Margin Leakage Prevention: Key Transactions to Focus on

August 1st, 2023 | 10 min. read

In the fast-paced world of business, maintaining healthy profit margins is crucial for long-term success. One area that often leads to margin leakage is transaction pricing. Every transaction, whether it involves selling products, providing services, or entering into contracts, holds the potential to impact on your bottom line. However, by identifying the top transactions that require careful attention and leveraging the power of pricing software, businesses can effectively mitigate margin leakage and optimize their profitability.

At Pricefx, as a provider of modern pricing software, we have spent a decade answering all manner of pressure points from our customers including assisting them to plug their margin leakage gaps.

In this article, we examine the key transactions to pay attention to avoid kissing your profit margins goodbye. Most seem innocuous but beware – remember – it’s frequently the quiet ones you need to watch.

Let’s dive straight right in and discuss why paying attention to your margins is important before we deep dive into the key transaction types to watch like a hawk.

Why Margins Are So Important to Profitability

Margins play a pivotal role in determining the profitability of a business. They represent the difference between the cost of producing or acquiring a product or service and the price at which it is sold. Maintaining healthy margins is crucial as it directly impacts on the bottom line. By preventing margin leakage, businesses can ensure that all their hard-earned profit remains in-house.

Even a small percentage of margin leakage can have a significant impact on the overall profitability of a company. Consider the power of 1% – a mere 1% increase in prices can lead to an impressive 11% improvement in operating margins.

This video and the concepts clarified in it demonstrate the magnitude of the effect that optimizing margins can have on a company’s financial performance. By implementing effective pricing strategies and utilizing pricing software to monitor and adjust prices, businesses can proactively prevent margin leakage and maximize their profitability. It is essential to recognize the value of every percentage point and strive to keep as much profit in-house as possible to drive sustainable growth and success.

Transaction Pricing & Transactions to Focus on to Avoid Margin Leakage

Transaction pricing is a critical aspect of pricing strategy that focuses on the specific pricing dynamics of individual transactions within a business. It involves carefully monitoring and analyzing the evolution of different transaction types and their impact on overall profitability. By paying close attention to transaction pricing and incorporating it into your organization’s pricing methodology, you can significantly enhance your ability to avoid margin leakage and safeguard your bottom line.

Similarly, cost components also need to be watched closely. “Cost recovery” involves being able to see not just standard costs, but actual production/acquisition costs, or not only standard freight but transaction specific freight costs. Less than full truckloads or expedited freight can cause costs to grow, and without a corresponding price adjustment, it all comes from the margin. A price point might look like a winner assuming standard programs, standard costs, and standard freight and operating costs but the reality is that many of these transactions could be below target or even negative.

The key to preventing margin leakage lies in understanding the intricate details of each transaction and its associated pricing components. By closely tracking transaction types, such as bulk orders, subscription renewals, or upsells, you can identify potential areas where profit may erode due to suboptimal pricing. Organizations often have issues especially with rebate or trailing programs and understanding the impact these programs have at the transaction level. Likewise in aggregate, a customer may look healthy with an appropriate amount of gross to net, but that gross to net may be disproportionately impacting a handful of transactions.

This insight enables you to make informed decisions and implement pricing strategies that capture the full value of each transaction. Integrating pricing software into your operations can further streamline this process by providing real-time data and analysis, allowing you to stay agile and respond promptly to evolving transaction dynamics.

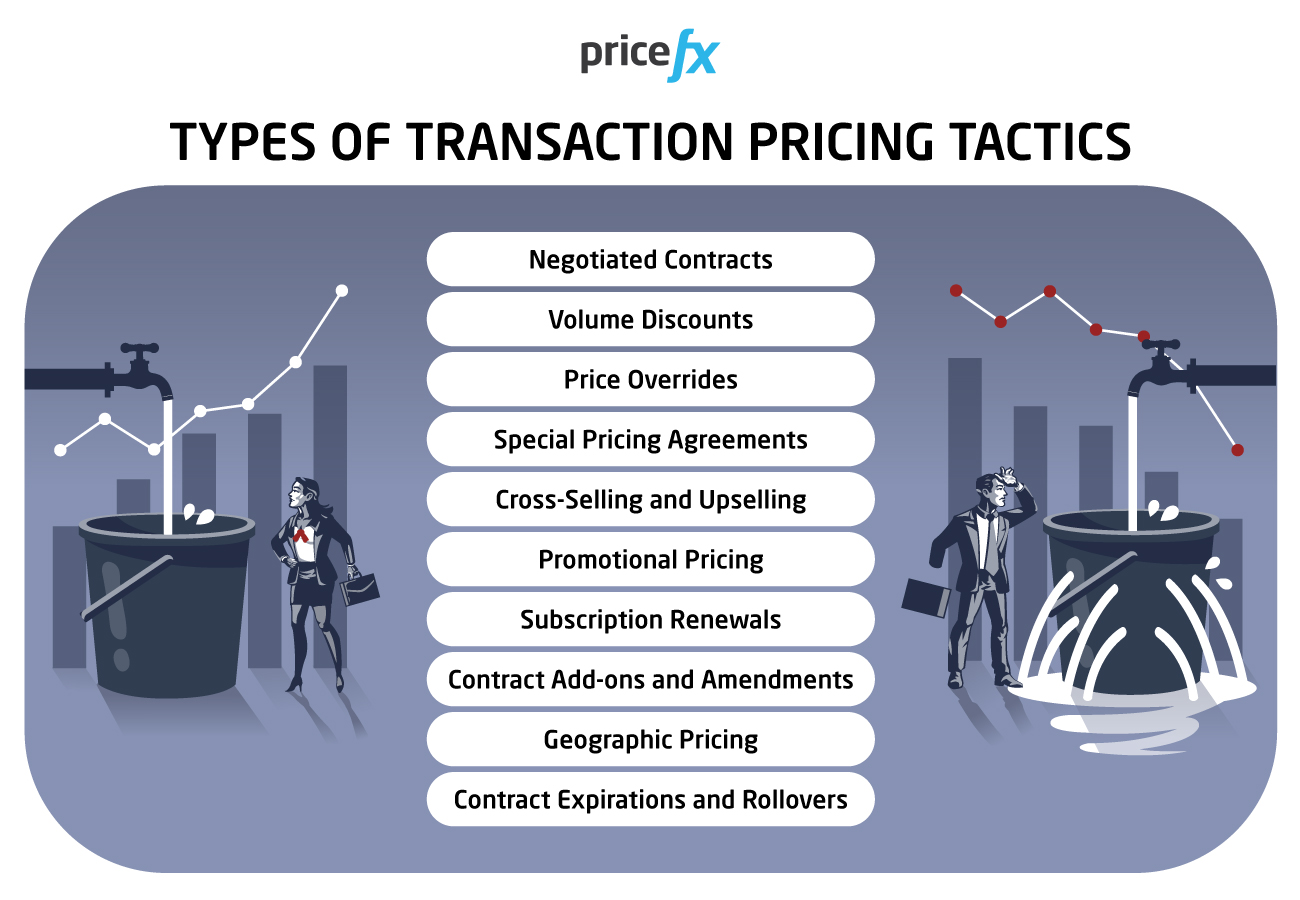

By proactively managing transaction pricing, you can mitigate the risk of margin leakage and protect your profitability. Pay attention and fine-tune to extract the maximum value from every transaction to maintain healthy margins and drive sustainable growth and especially watch these transaction types closely:

- Negotiated Contracts: Negotiated contracts are a common source of margin leakage, as the terms and conditions are often subject to intense negotiations. Pricing software plays a pivotal role in this area by providing data-driven insights and analytics to support contract pricing decisions. By analyzing historical data, market conditions, and customer preferences, pricing software enables businesses to set competitive yet profitable pricing levels. All discounts should be conditional, whether they are automated (for example orders over a certain size get a discount or period or a customer discount for having annual revenue over a certain threshold which is reviewed quarterly or annually). Any promotional or discount program which does not require something of the customer results in a margin give away and lost profit. Whether it’s offering time-limited discounts, bundle offers, or personalized promotions, pricing software enables you to optimize your pricing strategies and save money by maximizing the impact of your promotional activities.

- Volume Discounts: Volume discounts are a double-edged sword. While they can attract customers and drive sales, they can also erode profit margins if not carefully managed. Pricing software empowers businesses to implement dynamic pricing strategies for volume discounts. By analyzing customer purchasing patterns, inventory levels, and cost structures, pricing software can determine the optimal discount thresholds. This allows businesses to strike a balance between attracting volume sales and preserving profit margins, ultimately avoiding margin leakage.

- Price Overrides: Price overrides occur when employees have the authority to change prices at the point of sale or during order processing. Without proper controls, this can lead to inconsistent pricing and margin leakage. Pricing software helps address this issue by establishing guardrails and approval workflows. By automating pricing controls and implementing real-time monitoring, pricing software ensures that price overrides align with established guidelines. This helps prevent unauthorized or excessive discounts that can erode profitability. Price changes should always require approval before activating on an order. Authorizing users to make price changes to orders on the fly is a recipe for disaster.

- Special Pricing Agreements: Special pricing agreements, such as discounts for loyal customers or specific market segments, require careful attention to avoid margin leakage. Pricing software provides businesses with the tools to effectively manage these agreements. By centralizing pricing information, monitoring agreement performance, and automating price adjustments, pricing software helps ensure that special pricing agreements contribute positively to profit margins. This enables businesses to reward customer loyalty while maintaining profitability.

- Cross-Selling and Upselling: Cross-selling and upselling opportunities are valuable for increasing revenue, but if not managed properly, they can result in margin leakage. Pricing software can assist in optimizing cross-selling and upselling strategies by analyzing customer purchasing behavior and recommending relevant product bundles or higher-priced alternatives. By accurately pricing these additional offerings, businesses can capture additional value without sacrificing profit margins.

- Promotional Pricing: Promotions are an effective way to attract customers and generate sales, but they need to be carefully executed to avoid margin erosion. Pricing software enables businesses to simulate and analyze the impact of different promotional pricing scenarios. By evaluating the potential effects on profit margins, pricing software helps businesses design promotions that strike a balance between driving sales and maintaining profitability helping businesses invest their money better. A poor performing promotion may come at the expense of customer incentives, advertising, or lower upfront costs.

- Subscription Renewals: Subscription-based models are prevalent in various industries, and managing renewals is crucial to minimize margin leakage. Pricing software streamlines the renewal process by automating pricing adjustments based on factors like customer loyalty, market conditions, and competitive positioning. By ensuring that subscription renewals are priced optimally, businesses can retain customers while protecting their profit margins.

- Contract Add-ons and Amendments: When customers request add-ons or amendments to existing contracts, it is essential to assess their impact on pricing and profitability. Pricing software enables businesses to evaluate these changes by analyzing customer usage patterns, cost implications, and market dynamics. With accurate pricing recommendations, businesses can navigate contract modifications while safeguarding their margins and ensuring that additional services or products are priced appropriately.

- Geographic Pricing: Pricing variations across different geographic regions can pose challenges for businesses. Pricing software facilitates geographic pricing by analyzing market conditions, local demand, and competitive landscapes. By aligning prices with regional dynamics, businesses can maximize revenue while avoiding margin leakage and maintaining consistency across different markets.

- Contract Expirations and Rollovers: Managing contract expirations and rollovers is crucial to maintain pricing integrity and minimize margin leakage. Pricing software helps businesses stay on top of contract lifecycles by providing timely alerts, automating renewal processes, and analyzing pricing adjustments based on contract terms and market conditions. Especially with annual contracts, the number of renewals can be so great that without software to assist, most organizations resort to memorializing pricing year over year, ignoring cost head winds and setting a standard with customers which can be hard to remove. Managing contracts with automation ensures smooth transitions, eliminates pricing gaps, and supports the preservation of profit margins.

How Pricing Software & Good Strategy Work Hand-in-Hand to Mitigate Margin Leakage

As great as pricing software is, it cannot manage margin leakage and rampant price fluctuations independently and help you grow your business without paying attention. Your organization will also require a good pricing strategy that suits your company’s unique business goals in combination with the pricing software that can best help you execute it.

Pricing Software cannot singlehandedly set your company’s business strategy, whether it is a competitive pricing strategy, value-based, dynamic pricing strategy or low upfront price with few programs’ vs high price with lots of incentives. However, it will help you execute whatever your strategy choice is. As your business grows, your pricing software will then assist in proactively tracking, setting, and changing all those thousands of prices that are fluctuating, and in the process, protect your profit margins.

The most important thing to remember is that pricing is not a ‘set and forget.’ If you fall asleep at the ‘pricing wheel’ that could potentially be the biggest margin leakage risk of all.

It pays to be proactive, so you are never in a position where you must report losses because you were not ready to act. Many companies resort to standard or default analysis due to the number of data sources which need to be used and the frequency at which changes come. Pricing software can help streamline pricing by helping organizations plan at the strategic level and execute at the tactical transaction level even in highly dynamic environments where the data needed to understand margin can change daily.

If you would like to continue your pricing software learning journey, check out the article on the link below to help you select the best and most comprehensive pricing strategy for your business:

On the other hand, if you have your pricing strategy ducks in a row, talk to one of our experts today to start plugging your margin gaps by diving into pricing software and unlocking its potential.