Ticketmaster’s Dynamic Pricing: What It Is and How It Works

August 2nd, 2023 (Updated 11/24/2023) | 8 min. read

When it comes to dynamic pricing, few names resonate as prominently as Ticketmaster. With a spike in demand for live entertainment in the last year – and wildly inflated ticket prices to match – as venues become operational again, The Wall Street Journal dubbed 2023 “the year of the $1,000 concert ticket”. Should Ticketmaster’s dynamic pricing share the blame?

Here at Pricefx, as a cloud-native pricing software company dedicated to empowering businesses to implement their pricing strategies effectively using software solutions, we believe there is valuable insight to be gained from even the most controversial pricing narratives.

Ticketmaster is one of those cases we’d like to explore, drawing a line between pricing strategy and other factors that contribute to success.

In this article, we’ll unravel Ticketmaster’s dynamic pricing and go on to examine other factors that catapulted the industry giant to its dominant position in the live entertainment market.

Before diving in, please note: these conclusions are solely the opinion of the creator and do not necessarily reflect factual or universally accepted viewpoints or include all applicable factors.

What is Dynamic Pricing and How Does it Work?

Dynamic pricing is the strategy of adjusting prices in real time in response to market forces like supply and demand, cost fluctuation, competitor pricing, and consumer buying behavior.

Unlike fixed pricing models, dynamic prices are constantly in flux, driven by complex pricing rules or machine learning algorithms that take in large data sets from historical sales and competitor price data to arrive at an appropriate price point for any number of product and customer segments.

Common Types of Dynamic Pricing

Several types of dynamic pricing strategies exist, including:

- Time-Based Pricing: A strategy in which different prices are set according to the time of day, day of the week, or season. Entertainment and hospitality industries use this method, among others.

- Demand-Based Pricing: Prices are adjusted according to a market’s supply and demand dynamics. When a product’s supply is limited, the price increases, and when demand is low, the price decreases. Airline companies use this method to position their prices for flights.

- Surge Pricing: This involves setting peak prices during periods of high demand. Ridesharing companies like Uber use surge pricing to encourage drivers to work when demand is high, helping to balance high demand with the limited availability of drivers.

- Personalized Pricing: Prices are tailored to an individual consumer’s buying behavior, including their past purchases, loyalty status, and browsing habits. E-commerce is one of the industries that uses this approach in this pricing.

- Segmented Pricing: Prices are tailored to specific consumer groups (e.g., senior citizens or students). Although it resembles personalized pricing, segmented pricing takes a broader approach by categorizing consumers into larger archetypes instead of focusing on individual targeting.

Many businesses today use any combination of the strategies mentioned here. In the following section, we’ll explore Ticketmaster’s own approach to dynamic pricing.

How Ticketmaster’s Dynamic Pricing Works

Ticketmaster, a US-based entertainment ticket sales company owned by Live Nation Entertainment, is likely the most profiled example of when dynamic pricing falls short of consumer needs.

Despite being met with protest, Ticketmaster’s ticket prices continue to climb in parallel with new levels of demand brought in by a reopening of all its operating markets. Live Nation’s president remarked that “every sign points to incredible demand for live events,” including sales, attendance, and onsite spend like food and drink.

Let’s break down Ticketmaster’s dynamic pricing strategy, including the kind of data driving its conclusions, to get a fuller picture of Ticketmaster’s approach to pricing.

Ticketmaster’s Approach to Dynamic Pricing and the Consumer Response

At its core, Ticketmaster’s approach to dynamic pricing is a largely demand-based pricing model in which prices go up and down in real time based on the level of interest and the number of seats available.

The ticketing company regularly employs dynamic pricing in the U.S. and in the UK for many popular performers, including Harry Styles and Coldplay.

High-demand events, such as popular concerts or sports championships, are most likely to have a substantial price tag (Taylor Swift and Bruce Springsteen are a few big names making headlines in the past year for using Ticketmaster’s dynamic pricing to ramp up ticket prices to unprecedented levels). Tickets for Bruce Springsteen’s concert were reported to cost as high as $5,000, resulting in pushback from the public and a discussion on who profits from these price hikes.

In response to the backlash, Ticketmaster has responded largely by explaining how dynamic pricing works. The ticketing giant says on its website that tickets for popular performers are driven by demand from fans, and claim that this practice “enables artists and other people involved in staging live events to price tickets closer to their true market value”.

While there isn’t a pure formula for calculating the “true” market value of a product or service, or a set of conditions that warrant such drastic price adjustments, it’s worth exploring the data sources Ticketmaster relies on most to calculate its pricing.

Key Factors Considered in Ticketmaster’s Dynamic Pricing Algorithm to Calculate Prices

To adjust prices, Ticketmaster integrates historical data and supply and demand dynamics of the market into its pricing algorithms.

Based on what we know about how dynamic pricing typically works in the live events market, the following factors are likely to be taken into consideration in its dynamic pricing model:

- Historical sales data, including past demand patterns for the performer in general and for similar events

- Number of seats available before selling out the venue

- Seating segmentation based on proximity to the stage and other factors driving value perception

- Pricing from the secondary ticket market, including those of competitors and its own reselling platform, Ticketmaster Resale

- Seasonal events and holidays, particularly for events related to a specific season or holiday

- Off-peak periods such as weekdays or matinees

In short, Ticketmaster’s dynamic pricing is a composite of demand, time-based, and segmented pricing and considers data that inform each of these strategies.

Dynamic Pricing Is Only Part of Ticketmaster’s Business Strategy

While dynamic pricing certainly plays a central role in Ticketmaster’s business model, it’s important to recognize that the approach is only one aspect contributing to the company’s overall success. These factors have been equally decisive in Ticketmaster’s rise to its current position in the ticket sales market:

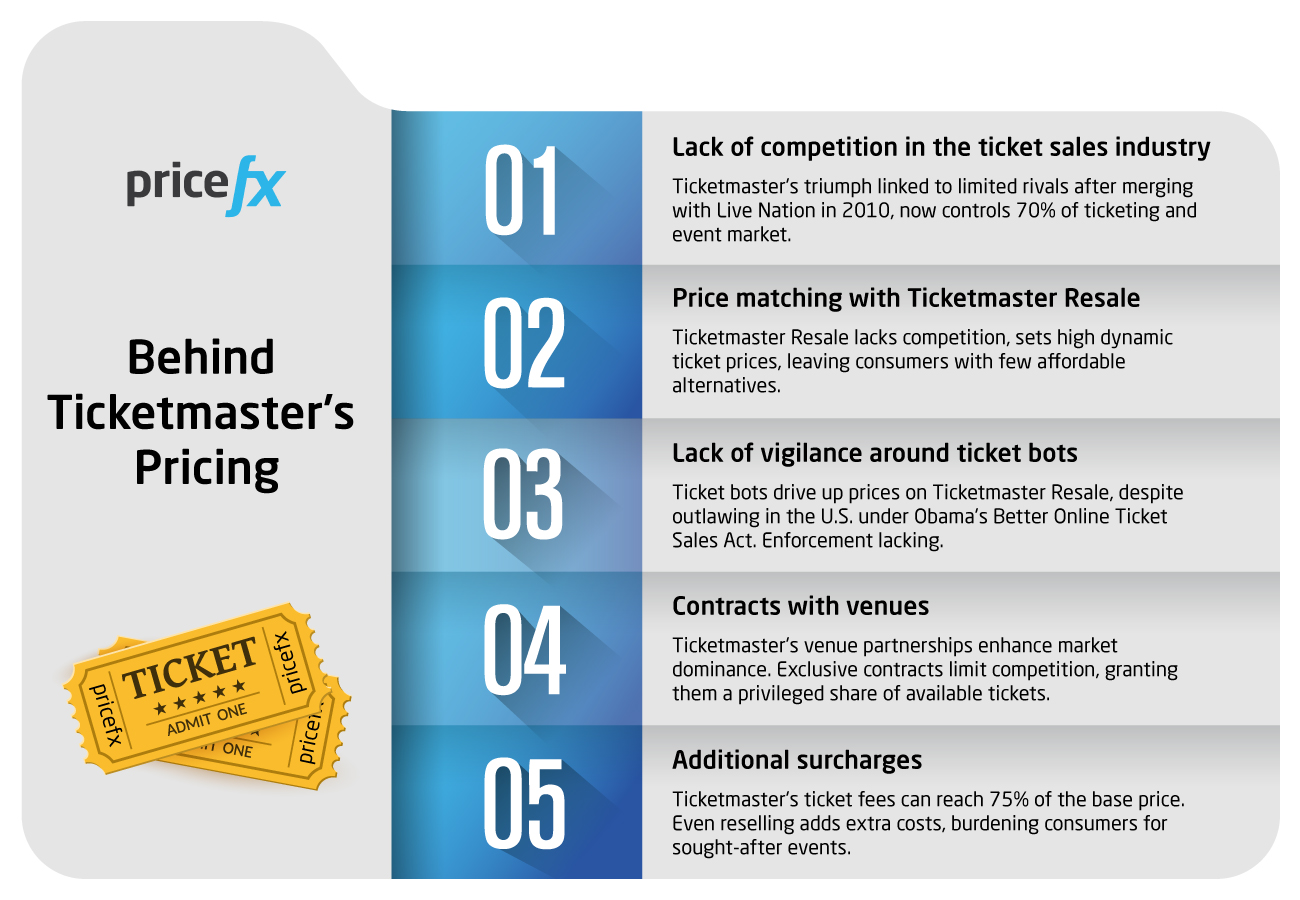

Lack of competition in the ticket sales industry

Many critics attribute Ticketmaster’s unparalleled success to its lack of competition, largely thanks to its merger with the industry giant Live Nation Entertainment in 2010. Despite not being the sole player on the market, Ticketmaster-Live Nation’s dominance is clear, reported by Yale University to control over 70% of the ticketing and live event venues market.

Price matching with Ticketmaster Resale

Ticketmaster Resale, Ticketmaster’s marketplace for the resale of live event tickets, sets a precedent for the company’s own dynamic ticket prices due to a lack of meaningful competition from other platforms. Faced with ticket prices set by the sellers themselves, often exceeding face value by many times over, consumers often find themselves with few affordable alternatives.

Lack of vigilance around ticket bots

Ticket bots, software programs that automate bulk purchases of online tickets, have been widely criticized for enabling anti-competitive selling practices on Ticketmaster Resale and driving up average prices. While the use of ticket bots has been outlawed in recent years, including in the U.S. under Barack Obama’s Better Online Ticket Sales Act (with fines of $16,000 for violations), the practice still thrives in the resale market due to inadequate enforcement of anti-ticket bot and scalping laws.

Contracts with venues

Ticketmaster’s long-standing relationships with venues also work to further enforce its dominance in the live event market. The company’s exclusive contractual agreements with major venues grants them a privileged share of the tickets available, significantly limiting the participation of other platforms at a comparable level.

Additional surcharges

Ticketmaster’s ticket fees, which cover service fees, order processing fees, and delivery fees in some cases, can amount to as much as 75% of the base price of the ticket. Ticketmaster also extracts fees from its own reselling platform, which adds further pressure on consumers in situations where ticket prices for highly sought-after events have no limit.

Learn More About Dynamic Pricing

Dynamic pricing is just a fraction of Ticketmaster’s story – and their near-monopoly of the live entertainment industry has a lot do with that. In other words, Ticketmaster’s dynamic pricing is just a tool among many the company uses to exercise the market share it has already locked in.

Dynamic pricing takes on different shapes depending on the business context it operates in. To learn more about what it looks like and how it could help your business, check out our comprehensive guide:

To dive deeper into a discussion of the ethical side of pricing, head over to our podcast, Pricing Matters, and give Mission-Driven, Sustainable, and Ethical Pricing a listen.