How to Improve Cost Recovery With Cost-to-Serve Analysis

October 30th, 2023 | 6 min. read

When wedged between volatile commodity prices and inflexible long-term contracts, improving cost recovery has become a central pricing concern within the chemical industry. However, with limited visibility into cost-to-serve elements and their recovery at a segmented level, many companies are missing out on opportunities to plug margin leakage and profit.

Here at Pricefx, as a leading cloud-native pricing software company, we appreciate the distinct challenges the chemical industry faces in pricing due to factors like complex formula-based pricing, supply chain instability, and fluctuating commodity markets. And with less opportunities to adjust core pricing, how well a company can track its more variable cost-to-serve and recovery metrics is decisive.

In this article, we explore why cost recovery and cost to serve are important KPIs in the chemical industry today and outline the key ways pricing software can be used to monitor and improve these metrics in the long term.

What Is Cost Recovery and Cost to Serve and Their Role in Chemical Industry Pricing

Before diving in, we’ll briefly revisit what is meant by cost recovery and cost to serve.

Cost recovery refers to the process of matching the expenses involved in producing and delivering a product with the revenue generated from selling that product. In other words, cost recovery is a measurement of the proportion of costs a business can get back with their chosen pricing strategy.

Cost to serve is the analysis of the costs associated with delivering a product or service to a customer, such as transportation, customer support, or inventory management.

Cost to serve is one of the variables considered when calculating a company’s cost recovery percentage. The more complex the supply chain or customer service demand, the greater the proportion cost to serve will take in total costs. This brings us to why these metrics are important in complex industries like chemical and process manufacturing.

Why Cost Recovery and Cost-to-Serve KPIs Are Important in the Chemical Industry

As chemical businesses tend to make most of their revenue from long-term contracts, variable off-contract costs impacting cost to serve provide one of the only avenues for frequent price adjustments.

With core prices locked into quarterly contracts, companies can mitigate profit loss from fluctuating raw material costs or supply disruptions by implementing their own surcharges, for instance, adding a dollar to a $5 gallon of gas. On the receiving end, customers tend to accept market volatility as a factor driving costs up, so much so that many are willing to pay extra in exchange for the illusion of stability.

Using cost to serve factors to tap into what customers value on a service level, and price accordingly, is a strategy that is especially critical among chemical companies with highly commoditized products. For instance, a company selling dirt to construction firms could take note of certain customers’ willingness to pay more for expedited delivery (as the opportunity cost for waiting to build is too high) and introduce tiered service levels to reflect this.

Understanding how cost to serve varies across customers, and reflecting customer preferences for specific aspects of service in pricing, allows companies in chemical manufacturing to tailor their otherwise traditional, long-term contract-bound pricing to serve them more profitably.

How Pricing Software Improves Cost Recovery

No two customers are identical in their servicing needs, and having the right analytical and price management tools to identify and optimize cost recovery and cost to serve across customers and regions makes all the difference in pricing. In this section, we’ll break down how pricing software can help chemical businesses like yours achieve this.

1. Visibility Into Cost Recovery

In the chemical industry, the intricacies of formula and index-based pricing, coupled with rapid commodity cost fluctuations, can obscure visibility into cost recovery and by extension block opportunities to address underperformance.

Analytical tools such as recovery heatmaps (an example from Pricefx is pictured below) provide a comprehensive view into cost components across customer and geographic segments. Using cost-to-serve analytics KPIs such as freight, packaging, warehousing, and services costs, chemical companies can identify and address cost-to-serve-based underperformance to improve cost recovery ratios and tackle margin leakage head on.

Users can conduct a cost-revenue comparison or calculate the cost to recovery ratio, finding that for example, the cost of freight for a particular customer exceeded the amount their company received back.

Cost-to-serve analysis allows businesses to not only set the right cost-to-serve norms for future trend analysis but can also inform pricing strategies and negotiations with suppliers, ensuring a company’s long-term resilience in the face of a volatile commodity market.

2. Granularity in Pricing

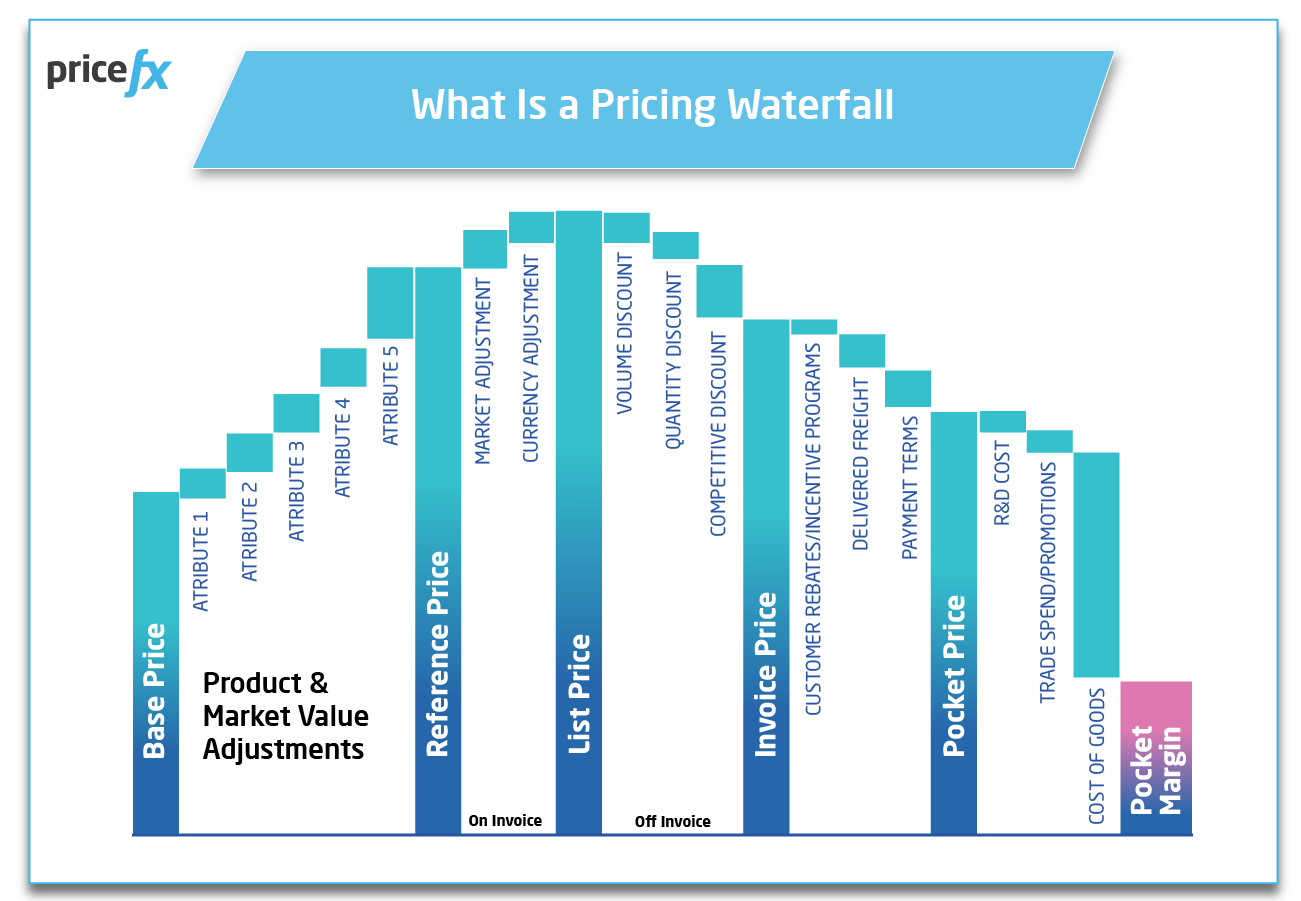

Businesses can take advantage of data visualization tools in pricing software such as pricing waterfalls to understand the activities impacting cost to serve at a highly granular transactional level. They can identify margin-draining transaction items that need to be considered when charging customers, such as cost of payment methods (e.g., credit card fees), payment terms, and freight costs.

From there, users can move along the pricing waterfall to the point at which these charges are outlined in invoices to customers based on specific conditions.

For instance, take a chemical company selling molecules, such as nitrogen or hydrogen, to manufacturing facilities that require hefty containers to transport. Using pricing waterfall analytics, the substantial packaging costs attached to these otherwise lightweight commodities can be anticipated ahead of time and integrated into invoice pricing. To offer another example, chemical companies could incorporate a demurrage charge (a penalty for leaving containers in the port or rail yard beyond the allotted time) within their invoices whenever commercial shipping is involved.

Introducing surcharges like these can easily offset the diverse cost-to-serve elements that appear beyond the base product price, provided companies have the data-driven tools to isolate these elements from their pricing.

3. Applying Insights in Agreements and Quoting

Rather than add to the complexity of an already-complex formula pricing model, companies can seamlessly integrate cost recovery insights into customer agreements and quoting by setting up rules that factor them into their special pricing parameters.

For example, if your company offers varying payment terms of 90 days or less to customers, your contracts and quoting structures can be set up in a way that automatically captures the different charges attached to each, ensuring each agreement remains profitable.

By leveraging integrated pricing software solutions, companies can effectively factor in cost-to-serve fluctuations across its entire pricing operations and support better cost recovery in the long term.

Next Steps: Dive Deeper into Key Chemical Industry KPIs to Consider

In this article, we explored the key ways businesses in complex industries like chemical and process manufacturing can improve long-term cost recovery with pricing software, namely through taking advantage of cost-to-serve analytics KPIs, pricing waterfalls, and integrated pricing features.

As you’ve seen, cost-to-serve KPIs are fundamental to any value-driving pricing strategy in the chemical industry. Are you just as familiar with the other KPIs that should be taken into account?

To learn more, consider checking out our recent article on the top chemical industry KPIs of 2023: