Are Neural Networks a Good Idea for Pricing?

July 3rd, 2023 (Updated 07/19/2023) | 10 min. read

By Ed Gonzalez

Thinking of handing over your pricing practices to neural networks, the latest newcomer on buzzword avenue? Before diving into the murky depths of what may be the Salton Sea of pricing algorithms, you should first consider the implications of using a neural network for your pricing to ensure that it’s a viable (and appropriate) approach in the long term.

At Pricefx, a leading cloud-native pricing software company, we strive to deliver AI-driven pricing solutions that are understandable, controllable, defendable, and most importantly, practical. Implicit in this goal is a consideration of what kind of data-driven solution is suitable for your business. In light of the increasing prevalence of neural networks in various non-pricing applications, it’s crucial to closely examine their potential in establishing pricing recommendations.

In this article, we’ll first give you a taste of what neural networks are and then go on to outline a few of the many important points your company should consider before taking on neural networks to set prices.

Neural Networks for Pricing: An Introduction

Before beginning, a quick disclaimer: this article is not meant to be an exhaustive account of how neural networks work. Our aim is to provide pricing teams with the most relevant questions they should ask themselves when deciding whether implementing a neural network algorithm into their pricing is a good idea. To this end, we will provide insight into the main concepts of neural networks that will help the reader understand the potential challenges in using this approach to set prices.

A neural network is a popular AI algorithm that can be trained on a data set to attempt to predict how similar data might look in the future. Let’s break this down further with a few main takeaways:

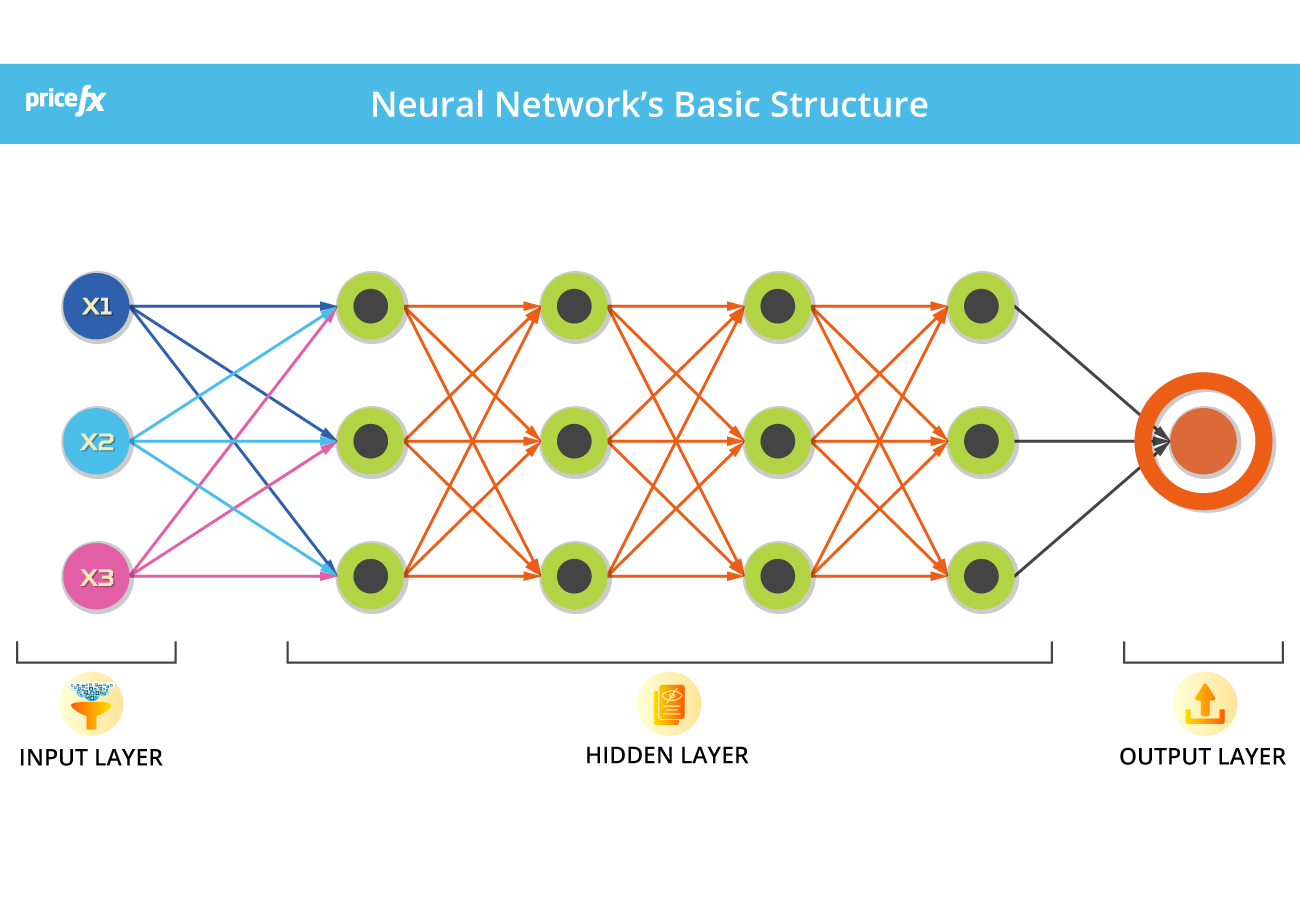

- This type of data evaluation approach is visually represented as a series of nodes and connections.

- When it first appeared in the late 1940s, the approach was given the name neural networks as the nodes and connections looked like neurons that were connected by synapses (a genius marketing move that appears to imply that this structure contains the inherent intelligence found in the brain, which is not the case).

- The initial input nodes take predefined input values.

- The interconnected nodes and connections individually represent simple mathematical computations and collectively provide an outputted recommendation based on their combined analysis.

The diagram below illustrates a neural network’s basic structure:

The complexity here is obvious, as there are many collective components used to generate a recommendation. While individually a neural network’s components are straightforward to understand, when put together in a larger network, the path to its conclusions is virtually undeterminable by users.

In other words, the real mystery of a neural network comes not from its structure but how it reaches its conclusions. And with several hidden layers of activity between input and output, that question is impossible to answer.

5 Questions to Consider Before Choosing Neural Networks for Your Pricing

As you’ve seen, neural networks are inherently difficult to understand. After all, by design, they are meant to provide a recommendation by using anything and everything that seems relevant.

Therein lies the central problem: what is everything and anything when it comes to pricing? Before asking your pricing team to hold your beer and follow the vague promise of a better pricing practice using neural networks, here are a few questions your company should ask themselves first.

How do you know the “bad” prices aren’t driving the analysis in a neural network?

A neural network takes your data and then runs with it without offering you any visibility into its path to output.

The problem there is this: when the data driving a neural network’s conclusions includes every price your pricing team has ever come up with (and more importantly, you have no control over it), there is no way of knowing how much weight the network assigns to historical prices that aren’t representative of your pricing strategy.

After all, you don’t make these kinds of distinctions when you’re feeding a neural network your pricing data; all prices will be treated equally. Instead, you’re essentially saying, “here’s everything we have, give us something back – hopefully it’s something good.”

The reality is that most companies only have a vague idea of which prices haven’t served them well in the past. In fact, that’s one of the main reasons a company chooses to implement pricing software in the first place.

So, if your team doesn’t have a way of distinguishing the good from the bad, we recommend starting there. Using a more transparent structure such as a segmentation model, you can identify the prices in a specific segment or cluster that you know work well, which will then enable you to automatically recognize prices that are too high or low compared to that group and adjust accordingly.

From a practical standpoint, the first step in any efficient pricing process is to strategically identify the good prices from the bad and set up an efficient, transparent process to address this discrepancy. After all, a pricing process shouldn’t be based on the hope that a neural network might produce something logical, because as any pricing practitioner will tell you, hope is not a strategy.

How do you know the prices for your niche products aren’t driving the price of your primary products?

In any pricing strategy, it’s reasonable and expected for your lesser-sold (i.e, middle runners) and niche products (i.e., long tail products) to have a different underlying pricing logic than the more strategic products driving most of your sales. Despite their secondary positioning, middle runners and long tail products still make up a sizable portion of a company’s product portfolio and will influence a neural network’s conclusion. This is important to keep in mind when considering their influence in the overall data.

Even if you manipulate the input logic to distinguish your long tail products from your primary products, the extent to which this distinction drives the analysis will still be unclear to you, or anyone for that matter.

In short, when you input a mix of products into a system like a neural network where results take all pricing logic into account, you won’t be able to discern how the algorithm is calculating the price points coming out on the other side. That could be a problem when your business needs its products to be priced strategically.

In this situation, in order for your pricing strategy to be properly implemented for primary, niche and middle running products, you would need to override the price recommendations generated by the neural network, essentially leaving you with a costly and unusable science experiment.

How can you guarantee that the prices generated by a neural network fit into your pricing strategy?

This question is crucial to consider if your expectation of your data-driven system is to price products at different price points than they’ve had in the past, such as charging certain customers more (do you expect your low-revenue customers to pay more than your high revenue customers?) or setting higher margins for lesser-sold specialized products (do you expect to get a premium for products that you sell just a few times a year?).

A neural network isn’t going to accomplish this. When its conclusions are based on an unknown combination of your historical prices, it won’t always offer price recommendations that are consistent with your pricing strategy. Sure, you might find a few examples where it may appear to be somewhat aligned with what you would expect, but you’re much more likely to find cases where it isn’t.

When it comes to neural networks, you’ll be playing a game of chance with your pricing strategy, which is a risk most companies can’t afford to take.

Can you defend an aggressive price increase your customers haven’t seen before?

Consider this situation: your neural network system suggests that you set a product’s price at 18% more than you’ve charged historically. Naturally, your customers will want answers (that is, if you manage to get your sales rep to quote such an aggressive price change). The question is, will you as a pricing manager know how to navigate that conversation?

Ultimately, the only defense your pricing team will have for aggressive price increases coming from a neural network is simply shrugging and admitting, “this is what the system has come up with.” And that’s not a very comforting message for most people to accept.

As there’s no way of understanding or controlling a neural network’s recommendations, there is no other option but to accept its conclusions as gospel. So, when these kinds of recommendations happen, which is likely to be quite frequently, you’ll need to ask yourself how you will be able to justify these prices.

If this doesn’t sound realistic for your business, you may want to consider a more transparent approach where the criteria for aggressive prices are well defined by your team and can be defended with confidence.

How can you know if your prices are driven by something meaningful to your business?

At the end of the day, you’ll need to ask yourself whether your business is willing to subject its prices to what is in essence a mathematical experiment. Since this approach is nowhere near proven to be effective in pricing, that’s exactly what you’ll be getting with a neural network: an experiment for the engineers behind them.

Without transparency into its logic, there’s no way of knowing the extent to which a neural network’s outcomes are based on a structured process or something much more random. How can you verify that your neural network doesn’t have a strong random component that generates price change recommendations between 1% and 10% to make the results “feel” practical?

When dealing with a process that can’t be understood, you are in essence making a choice to venture into the unknown (and you may end up finding out the hard way that the wizard behind the curtain is nothing more than a lost balloonist with a few stage tricks but no real substance).

In short, without understanding the mechanisms driving the numbers, obtaining certainty about the meaningfulness of the prices generated by a neural network becomes impossible – unless of course, you believe in wizards.

Data-Driven Systems Can Be Powerful Tools in Pricing – Make Sure to Use Them Wisely

At Pricefx, we’re strong advocates of AI-driven price optimization; in fact, it’s one of our core offerings. But we also believe it’s not something that should be taken lightly. Only by carefully considering the implications of AI-driven systems like neural networks can businesses ensure they’re using these pricing solutions for the right reasons.

Your business might be ready to implement artificial intelligence in its pricing but still errs on the side of caution. If this sounds like you, consider checking out our earlier article that addresses what pricing AI can’t do for you so the decision makers in your company are as aware of the limitations as they are of the benefits: