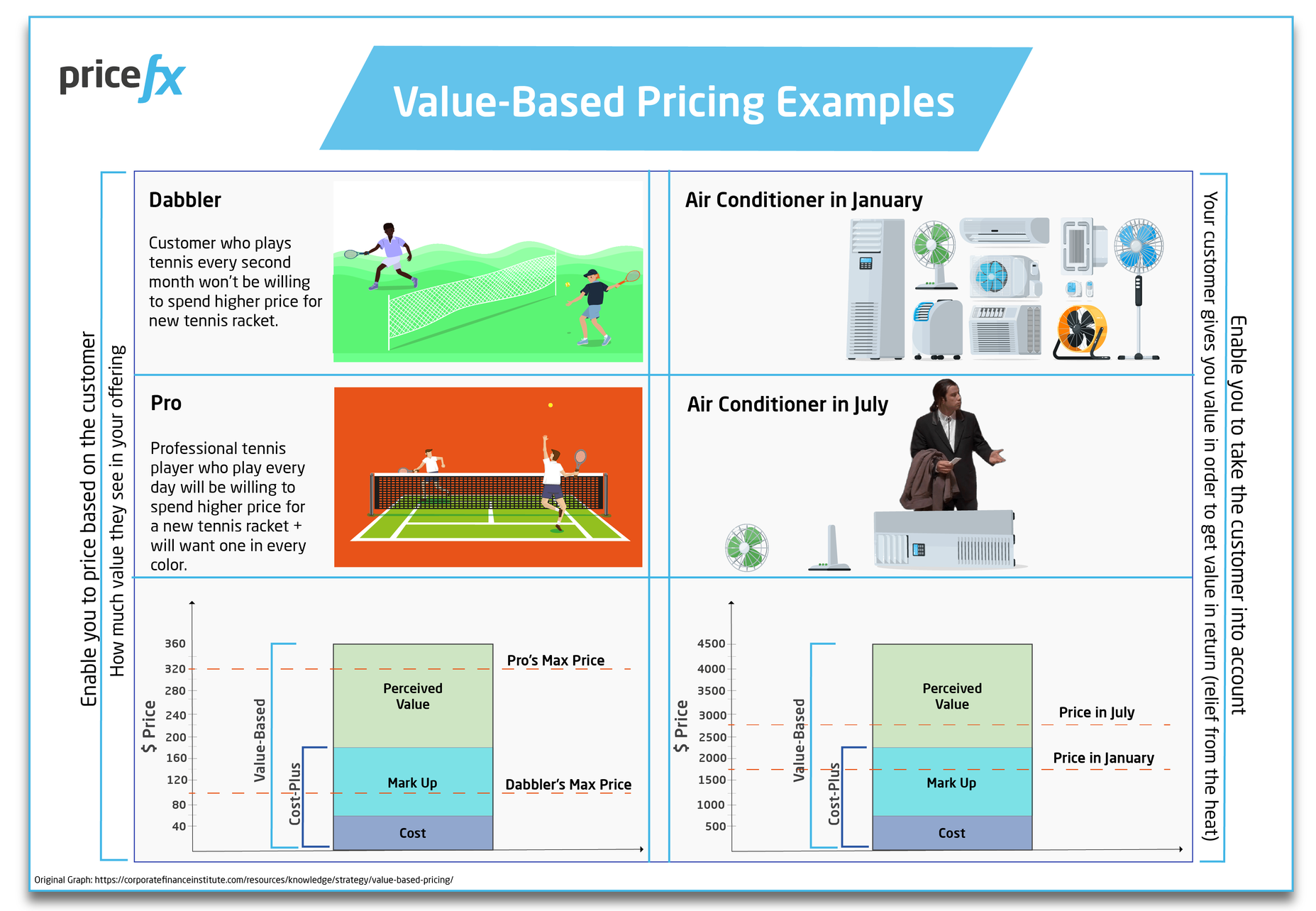

Of course, the amount a customer is willing to pay will be different for different types of customers. A customer who plays tennis every second month won’t be half as inclined to spend $320 on your fancy new tennis racket as the pro (who’ll want one in every color). The dabbler might spend $100, but $320 just isn’t worth the value he’ll get from it. Pricing for the dabbler means sacrificing potential profit from the pro, and pricing for the pro means losing the dabbler entirely.

So, the first thing value-based pricing does is enable you to price based on the customer—how much value they see in your offering. So, you can show a high-end price to impress your pro, and a lower price so as to win over the dabbler.

The second thing value-based pricing does is enable you to take customer context into account. Your air conditioner will be clogging inventory at an Alaskan warehouse in January but will be flying off the shelves at an Arizona supermarket in July. Your Arizona customers’ context increases their desire for your product, and they are therefore willing to pay more for the value it will bring them.

This is key: it’s not the appliance itself that is worth more to them, but the value the appliance brings. Its three speeds, slim-line appearance, and remote control are all great features, but features merely address a customer need. Value is what is derived from those features (faster cooling, stored out of the way, easy to operate).

A purchase of your air conditioner is an exchange of value. Your customer gives you something of value (their money) in order to get something of value in return (relief from the heat).

There are many different drivers of value.

We’ve all been standing in line for a ride at an amusement park, baking in the sun, gasping for a drop of water…when a guy turns up selling bottles for $5.

$5 for a bottle of water?? “Well, yes, because you really, really, really want it.” He’s right. You are actually willing to spend $5 on a bottle of water at this moment. And he’s leveraged that insight. That’s value-based pricing.

If however, you had just spent two days in the desert and are about to keel over from dehydration, and he assesses your need before putting the price up to $10… well, that’s called price gouging and as a business, you’ll want to steer clear of that.

The Benefits of a Value-Based Pricing Strategy

Value-based pricing has become an increasingly popular pricing approach thanks to its ability to maximize revenue and profit. Not only do you ensure you’re not leaving money on the table with customer segments willing to pay more, but you’re also not losing segments only willing to pay less.

A potential added benefit of asking higher prices is achieving prestige status. Your pro tennis player wouldn’t be seen dead with a run-of-the-mill tennis racket. Yours has a good weight, size, stringbed density and is very pricey (he should know, he has one in every color). But all this proves to the world that he’s a winner. His fans agree. So now you have a virtuous cycle where your high prices support a high perceived value, which in turn supports high prices… etc.

Your mark-up on items of high-perceived value can be incredibly high because of the added value of having something in this category. Your customers are willing to pay more for the intangible benefits that come from owning the same racket as a tennis pro.

Being able to price based on your individual customer’s willingness to pay for certain products requires a huge amount of research and data (an issue soon to appear in the “drawbacks” category.) However, building such a good knowledge of your customer can only be a good thing. You’re able to target them better with your marketing efforts to boost brand recognition and sales. It’ll help ensure you’re only spending time on hot leads and high-value customers. You can better nurture loyalty and brand advocacy and can quickly spot new trends and opportunities in customer behavior.

And now that you know where the perceived value of your offering lies for your customer, you’re able to shift it in an even more profitable direction with branding and advertising campaigns that position your product as exclusive or elite and therefore justifies an even higher price tag.

The Drawbacks of a Value-Based Pricing Strategy

As mentioned, a value-based approach requires much time on research, and can therefore be more time-consuming than other pricing models, especially if you’re working with a completely new offering for which there is no market yet.

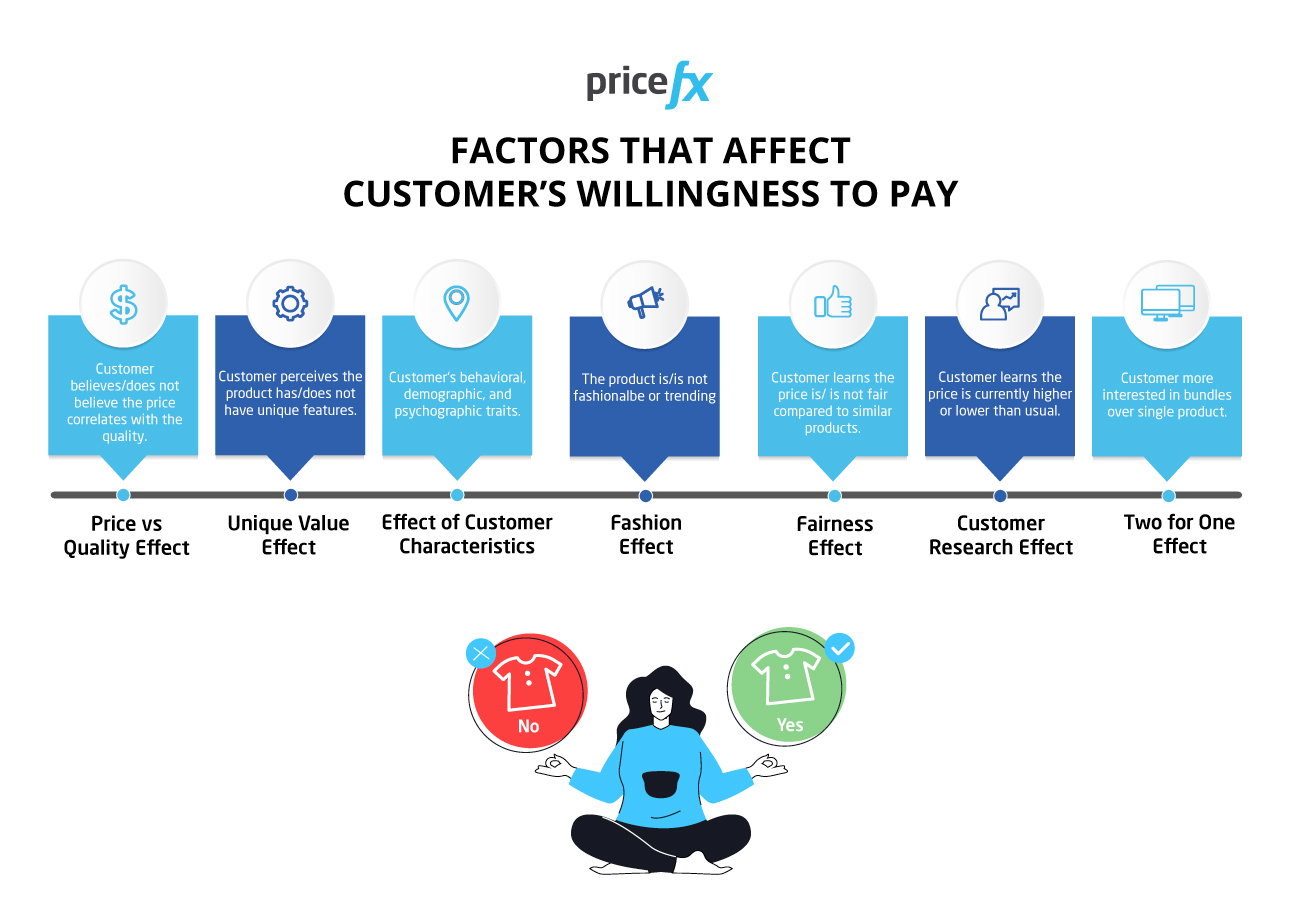

And while you’re spending hours calculating customer valuations and defining buyer personas, it’s important to remember that this isn’t a one-time cost, but an ongoing investment as you move forward. Because a customer’s willingness to pay is influenced by the market and their perception of value will change due to things out of your control.

If you’re a pro tennis player starts losing his swing and swearing at the umpire, or if your air conditioner doesn’t meet new household sustainability targets… its perceived value just plummeted.

Another influence on customer perceived value is competitor prices. If your box of 1000 staples is priced at $2 while your competitors’ box of 1000 staples is priced at $1, your customer will feel they are getting better value with your competitor.

Should a newcomer launch a box of 1000 multi-colored staples for $2, then value-based pricing dictates you should lower your price. If a plethora of copycat products (at vastly reduced quality) hit the market charging a mere 50¢… what do you do then?

As the above example illustrates, value-based pricing is not applicable to all market segments and products. (The question of whether staples should even be priced in this way is discussed later.)

While a value-based strategy can work really well in a market where you’re unchallenged or your customer isn’t particularly brand loyal, it will be difficult to leverage in a saturated or brand-loyal market. The model works best if your competitor is also strategically pricing their products.

Who Should Consider a Value-based Model?

A value-based strategy in one easiest employed by customer-focused companies with niche segments, where customers are more focused on the value your product delivers than how much they pay for it.

Brands with high-end positioning (deluxe cars, designer handbags, luxury watches), or those that offer uniquely valuable features (the strap that attaches your vanity case to your wheel-along, or the ink cartridges for your Montblanc) are more likely to succeed with this strategy. Staples, not so much.

Value-based pricing on lower-priced products resembles competition-based pricing because when a product is sold widely across the market, its price tends to naturally settle at one the customer considers is “correct”.

So, it’s likely that your box of 1000 standard staples are worth exactly the same to your customer as the box of 1000 standard staples your competitor sells. If you want yours to increase in perceived value, you’ll have to launch your glow-in-the-dark version.

A value-based model also works well for things like commodities as it is difficult to sell value on an item that can be found in abundance. Even companies who sell commodity products often have other value offerings such as smaller package sizes, technical support, payment plans etc … so “value” can be presented in unique ways.

Real Examples of Value-based Pricing

Let’s look at a multi-brand company like Volkswagen. They have multiple brands such as Škoda, VW and Audi. However, even if the production cost of each of these brands were to be similar, the final price ranges for each is very different.

Škoda’s range of cars, for example, would be one of the more affordable, VW in the middle and Audi is by far the most expensive. It is the “brand” surcharge and not the price difference across comparable models that account for the price changes.

The same can be said for travel. What’s it worth to you to arrive at your destination at closer airport and convenient time in a comfortable seat with extra leg room? Well, the difference is based on the value you place on location and comfort. If getting to your destination is the most important factor, then the perceived value of a Business of First-Class seat would matter less.

4 Steps to Setting Up Your Value-based Pricing Strategy

1. Customer research

Conduct buyer-value interviews to learn why your existing customers buy from you and what they would spend now that they see the value in your offering.

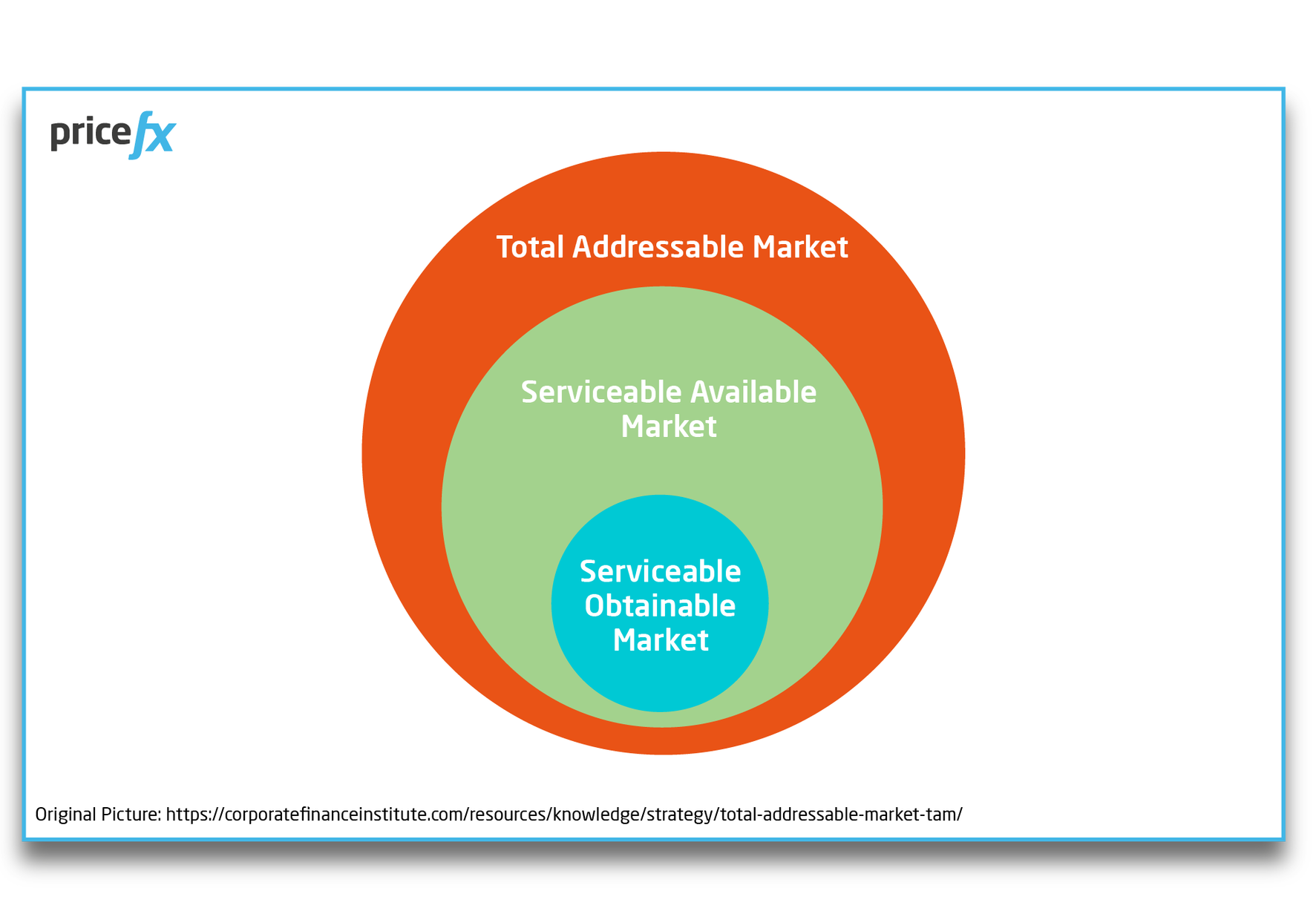

While this data is useful, remember that it’s a biased sample; these customers have already proved they’re willing to buy your product. So you’ll want to do research across your total addressable market to identify the price range that each segment is willing to pay for your basic offering as well as for specific features (like three speeds, slim-line appearance, remote control).

Your research will be a combination of demographic combined with qualitative data. Rather than asking your audience’s income level, ask instead what problem you’re solving—how your product affects their lives—and what they’re willing to pay (WTP) to solve that problem. Of course, you wouldn’t want to ask them their WTP directly. It’s better to ask them about the impact of not solving the problem e.g. machine downtime, increased service costs etc. If you were to ask buyers in target markets “how much discount, compared to competitor Y, would you need to switch” you might get an answer of around 20%. The reality might be closer to 5% to 10%.

2. Competitive analysis

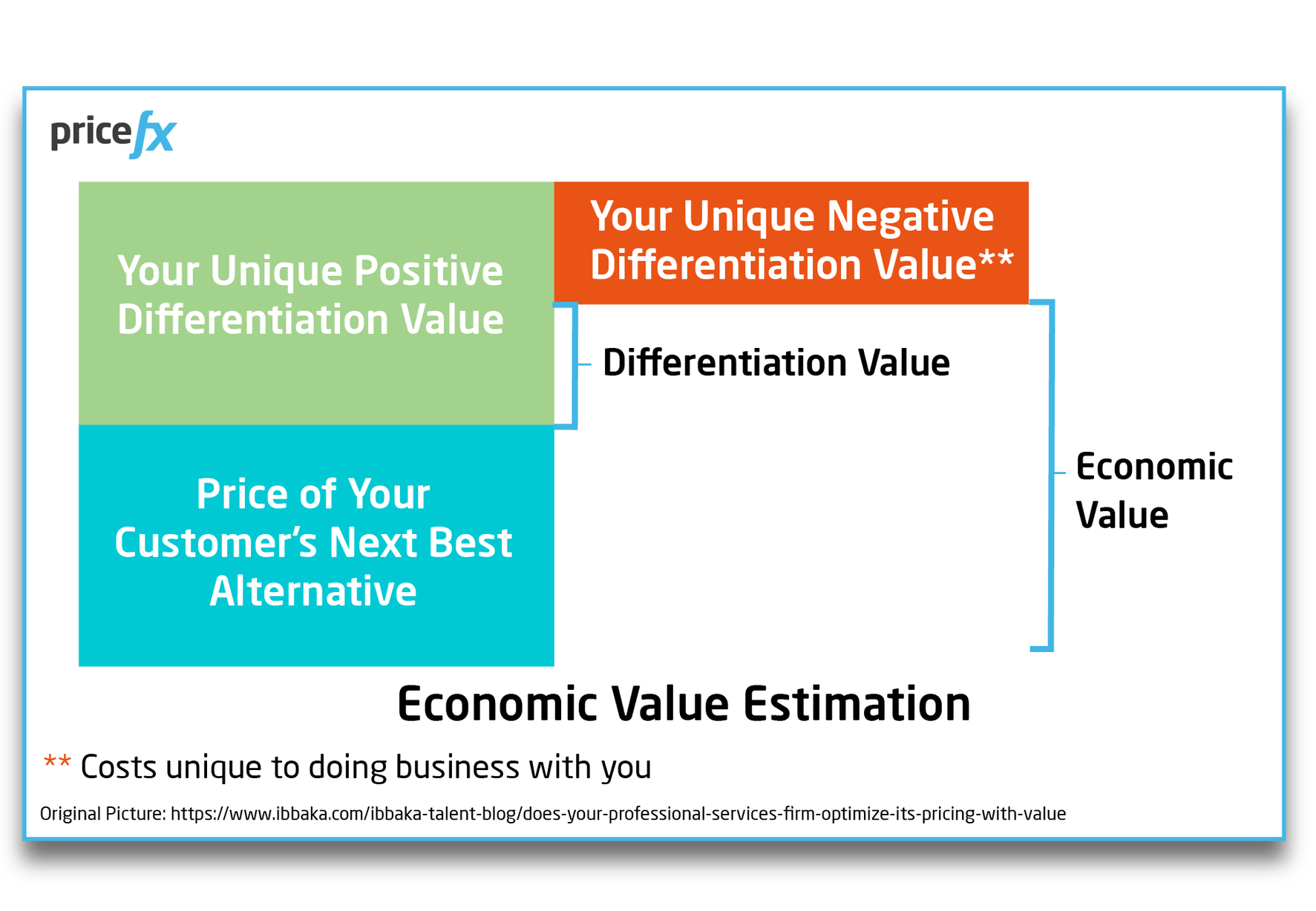

Your product’s value is only relative to the market. So you should undertake competitive analysis to uncover what the next best alternative for your customers is. If you were not part of the market, where would they go? The competition? What are they selling and how much are they charging? (Remember that there is always an alternative to your offering, even if that is “do nothing”.)

Your job is to clearly understand your differentiated worth as compared to the next best alternative. Does your offering last longer, look better, or work harder than the alternatives in the market? Does it come assembled, offer more features, is it made from better materials? The answers to questions like these will help you achieve a higher perceived value and therefore a higher price point.

Apple and IBM are both leaders in the computer hardware and software industry, but they each have very different messaging. Apple focuses on creativity while IBM focuses on business functionality, so even though they’re in the same market, their target customer segments differ. You need to find your uniqueness.

3. Packaging and Pricing

Now break your offering down into differentiated product offerings like “good, better, best” and price according to the willingness to pay of each segment around the features you’re offering.

There is no need to set a price for every single feature, common features (like the cropping tool in image-editing software) are already priced in—all companies offer this. Your job is to find the value of your differentiators and assess your customer’s willingness to pay for them.

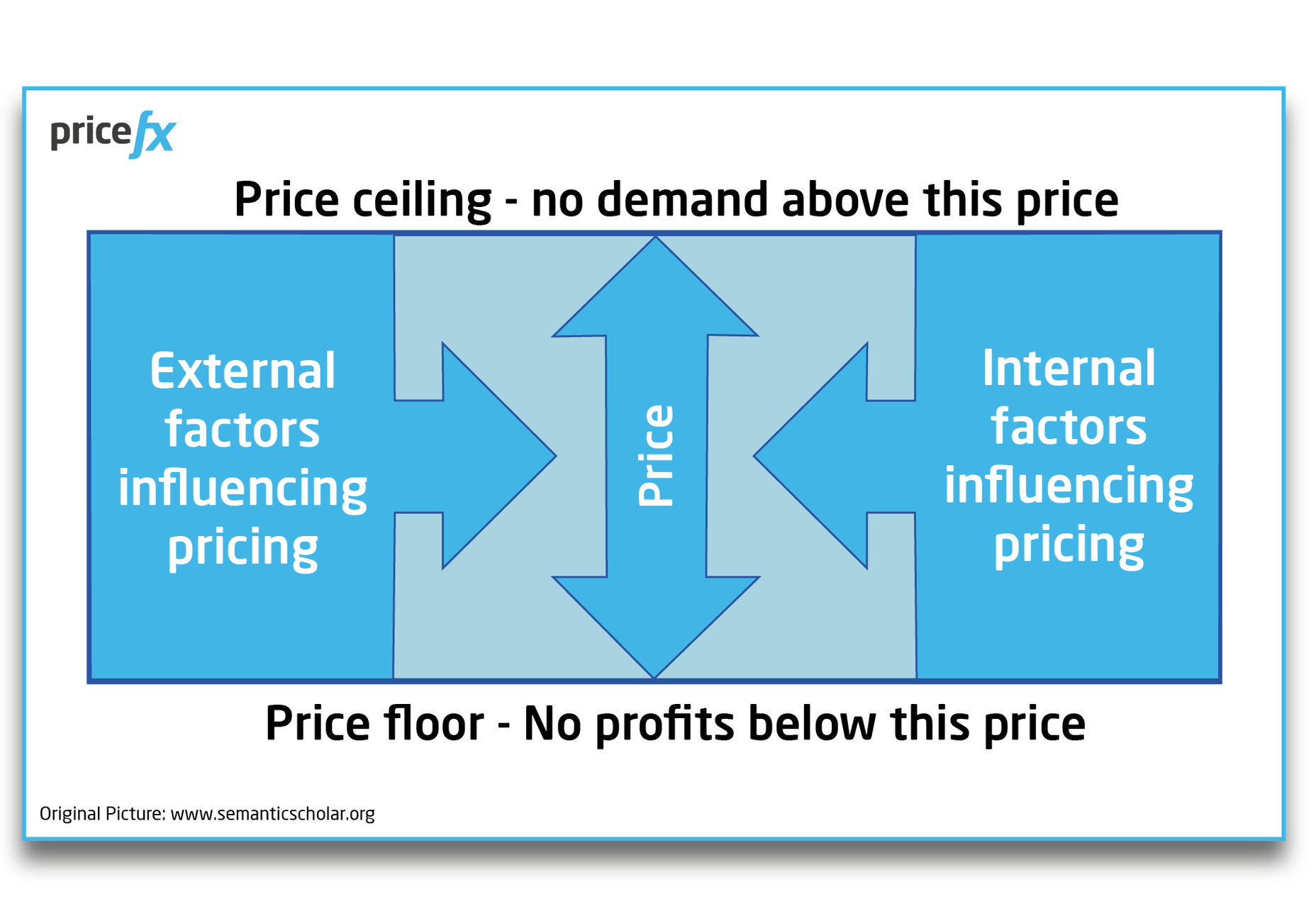

To work out how much to charge for each pricing bundle, you’ll need to identify and analyze your buyer personas in order to set ceiling and floor prices as well as average selling price goals.

At this point, you should also define your price positioning—how your offering is priced compared to the alternatives in the market and how customer WTP and company profit and market goals play a role in the final price.

4. Sales support

In order to ensure a successful value-based pricing strategy, your sales team needs strong enablement tools.

Not only do sales reps need a clear understanding of how you got to a certain price—transparency in pricing processes is essential here—but they should be able to communicate that to your customers in terms of the value you’re providing.

They should also be supported by having all customer data in one place, guardrails and guidelines for deal guidance, and non-price levers at their disposal (like volume discounts, rebates, early fulfillment benefits) for managing negotiations. They should be able to get accurate quotes to customers efficiently, even for complicated orders with multiple product variants, to ensure you seal the deal quickly.

The Power of Pricing Based on Perceived Value

As we’ve seen, a value-based pricing strategy won’t work for every business. Ideally, you’d want a high-quality customer-focused product that differentiates itself from the competition in a notable way, and your company should have a strong relationship and open channels of communication with customers.

But when correctly applied, value-based pricing has the potential to maximize your profits (through higher prices served to higher-paying customers) and revenue (through lower prices served to price-sensitive customers).

However, launching such a model takes a lot of time and effort as you have to get to understand your customers’ motivations intimately in order to uncover where you really deliver value to them. And this research is an ongoing commitment, as you should constantly refine your message and your price, and adapt to changing customer behavior in response to the market.

At Pricefx, we believe pricing software is a must if you’re going to embark on a value-based strategy. Not only does it bring together data from all over the market, but you can explore it at a granular level in order to identify drivers for value and uncover segments, patterns and opportunities you never knew you had. The AI and machine-learning capabilities will guide you in setting optimized floor, ceiling and stretch prices so that you’re never leaving money on the table again. What’s more, price optimization software like ours comes with built-in CPQ capabilities that support your sales team in understanding, communicating, and defending your prices during negotiation.

If you’re interested in how price optimization software can support your value-based pricing strategy, then check out the article below now: