Distribution Trends & Predictions to Look Out For in 2024

February 1st, 2023 (Updated 01/16/2024) | 13 min. read

With 2024 now upon us, it is time to take stock on what customers value are how that has changed throughout 2023. Distribution trends & predictions for 2024 are still shaped by the lingering remnants of the COVID pandemic, ongoing conflicts in Eastern Europe and the Middle East and mostly decelerating economies worldwide. Market factors are characterized by slowing demand, inflation, and continued market instability. If as a distributor you are positioning with product availability and support ahead of price in importance, it may be time to re-evaluate and also factor into the 2024 equation the increasing importance of digital elements too.

Like most years, in 2024, Distributors have a considerable challenge ahead of them.

At Pricefx, we have spent the last decade helping companies in the distribution industry optimize their pricing strategies, set automated customer-specific pricing processes, and execute real-time price changes to lock in profit.

In this article, we will revisit the trends in the distribution industry that we anticipated for 2023, judge how accurate we were in our predictions, and share the trends we did not see coming. Then we will explore our predicted distribution trends for 2024 and how distributors should be preparing for another volatile and uncertain year ahead.

What Did We Say About Distribution Industry Trends Last Year?

In our predictions for 2023, we told distributors that they should focus on changes in customer demand and to keep a close eye on out-of-control inflation and wildly fluctuating production costs. We also advised distribution to learn from B2B and embrace B2C like e-commerce, and to also use digital technology to help them in doing more with less as when economic times get tough.

Our advice to distributors was to reconsider their pricing strategies as often as changes apply to their sector and to institute a regular price review as part of their pricing strategy. We also urged companies to track their pricing metrics closely, including cost increases; competitor prices; inventory and stock control; picking, packing, and boxing costs; and the cost of any extra services (like delivery, installation, maintenance, etc.). Simulating the effects of your price list updates before they occur has been an ongoing theme for 2023 and will continue to be so in the future.

We believe most things that we predicted and recommended last year still ring true today. However, the world around the distribution business has shifted significantly during 2023 and has invited other immediate short-term challenges.

What Distribution Trends Surprised Us In 2023?

Ever since the initiation of the most significant monetary tightening in years by Western Central banks during the Jackson Hole event in August 2022, economists and market observers have foreseen an unavoidable recession looming over the US and Europe.

In the months turning into years that have passed since then, Europe exhibits indications of nearing an economic downturn and the US economy has displayed unexpected resilience, standing firm amid these challenging times. In that economic landscape, distributors have faced the following surprises.

High Inflation is Stubborn: Could it Return?

Distributors have celebrated the recent decline in headline inflation, but there is some feeling it could return. Inflation’s influence extends beyond monetary factors, demonstrated by widespread strikes in the US auto sector and Europe, driven by workers seeking higher wages to offset inflation. Such psychological impacts tend to persist, creating a challenge in mitigating inflation without a significant economic downturn. Historical data aligns with the notion that sustainable declines in inflation are often preceded by notable recessions.

Inflation’s potential resurgence could significantly impact the distribution industry. Heightened inflation is poised to trigger a domino effect, compelling distributors to grapple with rising costs across the supply chain. Increased oil prices, crucial for transportation, can inflate logistics expenses, thereby elevating overall operational costs for distributors.

As prices climb, the distribution sector might face intensified pressure to absorb or pass on these elevated costs to consumers, potentially impeding sales volumes and altering purchasing patterns. This anticipated inflationary environment poses challenges for distributors, compelling them to navigate a delicate balance between maintaining profitability and preserving market competitiveness.

Persistent Labor Shortages

It was expected to see availability and retention of staff, particularly distribution and logistics staff, start to return to normal during 2023. However, companies are still struggling to recruit and retain delivery drivers and warehouse operatives.

Furthermore, the psychological impact of inflation on labor markets might prompt demands for higher wages among distribution sector employees, mirroring the strikes seen in other industries. This trend could pose workforce management challenges, potentially impacting labor costs for distributors. Balancing competitive wages with escalating inflationary pressures becomes pivotal for retaining a skilled workforce. Not only are companies dealing with the cost of higher wages and constant recruitment, but they are also having to pay significant retention bonuses to get people to stay.

Distributors Remain Underinvested in Technology

In an intriguing turn that we first noticed 12 to 18 months ago, manufacturers are increasingly exploring avenues to directly engage customers, sidestepping traditional distribution channels by establishing their own robust ecommerce platforms. This strategic move allows manufacturers to establish a direct rapport with consumers, a pivot that is gaining traction and transforming the landscape. Leveraging advanced pricing technology, manufacturers are adeptly navigating real-time cost fluctuations and swiftly transferring these increases to distributors, safeguarding their profit margins in the process.

Most surprising is the apparent inertia or hesitancy among distributors to counteract this shift.

Despite manufacturers’ proactive measures, distributors seem reticent or slow to respond to this evolving paradigm, signaling a pivotal juncture for companies in the distribution sector to revamp their digital strategies.

This ongoing trend, which emerged about a year ago, underscores the pressing need for distributors to reevaluate their digital infrastructure and operational frameworks. It’s become evident that this phase demands a rethinking of distribution models, urging companies in this sector to prioritize digital readiness and technological sophistication. Distributors must recognize the significance of adapting to this changing landscape, embracing innovative digital tools, and enhancing their ecommerce capabilities to fortify their position amidst manufacturers’ direct-to-customer initiatives. This period serves as a critical juncture for distributors to recalibrate their strategies, capitalize on emerging technologies, and optimize their digital presence to remain competitive and resilient in a market gradually shifting towards manufacturer-consumer direct interactions.

Top 3 Distribution Industry Trends and Predictions For 2024

It is not doom and gloom in the distribution industry in 2024, however. Here are my Top 3 predictions for the coming year and trends that I believe smart distribution companies will be focusing on.

Watching Price in 2024: The Transformation of Profit Dynamics

In the realm of distributor profit-making, a pivotal shift is underway. While factors like product availability and support have historically held sway, an evolving trend demands a reassessment, compelling us to pivot towards technology. This resounding message echoes: price is asserting its dominance, surpassing other attributes in end customers’ priorities within distributor relationships. The ascent of price to the paramount position is a recent phenomenon, displacing availability from its long-held top spot. Formerly, support lingered within the top-tier priorities but has witnessed a steady decline over the years, particularly following COVID.

What becomes unequivocally evident is customers’ resilience in navigating unprecedented price hikes amid a landscape gradually alleviating supply chain challenges. As businesses strive to curtail costs, price assumes a newfound significance, influencing customer choices and market dynamics profoundly.

For distributors, this presents a dual opportunity – a defensive stance to retain existing clientele while wielding price as a potent methodology to seize new market shares and automated pricing software technology as the tool to execute the strategy.

Best Practice Customer Segmentation

In the distribution industry, serving an extensive customer base is the norm and the pain of undifferentiated strategies reverberates like an echoing gong. You may hundreds of thousands, even millions, of customers all treated with a one-size-fits-all approach. This peanut butter spread of generalized pricing, marketing, and customer service might seem the only option in the absence of effective segmentation. Yet, lurking in the shadows is a nagging unease – the inefficiency in pricing, the missed opportunities in marketing, and the subtle erosion of customer satisfaction that comes from offering the same experience to everyone. But there is the game-changer: customer segmentation harmonizing efficiency, with a symphony of satisfied customers, and a melody of optimized profits.

Customer segmentation transcends being a mere industry buzzword; it stands as a strategic necessity laden with manifold benefits for distributors. Its potential influence spans across diverse dimensions:

One of the most potent realms where customer segmentation wields its influence is in shaping pricing strategies. By systematically categorizing customers into distinct segments, distributors gain a nuanced understanding of each group’s varied willingness-to-pay levels and distinct purchasing preferences. Armed with this comprehensive insight, distributors can finely calibrate and optimize pricing strategies, ensuring they resonate powerfully with each customer segment, thereby maximizing their impact on the audience.

Moreover, the ripple effects of customer segmentation reverberate through the overarching business goals of a distributor. The deployment of targeted marketing strategies, rooted in the insights derived from customer segmentation, often results in a pronounced elevation of conversion rates, a surge in sales, and consequently, a substantial increase in revenue. This strategic alignment of marketing endeavors with specific customer segments enhances the distributor’s overall market positioning and fosters sustainable growth.

The crux of customer segmentation is its profound impact on customer satisfaction – a cornerstone of successful business engagement. By comprehending the nuanced needs and preferences of diverse customer groups, distributors can curate personalized experiences that resonate deeply with each segment. This bespoke approach not only fosters a sense of being understood and valued among customers but also serves as a competitive edge, enabling distributors to provide tailor-made solutions. As a result, this segmentation-induced differentiation in the market landscape not only bolsters customer loyalty but also cements a fortified position for distributors within the industry.

Competitive Data-Tracking as a Profit-Driving Strategy

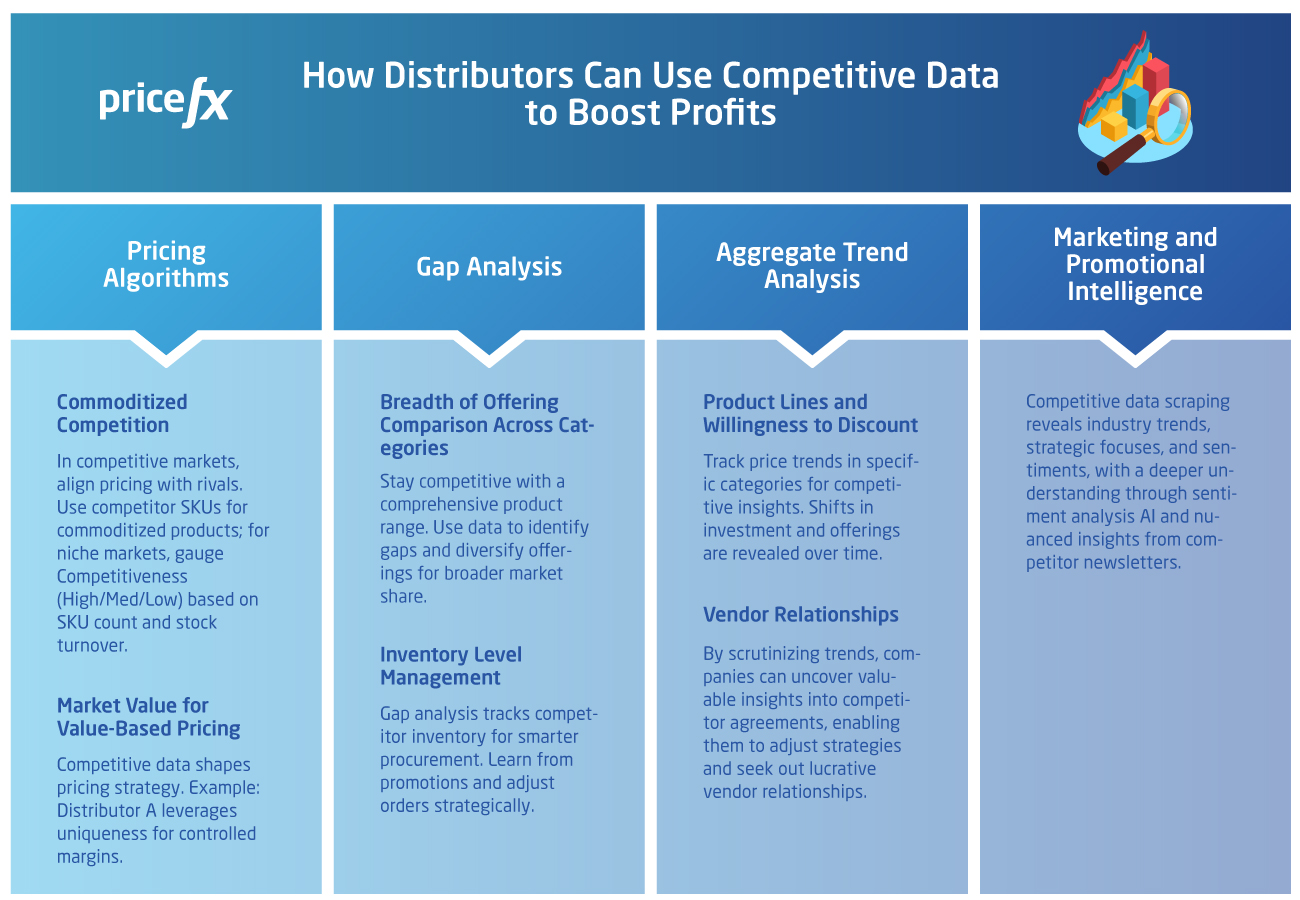

Competitive data plays a crucial role in distribution pricing strategies for a few reasons. Most notably, it helps businesses understand their competitors’ product offerings using techniques like gap analysis, where companies identify the products and services their rivals provide that they don’t (and vice versa). By being able to recognize these gaps, companies can take action, such as introduce new product or service offerings, boosting revenue and sales.

In highly commoditized markets, distributors often integrate competitor pricing into their algorithms to remain competitive. Whether it’s mirroring average market pricing or using a competitiveness score, this data-driven strategy helps align pricing strategies with market trends and competitor positions. Leveraging competitive insights allows distributors to discern market values better, aiding in establishing optimal pricing strategies.

For instance, understanding unique value propositions compared to competitors allows distributors to set prices aligned with their distinct offerings, enabling better control over margins and customer comparisons.

To dive in deeper and learn about how to use your competitive data as a distributor, check out this handy article below:

How Should Distributors Prepare for 2024?

Be Clear About Your Business Objectives

Thinking about where you want to be, not where you are now, is just as important in business. To weather the storm that’s coming (and not steer headlong into it), you need to know your business objectives and how you’re going to get there.

Most companies will say “more growth,” but how are you going to deliver on that? What does that look like in your business? You must have a plan for getting where you want to go. You need to be asking questions like: What level of growth am I going to see through e-commerce? If driving growth through acquisitions, how are we going to integrate those acquisitions into the business in an effective and streamlined manner?

Also consider your business objectives in your pricing plan. Will increasing revenue be your aim? Or will it be how much profit you can make that drives you in 2024? Whatever your business goals, you should be executing a pricing strategy that reflects it. Once you have your overarching business objective and plan mapped out, break it down as much as possible. If your company’s goal is to grow revenue by $2 million, you should know how that $2 million will be made across your different product families, different market sectors, etc.

Invest In Your Future with Digital Transformation

As mentioned earlier in this article, I am shocked by how few distributors are taking the need to digitally transform their business processes seriously.

The benefits of investing in the right technology are many:

- Automation of time-consuming and error-prone tasks (resulting in better accuracy, lower operational costs, and more time to focus on more important things)

- Improved visibility (of processes, resources, costs, pricing, and customer behavior)

- Smarter business decisions (thanks to artificial intelligence and machine learning pitching in after consuming hordes of internal and external data)

- Better customer experience (as ordering and payments are more convenient, experiences are personalized, and accurate customer-specific quotes are much faster)

- Improved overall organizational productivity, flexibility, and agility (making you ready for and capable of anything that comes your way) and;

- More profitability (through automated price setting locking in margins, customer-specific prices, management of complex rebates and agreements, AI-informed price optimization, and data-driven pricing strategies for the short and long term.

While it may seem counterintuitive to invest more during rocky economic times, it is actually when you’ll likely need it most, as it can help you get more done with fewer resources, allocate them appropriately, keep customers happy in challenging times, and make smart data-driven decisions that will help you get through the downturn and take advantage of the recovery.

2024: Let’s Remember It as the Year Distributors ‘Got Granular’

Distributors! It’s time to get granular with costs and prices, focus on what the customer wants, and to embrace the technology that allows you to do more with fewer resources. You’ll need to balance increased availability with changing demand and have a crystal-clear idea of where you want to go as a business and how you are going to get there. Get ahead of the crowd (and the economic recovery) but investing in the technology that will bring greater visibility, efficiency, and productivity to your operations and will help you win customers, minimize risk, maximize profit, and set you up for success.

If you’d like to learn more about the best features that the Pricefx software solution offers distribution industry players, click on the image below to learn more in this handy article:

Meanwhile, Happy Distribution Pricing in 2024!