Competitive Data for Distributors: Profit-Driving Strategies

October 23rd, 2023 | 8 min. read

Amidst the increasing market volatility and cutthroat competition that define today’s distribution landscape, keeping a close eye on competitive data is a crucial practice when setting the stage for pricing strategies that drive value. Acquiring competitive data for distributors is straightforward enough through means like web scraping or market research, but how can it then be used for competitive advantage?

Here at Pricefx, as a leading cloud-native pricing software company with distribution among the core industries we serve, we recognize that using competitive data strategically is critical for distributors in their fight to maintain a competitive edge in a cookie-cutter commodity market.

In this article, we outline some strategies distributors can use to transform their raw competitive data into actionable insights, empowering companies to navigate the complexities of the industry while still maintaining a competitive position in the market.

So, let’s dive in.

Why Competitive Data Is Important in Distribution

Competitive data plays a crucial role in distribution pricing strategies for a few reasons. Most notably, it helps businesses understand their competitors’ product offerings using techniques like gap analysis, where companies identify the products and services their rivals provide that they don’t (and vice versa). By being able to recognize these gaps, companies can take action, such as introduce new product or service offerings, boosting revenue and sales.

Additionally, competitive data can be used to refine pricing algorithms to set the right prices for products and services, as well as identify trends in the market and evaluate marketing and promotion activities of competitors.

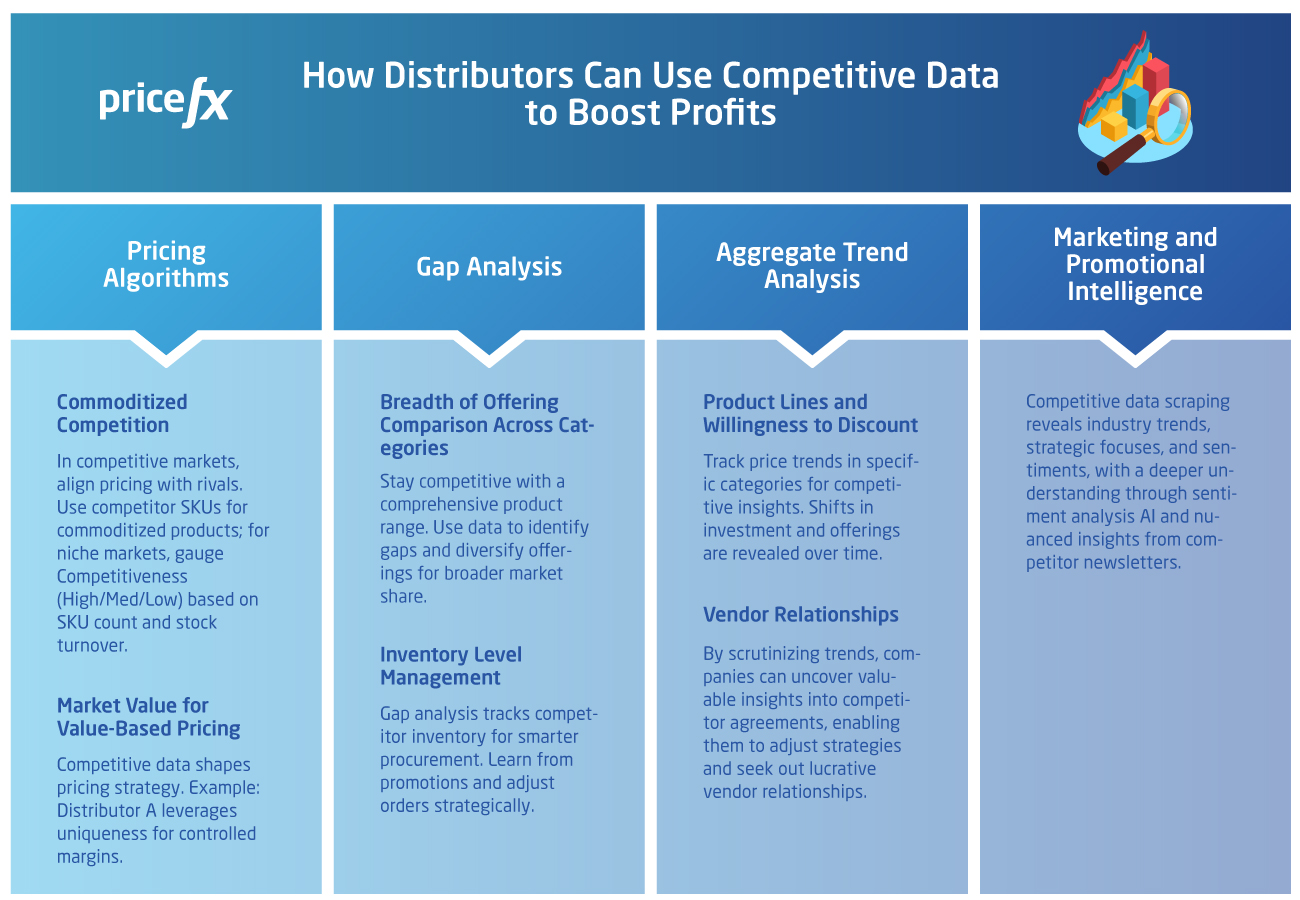

How Distributors Can Use Competitive Data to Boost Profits

Now, let’s take a closer look at the strategies distributors might employ to use competitive data strategically to enhance profits and maintain a competitive edge in the market.

1. Pricing Algorithms

Commoditized Competition

For a product offering that is highly commoditized where one distributor is selling identical or very similar products to another, it is very common to utilize competitor pricing in your own pricing formula. For example, if you’re aiming to be slightly cheaper than the average offering in the market your pricing formula might be something like “MeanCompetitorPrice-1%” in your pricing engine. Of course, this can only work when you can directly correlate a competitor SKU to your own.

For a less commoditized market, it might be common to abstract a “Competitiveness” score for that market – something like “High, Medium & Low”. Depending on that competitiveness, your price formula might be more or less aggressive in seeking margin. To abstract that High/Medium/Low, you would typically look at counting the number of SKUs offered by your competitors in that category and the ostensible throughput of their stock, if you can determine that.

Market Value for Value-Based Pricing

Competitive data can also be leveraged to determine the market value of a product or service to drive its value-based pricing strategies, as competitive analysis helps companies gauge the market and industry contexts they operate within.

Let’s take Distributors A and B again as an example. Imagine Distributor A offers a unique technology solution that sets it apart from its competitors in the market. With a comprehensive overview of what Distributor B and other peers currently offer, Distributor A can then gauge an appropriate price point relative to this, giving them more control over their margins on a product offering that is harder for their customers to directly compare to the competition.

2. Gap Analysis

Breadth of Offering Comparison Across Categories

To remain competitive in distribution, companies should ensure they’re a one-stop shop for all their resellers, and this is where gap analysis helps.

Competitive data enables distributors to gain a comprehensive overview of the product offerings of their competitors across categories, such as product type, brand, or geography, and identify areas where their offerings lack coverage.

For example, consider Distributor A and Distributor B, companies that are nearly identical at a commodity level; both offer laptops, desktops, and computer parts, with major brands like Hewlett Packard and Lenovo. If Distributor A finds that Distributor B is catering to a niche customer base by offering specialized software bundles, Distributor A could then decide to diversify its offerings in that segment. By doing this, they can capture a broader market share than what they’ve seen previously.

Inventory Level Management

As inventory is typically made publicly available on most major distributor websites, depending on the industry or geography, gap analysis also provides an opportunity to monitor competitor inventory levels, which can be used to guide more strategic decision-making in product procurement.

For example, observing dramatic reductions in a competitor’s inventory during certain promotions points to using similar strategies in the future, while stagnant levels for specific products might prompt a company to reevaluate how much of those products is worth ordering.

3. Aggregate Trend Analysis

Product Lines and Willingness to Discount

Instead of tallying up competitor SKUs in a vacuum, businesses can monitor the cumulative price metrics of competitor products within specific categories over time.

Conducting aggregate trend analysis can help businesses identify any shifts in where their competitors are investing, or in terms of offering, what shape it takes across time. For example, when a company observes that a competitor’s aggregate price for a particular product segment has jumped recently but its SKU count has remained consistent, this might be a good indication that they are selling products at a significantly higher price point.

Vendor Relationships

Trend monitoring also offers companies a speculative window through which to gauge potential vendor relationships or negotiated agreements underpinning their competitors’ pricing activities.

For example, consider how Distributor A and B both sell HP products. Distributor A might find that out of nowhere, Distributor B’s HP Server Category falls by 10% over the weekend. This may prompt questions like, what kind of trade agreements from HP are in effect this week? Did they get an upfront discount for hitting certain sales targets? Or do they simply need to move excess stock?

Conducting aggregate trend analysis allows distributors to pull back the curtain on the potential vendor relationships of their peers and implement strategies that effectively react to those agreements.

In essence, theorizing about vendor relationships through the lens of trend analysis allows companies to gain important insights into competitor agreements and adapt their own approaches accordingly. Alternatively, this can indicate which vendors to seek out and strike a deal with, as it’s known which have an MDF (Market Development Funds) budget.

4. Marketing and Promotional Intelligence

Finally, scraping competitive data offers companies a glimpse into the marketing and promotional investments of their peers to uncover industry trends, strategic priorities, and even sentiments.

In e-commerce and retail industries, decoding rival advertising activities across platforms like Facebook and Google ads offers a larger narrative of their strategic priorities, which can be further enhanced with sentiment analysis AI to detect the emotional undertone around those promoted product segments or brands.

For those in distribution, competitor newsletters can serve as a window into how competitors’ promotional focus shifts over time, which is a qualitative insight that more automated processes miss.

What to Remember Before Scraping Competitive Data

Before diving headfirst into the exciting world of competitive data, it’s important to acknowledge the legal and ethical dimensions inherent in data scraping, the process of collecting public data from the web.

First, keep in mind that the laws and regulations concerning data scraping, particularly around personal data and GDPR, may vary across regions. Scrapers should also be mindful of the terms of service on individual websites (as they may include their own data scraping restrictions) as well as the robots.txt files in websites that indicate areas that crawlers should avoid. Additionally, companies should engage in fair play when scanning competitor websites and refrain from deploying an excess of bots that could potentially overwhelm the platform, leading to slow performance or, at worst, a denial-of-service scenario for their customers.

Adhering to local laws around data scraping, as well as striking the right balance between data collection efficiency and website integrity, are best practices that ensure companies collect the competitive intelligence they need without getting their rivals (or themselves) in uncomfortable positions.

Take Your Competitive Data to Greater Heights With Analytic Tools

In this article, we outlined a few important ways distributors can use competitive data to their advantage, including refining their pricing algorithms, closing gaps in their product offerings, keeping up with trends, and monitoring the strategic direction of their competitors.

As you know, competitive data plays a crucial role in enabling companies to set the right context for their pricing strategies. To help, Pricefx offers an analytical tool designed to make sense of your competitive data and drive more strategic decision-making.

To learn more about the key insights offered by our competitive analysis tool, consider checking out our article below: