The Difference Between Rebate Processes and Ship & Debit Processes

February 26th, 2020 (Updated 06/20/2023) | 8 min. read

By Garth Hoff

The Difference Between Rebate Processes and Ship & Debit Processes

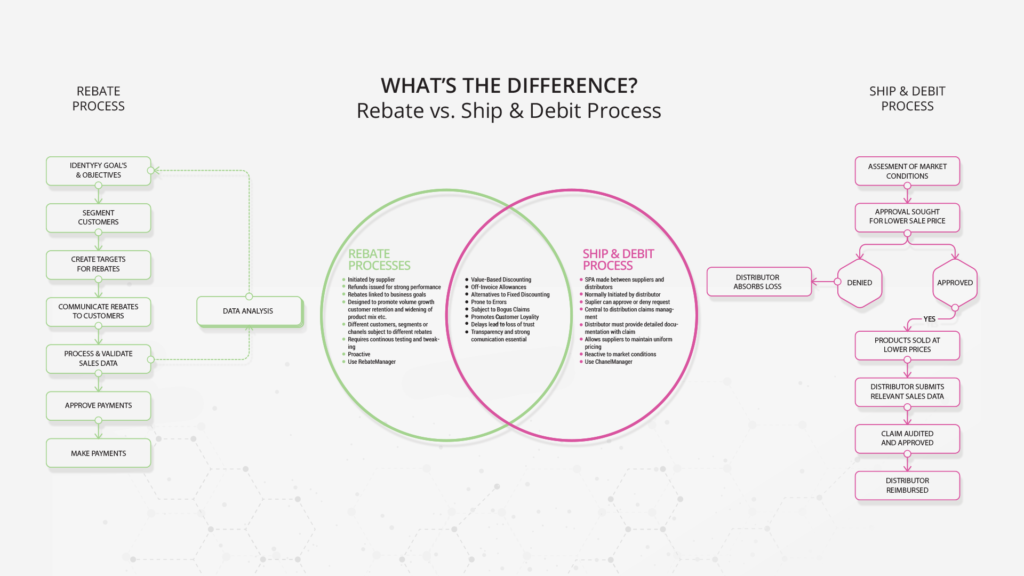

The smartest businesses practice value-based discounting. This means structuring incentives in such a way as to sculpt customer behavior towards meeting specific business goals and objectives. Different discounts are applied to different customers, channels or segments, in a highly bespoke and carefully considered way, taking into account past performance and current market conditions.

Rebates, whereby a customer is re-paid some of their spend in return for hitting certain pre-determined targets, are very effective at eliciting behavioral change. Ship & debits, whereby distributors debit suppliers for goods shipped below list prices, are special pricing agreements that should also be used strategically.

Often lumped together, rebate management and ship & debit management share many of the same challenges, especially when claims are processed manually with pen, paper and Excel, as they so often are. Pricing professionals can be dealing with thousands of claims each month, which is extremely time-consuming, labor-intensive and error-prone. There can be very big numbers at stake, which only add to the level of tension and pressure that pricing teams work under.

Late or missed claims throw budgets completely out of line, while late or missed payments can erode customer loyalty, which is precisely the opposite of what incentive management is designed to promote. Ultimately, these processes can become so bloated and complex that the administrative costs end up outweighing the financial benefits.

While the similarities between rebate processes and ship & debit processes are clear, sometimes we overlook the nuanced differences between the two. A granular understanding of these processes can help you to craft one-to-one strategies that get you the maximum return on investment for every $1 given away in discounts. Remember that discounting without a strategy is just giving money away.

The Problem with Fixed Discounting

The vast majority of B2B businesses are fixed discounters. They offer the same discounts to all of their customers, usually in return for higher order values. This model completely ignores one crucial differentiating factor of their customers – their willingness and ability to pay. Some customers would be more than happy to pay the full list prices, but how will you know which ones they are if you’re offering blanket discounts across the board?

There are other problems with fixed discounting too. Your competition will soon find out your discounting strategy and lower their prices accordingly, triggering a race to the bottom that benefits no-one but the customer. Over time, these discounts are taken for granted and customers will expect them year after year.

When fixed discounts are applied to larger volume orders, you should test your assumption that bigger orders are always better. Are customers ordering less frequently, but in larger volumes, in order to qualify for discounts? Does this ordering pattern actually place unnecessary stress on staff and require you to hold more stock? Would you ultimately be better off if customers ordered in smaller batches more frequently? The answers will be different from business to business, but these kinds of questions need to be asked.

Rebate Processes

Rebates take many forms and are as varied and numerous as the customers we serve. Therein lies their beauty: they can be uniquely tailored to each customer or segment, driving specific behaviors under specific conditions. Examples of such behaviors include:

- Meeting a minimum spend on a new product line in order to achieve a successful product launch

- Purchasing overstocked products in larger volumes than usual to aid in-stock clearance

- Referring new customers (an essential tactic in SaaS industries)

- Switching to higher-margin products

- Using sales channels with lower customer-service costs

- Providing a testimonial or acting as a reference

- Sharing valuable data

The first step in establishing a rebate program is the identification of clear and distinct goals, whether they be volume growth, customer retention, or broadening of the product mix. It’s strongly advisable that you focus on just one or two goals per customer, segment or channel. Complexity is the enemy of incentive management. Not only is it an administrative strain, but it also makes it so much harder for conditions and rules to be communicated to customers.

Simplicity is key also in effectively measuring and testing the efficacy of your rebates, i.e., have you achieved your goal(s). Keeping rebate time-frames short allows you to test, tweak and change goals more effectively. The longer the time-frame, the more that extraneous variables will come into play, and the more likely a customer will start seeing an incentive as an entitlement instead of a motivator.

Once overarching goals have been decided upon, you need to segment your customers by goal-specific metrics, identifying key performers and strategic partners. Each customer will, no doubt, be subject to different rules and conditions. These need to be communicated to your customers with the utmost care and clarity. A strong line of communication is essential throughout the process, as progress is logged and reported back to customers, keeping them updated and engaged.

At the end of the specified time-frame, sales data needs to be processed and validated, before rebate payments are finally approved and subsequently released in an accurate and timely manner. Delays in rebate payments cause frustration and an erosion of trust, so they should be avoided at all costs.

At the end of the process, all gathered data must be thoroughly analyzed. Have you been successful in sculpting customer behavior towards meeting your pre-determined business objectives? Internal and customer-facing reports should be produced before you draw up the next round of rebates.

Ship & Debit Processes

Ship & debit is another kind of off-invoice allowance that can be used to strategic effect. While rebate processes often bypass distributors by design, so that each customer’s prices can be kept private from one another (distributors can be loose-lipped), ship & debits are arrangements between suppliers and distributors. They are an essential element of distribution claims management: they deal with all the business that needs to be sold at lower prices than those quoted on the distribution price list.

There are many reasons why a distributor might cut its prices: it might want to retain a customer, entice a new one, or attempt to clear slow-moving stock. Under such conditions, the distributor might absorb such losses itself, but most often an attempt will be made to claw back the shortfall by debiting a supplier. Thus, the supplier can sell goods at a uniform price and the distributor can react to market conditions by lowering prices without losing all of its margin.

The process begins when a distributor seeks approval from a supplier for discounts on one or more products, to one or more customers. The supplier subsequently approves or rejects these new discounted prices. An accrual offer is made for the approved request and sales are made against this offer. Finally, accruals are consolidated against ship and debit offers and a claim or debit is submitted to the supplier. It’s incumbent on the distributor to gather all the relevant documentation related to the discounted sale, and it’s incumbent on the supplier to process the claims in a timely and accurate manner.

How to Improve the Incentive Management Processes

When you’re bogged down with hundreds of rebate and ship & debit claims, the last thing you want to do is invest time and money in implementing new tools and systems. But, in reality, if you find yourself in this situation, it’s exactly the right time to make a change. RebateManager is designed to be fast, painless and inexpensive to implement, integrating seamlessly with existing software. What’s more, it’s suitable for use in all industries, not just high-tech hardware.

RebateManager can be used to define, manage and calculate special off-invoice conditions. You can use live data to build a library of rebates, testing, tweaking and improving them continuously. User-roles, audits, and entitlements can be established and custom review and approval processes set up and integrated with your CRM and payment systems. All this can be done from inside the centralized module, boosting efficiency, eliminating expensive errors and improving transparency.

ChannelManager, on the other hand, centralizes, simplifies and de-risks ship and debit claims management. With ChannelManager, ship and debit claims are validated, with proof, automatically so miscalculations are avoided, turnaround time is shortened and your team is freed up to focus on new business opportunities. When claims are processed on time, budgets can be calculated accurately and claims reconciled for the right financial period. Everyone in the claims process has visibility and this improved transparency, combined with always-on-time reimbursements, helps build trust between supplier and distributor, nurturing new relationships and cementing existing ones.