Economic Downturns: Why Spending on Pricing is a Good Idea

October 18th, 2023 | 9 min. read

In the realm of finance and economics, it’s no secret that downturns can be as inevitable as that sudden afternoon rainstorm you forgot to check the weather app for. When belts are being tightened and uncertainty lingers like a stubborn cloud, it might seem counterintuitive to consider spending on anything. But hold on to your calculators, because there is a strategy that could just be your silver lining – investing in pricing software during economic downturns.

Picture this: You’re in a boat, sailing through choppy waters of the economic sea. Everyone around you is gripping the sides, worried about the storm ahead. But you? You have got a GPS system guiding you through those turbulent waves. That is what investing in pricing software can be for your business. It is your tool to navigate through those economic storms, helping you set the right prices, boost your margins, and steer your ship toward the safe harbor of profitability.

At Pricefx, as a provider of modern pricing software, we have spent more than a decade assisting our customers through good times and bad, and when the going gets tough we have been answering all manner of pressure points from our customers in choppy times of sudden and extreme change.

Now, I know what you’re thinking – spending money during a downturn sounds like a risky proposition. But here is the kicker: it might just be the smartest pricing move you and your organization ever make. Let’s dive into why.

The Top 7 Reasons to Invest on Pricing Software in an Economic Downturn

In the unpredictable tides of economic downturns, strategic decisions take center stage for businesses aiming to navigate the storm. Amidst these challenges, investing in pricing software emerges as a beacon of financial wisdom. Let’s analyze the top 7 compelling reasons why pricing software can become your company’s strategic ally during economic downturns, offering your company a lifeline to potential profitability and financial resilience.

1. Fine-Tuned Pricing Can Boost Your Bottom Line

Imagine you are in a bakery, eyeing those delectable pastries. You are willing to pay a bit extra for the perfectly flaky croissant, but not a fortune. Well, guess what? Regardless if you are in a B2B or B2C environment, your customers are no different. In fact, they are likely scrutinizing their spending more than ever in tough times. This is where precise pricing comes in.

Investing in pricing software gives you the clarity of setting prices that your customers see as fair, even in a downturn. That transparent approach crystal ball that tells you exactly how much your customers are willing to pay for that croissant without feeling guilty. With such insight, you can keep healthy margins and your customers satisfied – a win-win, right?

For example, many B2B companies conduct business via long-term contracts, many of which are governed by volume commitments. However, contracts signed 12 months ago do not account for the skyrocketing costs caused by an economic downturn. In this scenario, you could use CPQ (Configure Price Quote) software to have automated written clauses into each contract that allow for cost-driven increases or shortage of inventory.

What’s more, honest and open communication with your suppliers driven by data is more critical than ever. You can use all available data to plan product availability, forecast wait times and establish alternative strategies where necessary. Transparent and communicated pricing software-based decision-making will empower your teams to be more proactive and decisive with your customers. Getting out in front of upcoming cost hikes can be invaluable to the effectiveness of your pricing models.

2. Leverage Price Adjustments by Product or Customer Segments with Pricing Software

Amidst periods of economic downturn and the consequent fluctuations in prices, utilizing pricing software to pinpoint the sectors within your business that are most affected by cost changes becomes paramount. For instance, when dealing with products that are hard to source or possess limited alternatives, passing on cost hikes to maintain profit margins can be more effectively managed within this segment.

Similarly, on the customer side of the segmentation equation, strategic cost allocation may be required for competitive clients operating in price-sensitive markets or regions where cost effects are irregular, necessitating careful margin protection. Employing segmentation helps identify key customer characteristics, purchasing behaviors, and price optimization strategies tailored to each. Remember, even seemingly minor price adjustments can significantly boost your overall profitability.

This underscores the necessity of maintaining data accuracy. A comprehensive understanding of both internal data (encompassing current and projected sales history, costs) and external data (like customer demand, competitor pricing, and partner input) provides a comprehensive market perspective.

Integrated pricing software consolidates these diverse data sets, facilitating specialized analysis that drives optimal pricing decisions, shedding light on transaction-generated revenue and potential financial leaks.

3. Price Optimization Keeps You Ahead of the Curve

Remember the fable of the tortoise and the hare? Well, in the business world, the tortoise is the one who has the pricing software on their side. While competitors might be running around like headless chickens, struggling to figure out how to price their products, you are the calm tortoise, armed with data-driven insights.

Pricing software does not only help you set prices – it helps you optimize them. The data insights can help you analyze market trends, competitor pricing, and customer behavior faster than you can say “recession.” So, while others are running around and busy second-guessing their strategies, you are already ahead of the curve, making pricing decisions that keep your business nimble, targeted, ready to adjust and thriving.

Learn all there is to know about price optimization and how it works by clicking on the image directly to read one of my favorite articles:

4. Uncover Hidden Opportunities & Save Time

You know that feeling when you find money in your jacket pocket that you didn’t know was there? Well, pricing software can do that for your business. During an economic downturn, every dollar, euro, yen, rupee, or dirham counts, and you need to squeeze value from every corner.

Pricing software allows you to dive into your data like a detective, uncovering opportunities you didn’t even know existed. It identifies underperforming products, untapped markets, and pricing strategies that could be your golden ticket. In a sense, it is your financial advisor, helping you make the most of what you have.

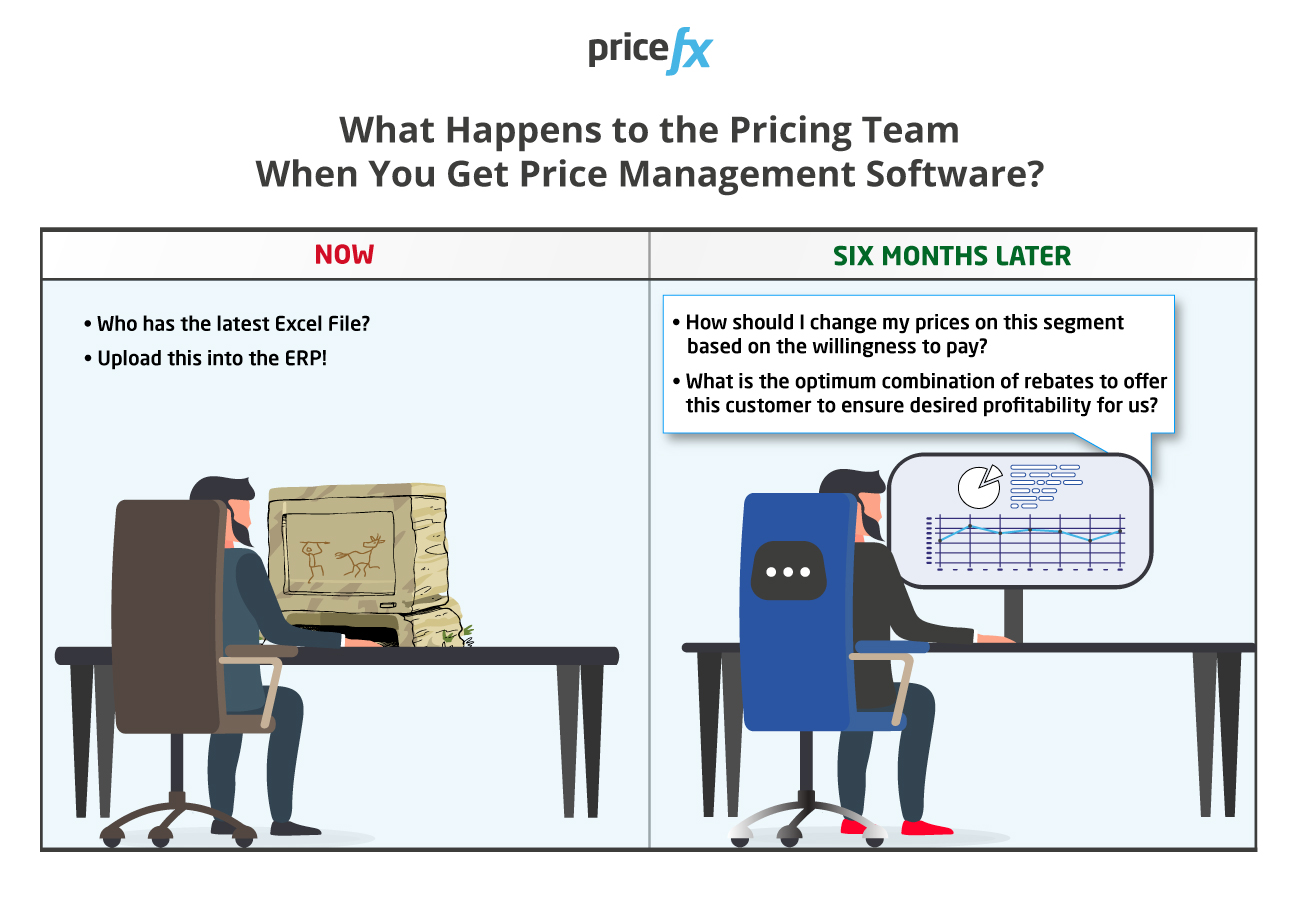

What’s more you can use the time savings gained from your automated pricing software to repurpose your team to find value. For example, with pricing software, imagine a world where you can cut your global price list update time from 2 months to 20 minutes.

With those kind of time savings, pricing teams can be repurposed to go and discover additional pockets of value. Instead of preparing price lists for 2 months, your pricing team can spend that time strategically unearthing pockets of previously hidden value and additions to your bottom line.

5. Gain Customer Loyalty with Transparency – Communicate & Focus on Value

In times of uncertainty, trust becomes more valuable than gold. Customers want to know that you are not taking advantage of the situation, and they appreciate transparency. Guess what builds trust? Yep, you guessed it – fair and transparent pricing based on value.

With pricing software, you can show your customers that you are not playing any pricing games. You are being upfront about your costs and margins, which builds loyalty that lasts beyond the economic storm. When customers see that you are in it for the long haul, they are more likely to stick with you, even when the sun starts shining again.

6. Turn the Tables on Your Competitors

Think of pricing software as your secret weapon – the kind that Lara Croft or James Bond would use to outsmart their adversaries. In a downturn, your competitors are scrambling to keep their prices afloat. But with pricing software, you can do more than just stay afloat – you can rise above the tide.

Imagine being the one business in your niche that is adjusting prices flawlessly, meeting customer expectations, and maximizing profits.

Working with fully integrated software allows you to be faster when it comes to price adjustments, creating competitive advantages. The flexibility to adjust their pricing strategies based on changes in the market gives your business a head start.

It is like taking the lead in a race while others are still figuring out how to tie their shoelaces. By the time your competitors catch up, you’re already miles ahead.

7. Set the Stage for Post-Downturn Success

Every storm has an end, and the economy’s ups and downs are no different. When the clouds eventually part, you want to be in a position of strength. Investing in pricing software isn’t just a short-term fix; it is a long-term strategy.

As you sail through the choppy waters of a downturn, your pricing software is collecting data, allowing you to fine-tune your strategies, and building a foundation for success. When the skies clear and the economy rebounds, you’re not starting from scratch. You’re armed with insights, data, and a pricing strategy that has been battle-tested and ready to drive your business to new heights.

It all adds up to why spending on pricing software during an economic downturn is a savvy move. While others are battening down the hatches and hoping for the best, you are taking charge of your destiny. You are using data, insights, and strategy to weather the storm and emerge stronger on the other side.

In the toughest of economic conditions, the options of losing margin, unoptimized prices and literally guessing your different customer segment’s willingness to pay when you need to be the most scientific and pricing savvy does bear contemplation.

If your business is tired of needlessly throwing away cash during economic downturns, then it is high time to contemplate discovering the realm of pricing software solutions. Check out the article below to get you started:

Or if your organization has already done your research and you are looking to get started with the Pricefx pricing software solution, talk to one of experts today.