Change in Demand Forecasts: Optimizing Your Portfolio with Pricefx

October 31st, 2023 | 12 min. read

In the intricate landscape of the chemical industry, pricing risks loom as substantial challenges that demand unwavering attention. One of the most significant threats arises when the undergo sudden and unexpected changes. The shifts can ripple through the entire supply chain, causing disruptions that reverberate across pricing strategies. The potential consequence of such a change in demand is far-reaching and encompasses a multitude of facets that can strain profitability, operational efficiency, and customer relationships.

For more than a decade now at Pricefx, we have been analyzing chemical sales, pricing data, and setting automated pricing processes for our clients, helping them to make nimble, focused, and accurate real-time price changes, proactively protect their margins, and adapt to dynamic market changes quickly and easily to stay ahead of the competition.

In this article, we will outline the risks of not optimizing your portfolio, why it is essential to do so and explore the methods of how to optimize your portfolio including how the Pricefx pricing solution can assist when demand forecast (in particular) changes.

What Can Happen If Demand Forecast Changes Are Left Unchecked?

Demand forecast changes can have profound consequences on your chemical company’s bottom line, operations, and customer relations. To tackle these challenges effectively, chemical firms are turning to AI-driven pricing solutions like Pricefx. But why is this so crucial?

Picture this: your demand forecast takes an unexpected nosedive due to unforeseen market shifts or external factors like regulatory changes. . This situation not only eats into profits but also occupies valuable storage space.

Conversely, underestimating a surge in demand can lead to stockouts, damaging customer relationships, giving rivals an opportunity to swoop in and indicate incorrect value-price alignments. For example, not considering specialty vs commodity-based products may dilute the brand or miss portfolio adjustments.

These effects will destabilize your portfolio’s balance (commodities versus specialty products, etc.) at different speeds and in different ways, highlighting the sophistication of analytical and strategical capabilities required to perform crisp analysis and rapid changes.

These examples underscore the intricate balancing act pricing managers face when adjusting prices in response to shifting demand. The worst-case scenario? Mishandling these adjustments, either by overreacting with steep price reductions, eroding margins and product value, or under-adjusting, resulting in missed revenue opportunities.

Given the chemical industry’s complex supply chain, these effects can cascade, impacting downstream partners. That’s why leveraging advanced pricing software and predictive analytics is paramount. These tools enable swift interpretation of market dynamics, facilitating agile pricing adjustments that mitigate risks and maintain your chemical firm’s resilience in the face of demand fluctuations.

Why is it Important to Optimize Your Portfolio When Demand Forecasts Change?

Optimizing your portfolio becomes vital when demand forecasts suddenly shift. These aren’t mere fluctuations; they are seismic shifts that can reshape markets and alter customer preferences. Failing to adjust your portfolio in response can lead to dire consequences for your business.

In the chemical industry, your product portfolio is a delicate ecosystem, strategically designed to meet market needs. But when demand projections unexpectedly change, this equilibrium is disrupted.

By optimizing your portfolio to match shifting demand, you align your offerings with real-time market needs, minimizing financial losses and preserving your reputation.

Now, imagine the consequences of ignoring portfolio optimization during demand changes. You might react too late, leaving your products out of sync with the market and causing revenue leaks and potential market share losses. Neglecting portfolio alignment risks declining profitability and competitiveness. Portfolio optimization is a strategic imperative that empowers your chemical company to respond agilely to demand shifts, retain customer loyalty, and secure a profitable position in this ever-evolving industry.

Manual vs Automated (Pricing Software) Portfolio Optimization

While both have their merits, the chemical industry’s complexity and the need for real-time precision often lean heavily in favor of pricing software.

Manual Portfolio Optimization

In the manual realm, portfolio optimization requires exhaustive data analysis and strategic decision-making. Chemical companies must undertake a labor-intensive process of identifying which products to prioritize, adjusting pricing strategies, and coordinating with various stakeholders. However, the manual route comes with inherent challenges. It’s time-consuming, susceptible to human error, and lacks the agility needed to swiftly respond to dynamic market changes. Moreover, in a rapidly evolving industry, relying solely on manual methods can lead to missed opportunities and loss of competitive advantage.

Automated (Pricing Software) Portfolio Optimization

Conversely, the integration of advanced pricing software, like that provided by Pricefx, streamlines portfolio optimization. Such software harnesses the power of data analytics and artificial intelligence (including machine learning) to swiftly interpret shifts in demand forecasts and adjust pricing strategies accordingly. This software enables chemical companies to harmonize their product offerings with evolving market demands in real time. It empowers businesses to make data-driven decisions, quickly identifying which products need promotion, adjusting pricing strategies, and reallocating resources. The result is an agile, adaptable portfolio that remains optimally aligned with changing demand dynamics. In a highly competitive and rapidly evolving chemical landscape, where every decision counts, choosing advanced pricing software emerges as the strategic choice, ensuring not just survival but sustained growth and profitability.

How to Optimize Your Portfolio with Pricefx When Demand Forecasts Change

When looking at how the Pricefx solution specifically can assist your chemical company, we can clearly look at 4 areas by which the pricing software can mitigate your risks and help you make better decisions:

1. The Pricefx Platform – Data, Analytics & Assessing Pricing Power

The Data/Analytics Relationship in Pricefx

In the realm of chemical portfolio management, it all begins with having the right data, in the right place, accessible to the right people. Imagine a chemical company that wants to optimize its portfolio based on future demand forecasts. They need data on industry trends, supply projections, their own capacity plans, and sales pipelines. Now, picture each of these critical pieces of information scattered across different databases, isolated from one another. This fragmentation creates inefficiencies, making it challenging to derive meaningful insights and predictions.

For instance, consider the petroleum industry. Suppose a company manufactures a range of petroleum-based products, but many require a range of different ingredients, all available at a range of prices and levels of demand. To make informed decisions about their portfolio, they must blend data on industry growth, capacity, and their sales forecasts seamlessly.

Data management plays a pivotal role here.

It is not just about collecting data; it is about the strategic amalgamation of data sources, creating a coherent database that becomes the bedrock of effective analytics.

By optimizing data integration, chemical companies can bridge the gap between planning and actionable insights, resulting in better decision-making and a competitive edge in an ever-evolving market.

Beyond planning, data’s backward-looking aspect is equally vital. This retrospective analysis involves examining historical data to understand what has worked and what has not.

For example, a pricing manager for a petroleum company may assess the profitability, pricing power, and demand for different product segments. This is where portfolio management comes into play, driving decisions about which products to prioritize and which to phase out.

In industries like chemicals, where costs fluctuate frequently, such as in raw materials and logistic expenses, data-driven insights are indispensable for ensuring cost recovery and maintaining profitability.

With robust analytics, companies can tackle these multifaceted challenges head-on, guiding their pricing strategies and resource allocation effectively. The integration of data-driven insights into portfolio management is not just an option; it’s a competitive necessity in today’s rapidly changing chemical industry landscape.

Assessing and Leveraging Pricing Power

The power of data analytics is akin to having a master key that unlocks countless opportunities for a chemical company. These opportunities are deeply aligned with their unique business goals, which can vary not only by region but also by product category. With data analytics, businesses gain the capability to examine their pricing strategies holistically, tracing back to what worked effectively in the past and projecting how those strategies can unfold in the future.

Consider this scenario: a chemical company operates in both mature and emerging markets.

In North America, where the market is well-established, they might be focused on optimizing margins for profit.

In contrast, in South America, where they are looking to expand their presence, the emphasis could be on gaining market share and increasing volume.

These divergent goals necessitate nuanced pricing strategies, which can be precisely crafted and fine-tuned using data analytics. By harnessing the insights derived from historical data, chemical companies can model and adjust their pricing strategies to navigate the unique landscapes of various markets. It’s about the power to adapt, refine, and execute pricing strategies that are not just data-driven but goal-driven, ensuring that pricing power becomes a pathway to achieving their specific objectives in each market and product category.

2. The Key Science Capabilities – Demand Forecasting & Constrained Modeling Algorithms

Pricing software can be a total game-changer when it comes to leveraging data to optimize pricing strategies in real-time. Two key science capabilities of Pricefx pricing software are demand forecasting algorithm and constrained modeling.

The Demand Forecasting Algorithm

Demand forecasting algorithms help businesses understand the future based on available data, which can be scarce and difficult to obtain. This capability is especially important in the chemical industry, where sudden and unexpected changes in demand forecasts can cause disruptions throughout the entire supply chain.

It enables businesses to predict the demand for products and anticipate customer behavior and purchase decisions based on historical data and inputs from across the organization.

Accurate demand forecasting is crucial for chemical companies to avoid stock-outs or over-stocking, improve profits, and strengthen supply chain management.

Constrained Modeling

Constrained modeling is another key science capability of Pricefx pricing software that helps businesses optimize their portfolio management. It considers the constraints that chemical businesses have on their profitability, manufacturing capacity, and fixed capacity.

By using constrained modeling, businesses can make the most out of their capacities and avoid excess inventory that they cannot sell.

In the chemical industry, constrained modeling is particularly important because companies make long-term investments in their capacities.

They may have plants in various countries that have a total fixed capacity.

Constrained modeling can help companies understand what they should do when they get demand for more than their capacities.

In the chemical industry, constrained modeling is particularly important because companies make long-term investments in their capacities. They may have plants in various countries that have a total fixed capacity. Constrained modeling can help companies understand what they should do when they get demand for more than their capacities.

By modeling their problem, which may be complex, and getting out of the optimization, something that satisfies their constraints and gives them the best outcomes, businesses can maximize their revenue and profitability – an essential tool for chemical companies to optimize their pricing strategies and stay ahead of the competition.

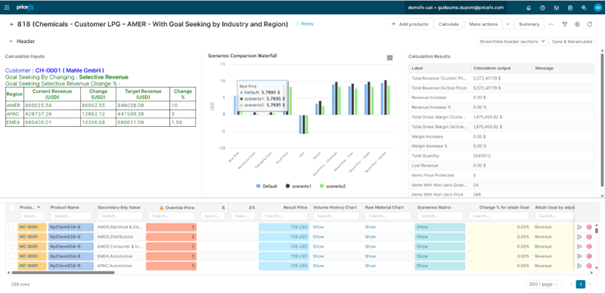

3. Mapping Demand and Capacity for Planning Purposes

Navigating the intricacies of data analytics in the context of portfolio management and pricing can be a complex journey, but it’s all about leveraging key science capabilities and translating them into actionable strategies. For those less technically inclined, the challenge becomes delivering this content effectively. In practice, real-world use cases provide clarity. Take, for instance, the first use case: mapping demand to capacity. This isn’t just about crunching numbers; it’s about gaining a holistic view of the market. It starts with gathering projections and data, and then Pricefx steps in, providing the analytical framework to make sense of it all. Whether you’re aligning your CRM pipeline with your product per plant capacity, considering raw material costs or planning for the industry’s future, it’s a balancing act between the micro and macro views. The goal? To optimize your portfolio, maximize revenue, enhance profit margins, and achieve your business objectives. This is where data science and pricing strategies converge, forging a pathway to success in the chemical industry and beyond.

4. Using Pricefx for Continuous Improvement – It’s Not ‘Set-and-Forget’

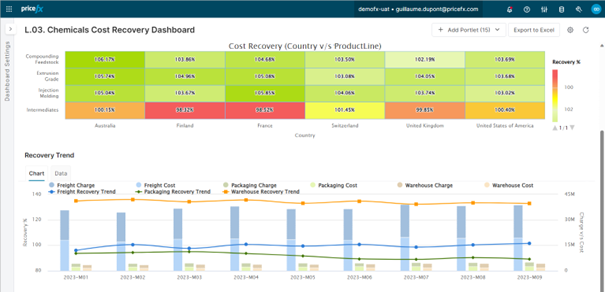

In the ever-evolving landscape of pricing and portfolio management, one thing remains clear: it’s not a “set-and-forget” endeavor, but continuous improvement. To optimize pricing strategies effectively, , even down to the product level. You want to do so at the right time, when the system spots an anomaly that needs your attention. situation where a chemical company collaborates with a distributor. This scenario, while not explicitly centered on pricing, vividly demonstrates the intricate nature of the industry and the numerous factors that can affect prices such as short or long-term economic trends or raw material price forecasts, and that by watching them closely and tracking them profitability can be maximized.

Picture a commitment to deliver a particular material, laden with various constraints and attributes, such as fire resistance and other critical factors. In this complex interplay, there exists an opportunity to refine not only pricing strategies but also compound formulas, effectively reducing costs while guaranteeing the best outcomes. While these real-world instances often require offline fine-tuning, they could seamlessly integrate into the Pricefx platform, showcasing its remarkable adaptability and ability to respond to a range of factors, including cost recovery (as seen in the screenshot below).

However, the pricing journey does not stop there. Value-based pricing emerges as a pivotal component, aligning input factors with customer value output. It’s about determining the right pricing strategies to maximize revenue and profit margins while delivering superior value to consumers.

These multifaceted elements, including surcharges, cost increases, and profitability analysis, create a holistic pricing strategy that extends from macro to micro levels. The importance of this comprehensive approach cannot be understated, especially in the chemical industry, where complexities abound. By combining data, analytics, and a structured approach, you can drive continuous improvement, ensuring that your pricing strategies stay agile, effective, and aligned with your business objectives and portfolio strategy.

To learn additional ways that the Pricefx solution can assist your chemical company’s unique set of business objectives, check out the handy article below:

Happy Pricing!