What do Amazon, Ticketmaster, and Uber have in common? All companies have found themselves in hot water with consumers, but a good deal of that scrutiny has to do with the strategy they use to price their products: dynamic pricing. While controversial, this strategy, defined by rapidly adjusting prices according to market forces, is still little understood. As dynamic pricing comes in opposition to non-dynamic pricing strategies, such as fixed pricing, it’s important to know the differences between them, as well as their pros and cons, so you can decide for yourself which approach serves your company’s needs best – and avoid leaving money on the table.

Here at Pricefx, when we help our customers carry out their unique pricing goals with our cloud-native pricing software, we often stress that data-driven tools only work well if you truly know what you’re looking to achieve – and this is where picking the right pricing strategy becomes crucial.

To help you get there, in this article we’ll discuss what fixed and dynamic pricing look like both in theory and in practice before moving on to their pros and cons.

Dynamic Pricing vs. Non-Dynamic Pricing: An Overview

In our discussion of dynamic pricing and non-dynamic pricing methods, we’ll be using fixed pricing as the featured example of non-dynamic pricing, as it’s one of the most common non-dynamic pricing strategies today.

What is Fixed Pricing?

Fixed pricing is a non-dynamic approach to pricing in which one non-negotiable price is set and remains consistent over time, regardless of changes in the market. Some of the most common situations when fixed pricing is used include:

- Bulk supply orders

- Outsourced projects for companies (e.g., website design)

- One-time, time-dependent payments (e.g., memberships, subscriptions, or educational services)

Fixed prices are calculated using variables like cost, margin, the value claim of the product or service, and any other internal factors unique to that business. Unlike dynamic pricing, these prices remain stable over time, rather than automatically recalculated based on shifting market forces.

Typically, fixed pricing is an uncommon approach to pricing for most businesses today. In some cases, it’s a byproduct of IT and structural limitations rather than a sought-after practice; for example, it might be used in cases of limited access to data and siloed systems and processes where multiple parts of the organization don’t collaborate on pricing.

In other cases, such as when companies want to give their customers a better idea of their costs so they can plan their budgets, or in industries where the market is highly regulated and there is little opportunity for price increases, this strategy is a good choice.

What is Dynamic Pricing?

Dynamic pricing is a type of price differentiation that involves continuous adjustment of the prices of the same goods or services based on the current market conditions, most notably supply and demand. This type of pricing is alternatively referred to as demand pricing, surge pricing, or time-based pricing.

Its highly flexible and data-driven approach to price setting makes it an attractive option for companies with complex pricing needs, for instance those who require competitive pricing for an extensive customer and product portfolio. Travel and tourism, entertainment, electricity, car rentals, e-commerce and other retail businesses are among the industries using dynamic pricing to capture more profitable margins in sales, among other uses.

While each industry considers a unique set of factors for its price calculation, dynamic pricing generally considers a combination of any of these variables in its algorithms:

- Competitor pricing

- Consumer purchasing behavior

- Supply and demand dynamics

- Market trends

- Time, events, and seasonality

One well-known example of dynamic pricing comes from the ridesharing giant Uber, which uses surge pricing to calculate fares based on demand, peak hours, and even customer-specific willingness to pay. Ticketmaster, a self-service ticket platform, has stirred up controversy in recent years for its own dynamic pricing strategy, which has led to accusations of price gouging among its critics.

Behind the scenes, modern dynamic pricing strategies use machine learning (ML) algorithms and other artificial intelligence systems to identify patterns in historical sales, competitors, market trends and other data sources to set optimal prices for products.

Dynamic Pricing and Non-Dynamic Pricing: Pros and Cons

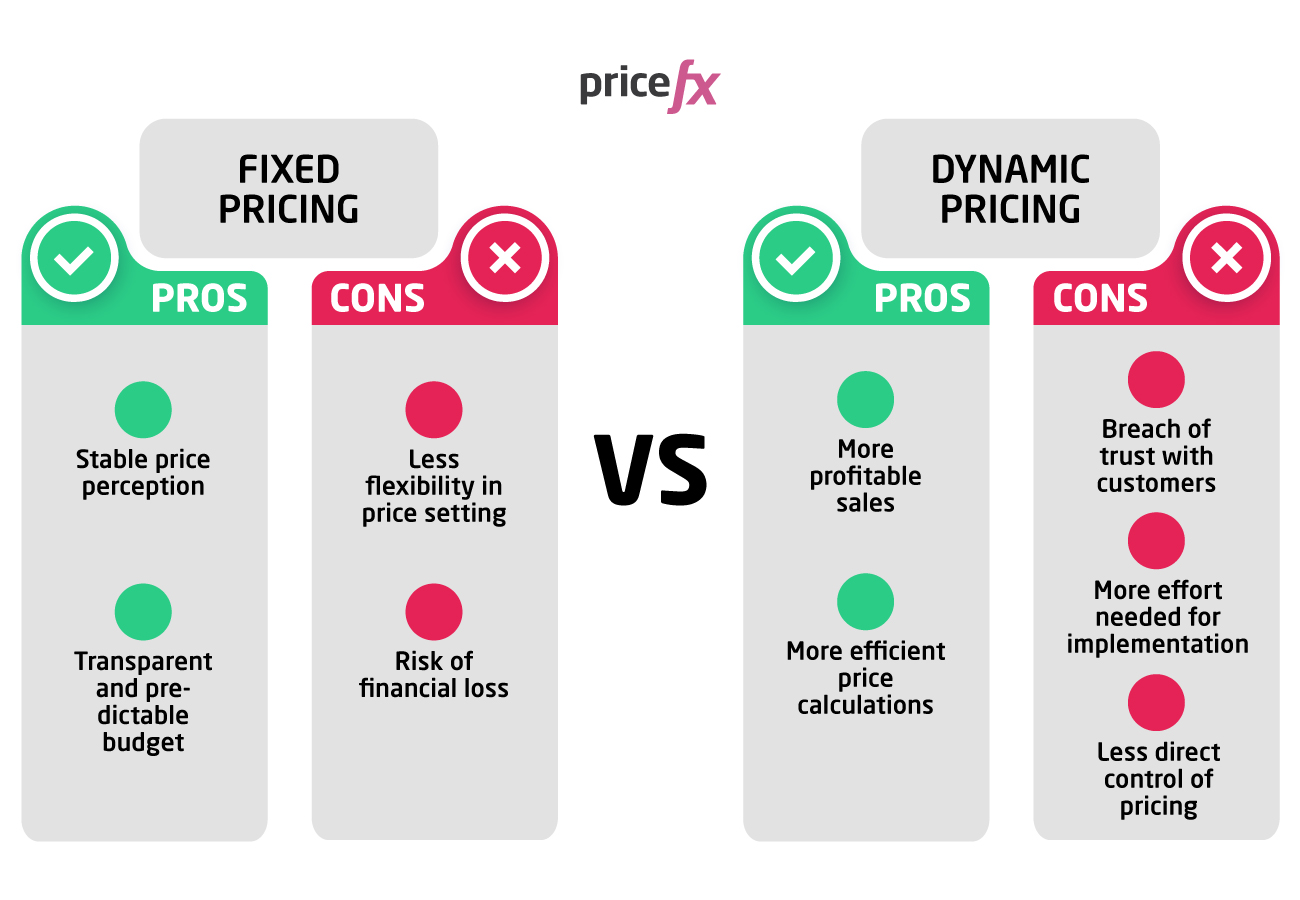

With the underlying principles of dynamic and non-dynamic pricing in mind, let’s move on to the pros and cons of each pricing strategy, again using fixed pricing as an example.

Fixed Pricing

Pros

Stable Price Perception

One of the standout benefits of fixed pricing is a stable perception of prices among consumers. When your customers know exactly what prices to expect from you, that certainty brings more confidence to their purchasing decisions and maintains their trust in your business in the long term. However, it should be noted that with this approach, customers might be more sensitive to price changes, as they’re more likely to notice any deviations from the norm.

Transparent and Predicable Budget

With more stability in pricing, sellers and buyers mutually take advantage of having greater visibility of the budget (something neither side is guaranteed with dynamic pricing). Companies benefit from a predicable budget as it enables easy planning and sales forecasting, while consumers enjoy the psychological safety that predictable pricing brings.

Cons

Less Flexibility in Price Setting

In a fixed pricing model, companies lack the agility to quickly react to changes in the market as they happen; when shifting supply and demand dynamics, global events, inflation, or the consumer confidence index take a back seat, companies miss out on opportunities to price their products more competitively.

This model is also more one-size-fits all in its approach to customer-specific pricing than dynamic pricing. With one set price for a given product, irrespective to the customer profile on the other end of the transaction, there is little room to factor in different willingness to pay across consumer groups, or the maximum price point a given consumer is comfortable accepting, resulting in considerable profit losses.

Risk of Financial Loss

While the fixed price approach is relatively low risk for the customer due to its stability over time, the same isn’t afforded to a company with a fixed pricing model. Once established, a fixed price that is inaccurately calculated, i.e. underpriced, at the onset is difficult to take back. By the same token, as the price is set irrespective of changes in consumer demand, it will be the company, not the consumer, that absorbs those losses.

Dynamic Pricing

Pros

More Profitable Sales

With dynamic pricing, businesses have a mechanism to automatically push pricing levers up and down in response to supply and demand dynamics and customer buying behavior, which in turn brings in both increased sales through low pricing and profits through more “premium” pricing.

Dynamic pricing can also be used as a safeguard in this way; in response to imbalances in supply and demand, dynamic pricing works to quickly reprice goods to cover losses on the production or inventory side.

More Efficient Price Calculations

Dynamic pricing helps companies price with a higher grade of efficiency, as it brings in data-driven automation to calculate optimal price points with sales and market data, in many cases with minimal human interference.

Not only does dynamic pricing enable quicker price adjustments, it also allows businesses to scale its pricing to a point it wouldn’t have reached using more traditional strategies; those with seemingly infinite (and steadily growing) combinations of customer and product groups simply don’t have the manual resources to calculate prices at the same pace or level of accuracy.

Cons

Breach of Trust with Consumers

The more variability there is in pricing, as is the case with dynamic pricing, the greater likelihood of an upset among, and alienation of, your consumer base. Consumers need to be assured that the same carton of eggs is priced the same a week, a month, or even a year from now. If the price of eggs skyrockets for reasons (assumed to be) outside of the individual consumer’s control, this weakens their perception of your business as an entity they can trust – and this kind of skepticism hurts sales.

More Effort Needed for Implementation

Dynamic pricing requires significant effort upfront to identify the parameters to be used to determine when a price adjustment is necessary. You’ll also need to have the strategy you’ll use to establish what that adjustment is going to look like. So, while much more scalable, dynamic pricing is by no means a simple exercise.

Less Direct Control of Pricing

As is often the case with any data-driven system that pulls in large amounts of data and considers several variables in its calculations, dynamic pricing strategies are harder to control the more complex they get; this is especially the case with dynamic pricing using black box artificial intelligence, a type of AI with incomprehensible outcomes.

Unfortunately, companies who’d like to avoid taking ownership of their surge pricing take advantage of this lack of control and transparency, attributing their higher-than-average prices to an elusive “algorithm” rather than something the company enforces directly.

Dynamic Pricing: Is It Really the Right Move for Your Business?

As you’ve seen, dynamic and non-dynamic pricing strategies respond to distinct business contexts, so it’s important to consider what yours looks like to make an informed decision.

In case you’re leaning towards dynamic pricing to support your company’s pricing goals but aren’t sure yet, consider checking out our comprehensive article on dynamic pricing, where you can dive deeper into what this pricing model looks like, including tips for its application and real-world examples.