7 Insights to Get From Pricefx’s Competitive Analysis Tool

August 22nd, 2023 (Updated 11/23/2023) | 8 min. read

With hundreds of thousands of active SKUs and daily competitive records, resulting in millions of data records per day, the ability for retail businesses to make strategic data-driven decisions about their pricing can feel daunting and overwhelming. Without the analytical pricing tools to quickly process the vast amounts of data pouring in from their competitors and act accordingly, making sense of it all in a meaningful way is nearly impossible. That’s where our new Competitive Analysis tool for retail comes in.

Here at Pricefx, as the leading cloud-native pricing software vendor, we take pride in our continuous search for ways to innovate our offering to support enterprise-level businesses like yours in staying ahead of competitors, and this includes introducing world-class analytical tools that get right at the heart of what matters most to our customers in retail.

In this article, we’ll walk you through the Competitive Analysis offering, including what it is and how it works, and most importantly, the key insights your retail business can expect to leverage when utilizing the tool to inform their pricing.

So, let’s dive in.

Competitive Analysis: What It Is and How It Works

The Product

The Competitive Analysis tool is designed to provide retail businesses with the ability to make sense of large volumes of competitive data, visualized in an easy-to-navigate customized dashboard, and make informed decisions about their pricing across channels, assortment, availability, and regions.

In essence, the tool users to assess competitor activity at a high level to identify market leaders to watch out for and understand the pricing dynamics of specific groups of products or commodities.

The Methodology

Rather than comparing product by product (a level of complexity that does not lend itself well to sourcing transparent actionable recommendations in a sea of SKUs), the goal of the tool is to analyze general market trends to guide quick pricing decision making.

The tool involves building indices of data to normalize and compare information across different products and commodities with competitors. The result? Standardized dashboards with easy-to-understand insights into a company’s market positioning, price differentials, and trends over time, enabling a seamless analytics experience through which retail companies can make strategic decisions backed by real-time competitive intelligence.

Businesses will need to provide their own competitive data to use Competitive Analysis, as the tool is powered by a “bring your own data” approach.

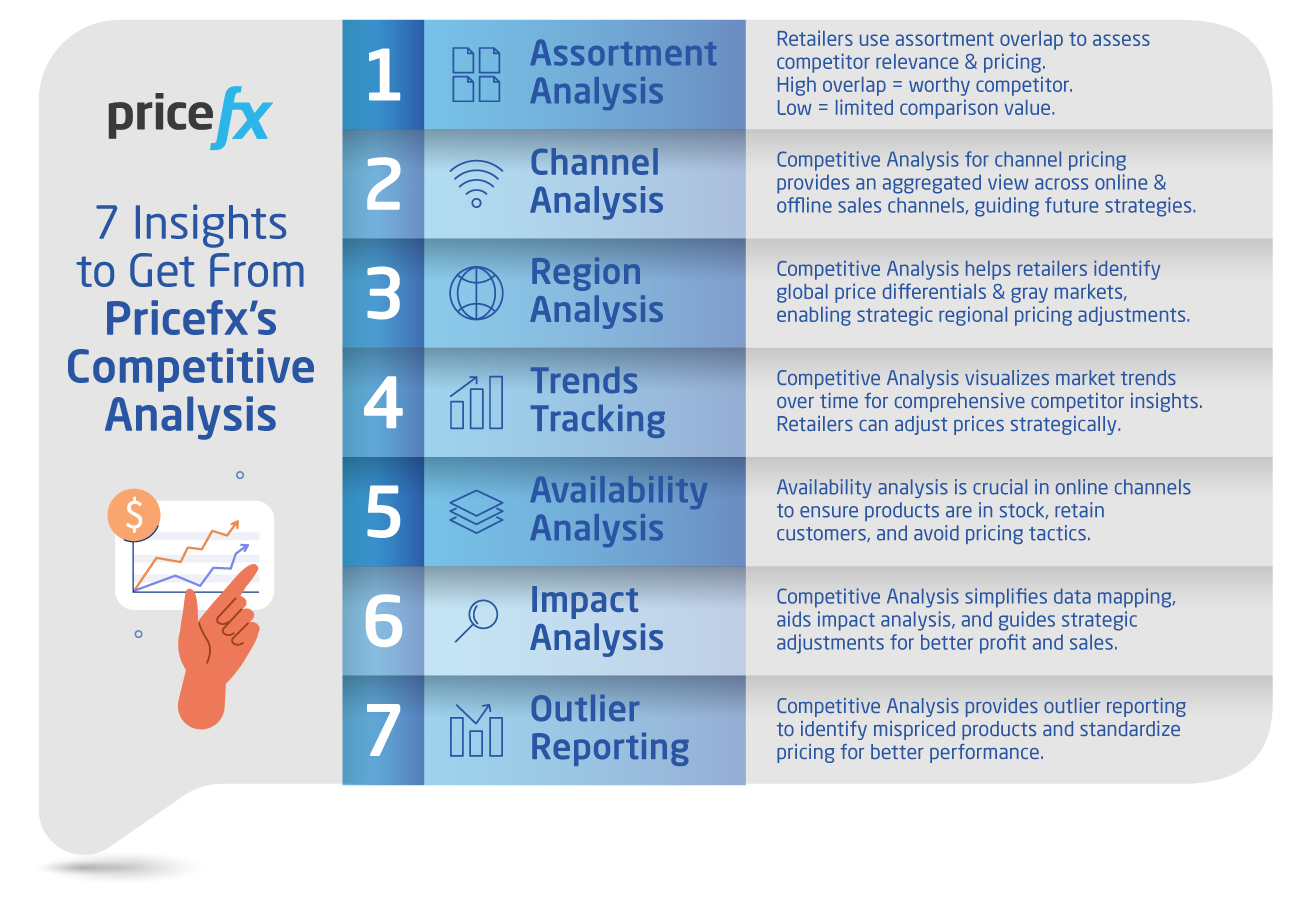

7 Insights to Expect From The Competitive Analysis Tool

Above all, Pricefx’s Competitive Analysis arms retail companies with actionable insights to strategically navigate a volatile and competitive market landscape and stay ahead of the competition.

The key insights companies can expect from using the tool touch on the following 7 areas:

1. Assortment Analysis

Retail businesses can analyze the relevance of specific competitors in a market by determining how much their product assortment overlaps with their own. Positioning competitor pricing through the lens of assortment overlap analysis is vital because it helps users pinpoint which entities with aggressive pricing have a comparable product offering and, by extension, are worth paying attention to.

In practice, while a higher overlap percentage indicates that the competitor covers most of your products on offer, a lower score demonstrates that out of your 50 products in a category, that competitor matches only a handful. For example, an electronics retailer may discover that a competitor is 25% cheaper in a specific brand but only has a 5% assortment overlap, which renders an apples-to-apples price comparison less useful.

With Competitive Analysis, assortment overlap can be easily aggregated across different product ranges and brands to evaluate the pricing competitiveness of competitors in the context of assortment depth and stock levels.

2. Channel Analysis

With so many variables at play informing channel-specific pricing, an aggregated and standardized view of competitive pricing across channels is necessary, particularly in the case of online pricing where distinct pricing strategies drive the pricing of popular channels like Amazon, Google Shopping, or eBay. Competitive Analysis offers the opportunity to easily source competitive pricing data across offline and online sales channels while still maintaining a high degree of granularity in the analysis.

The channel analysis capability considers a wide array of relevant dimensions through which to evaluate channel pricing, including competition types, pricing strategies, regional price differences, to be easily filtered to tailor reporting.

By enabling highly contextualized price tracking across channels, businesses can better assess the performance of their own products and plan their future channel-based strategies accordingly.

3. Region Analysis

Using Competitive Analysis, retailers can better understand price differentials and identify gray markets on a global scale by examining how prices and competitive dynamics vary across specific regions or countries.

For example, during COVID, the price of Nintendo Switch consoles skyrocketed in Germany but remained lower in France. This led many customers to purchase from France and have it shipped to Germany. Region analysis provides a means to pinpoint where price discrepancies exist, how customer incentives have cropped up in each market as a result, and adjust prices across global markets accordingly.

Regional analysis also helps retailers align pricing strategies with regional market conditions and customer preferences. For instance, Amazon has more aggressive pricing in the German market, where it earns a significant portion of its revenue, while it goes on the defensive in the Austrian market. Evaluating regional prices in the context of factors like market share and demand enables businesses to carve out more strategic market-specific pricing and remain competitive in diverse markets.

4. Trends Tracking

While the Competitive Analysis tool is concerned with market trends by default, it offers the added benefit of visualizing those trends over time, as opposed to, for example, over a month-by-month period, to afford companies a more comprehensive look into a competitor’s performance.

Retailers can assess how their prices compare to competitors over time by tracking pricing fluctuations, examining transactional data across multiple dimensions and calculating price indices. For example, when analyzing the pricing history of Apple AirPods Pro, retailers may observe that competitors’ prices initially increased, indicating a more conservative pricing strategy, but later decreased to gain market share, which helps companies understand how reactive they should be in their own prices to remain competitive.

What’s more, instead of solely extrapolating trends based on specific items in isolation, retailers can evaluate pricing dynamics for entire product segments, such as consumer electronics. Applying a broader perspective to competitive analysis helps retailers understand the shape of market trends overall, enabling better informed pricing adjustments that withstand the test of time.

5. Availability Analysis

Similar to the assortment capability, availability analysis involves determining whether a competitor’s products are currently in stock and ready for immediate delivery. This is especially crucial for online channels, for example, when customers visit a comparison website, they typically filter their search results to display only in-stock products, or seek out companies that offer free returns.

The ability to differentiate competitor availability when comparing prices is important, as a company tends to offer a lower price for a product they do not actually have in stock or have delisted.

Availability analysis allows businesses to attract (and retain) customers by ensuring that their products are ready for purchase and helps them avoid losing potential sales to competitors who may mislead customers with these kinds of pricing tactics.

6. Impact Analysis

The Competitive Analysis tool also simplifies the process of mapping external and internal data sources, internal KPIs, time zones, and nomenclatures, allowing a more birds eye view of the market reality with which companies can perform impact analysis more effectively. For example, analyzing the turnover of a specific product group based on competitive data can determine the impact of making changes to that group over time, which lends itself to discovering more optimal strategies to drive more profit and sales.

In short, companies can perform impact analysis to assess the effects of various factors on their product performance and make strategic adjustments accordingly.

7. Outlier Reporting

Finally, Competitive Analysis offers outlier reporting, which involves a dashboard that displays relevant anomalies within a specific product group. This feature allows for step-by-step analysis of a wide range of factors such as current turnover, profit, number of competitors, SKU index, and stock availability, enabling businesses to identify mispriced products and take immediate steps to standardize the black sheep in their pricing.

Stay on Top of Retail Competitors with These Key Metrics

In a market landscape as volatile and complex as retail, the companies with easy-to-use, robust analytical tools like Competitive Analysis can respond swiftly and strategically to competitive intelligence.

In this article, we called out KPIs as a vital piece of data that companies need to leverage in any competitive analytics setup to support successful outcomes. Retail businesses will need to know which KPIs are the most important to watch out for to stay competitive, which is why we’ve written an article about it. Check it out below: