Avoiding Inflationary Margin Compression with Dynamic Pricing

October 12th, 2021 (Updated 06/20/2023) | 3 min. read

The Current Economic Situation

Supply chain disruption and shortages combined with quantitative easing and improved employment have triggered massive inflationary pressure. Many companies and their pricing teams are struggling to keep up with the rate of change and suffering from margin compression and revenue disruption as a result.

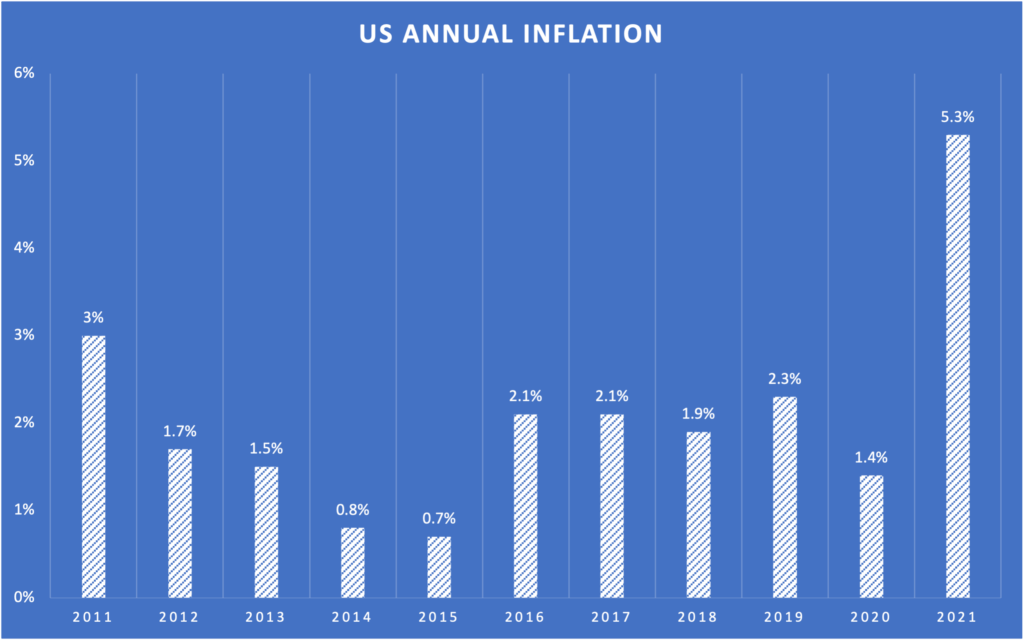

As of September 2021, the annual US inflation rate is at 5.3%, the highest since 1990. Analysts say it could cool down, but it will likely continue at record levels into 2022 and beyond.

Why it’s Hard

It’s difficult for large companies to manage this because many have millions of price points in the market, and 66% of companies still rely on Excel to do their pricing, according to a study conducted by Pricefx in 2021. For example, if you are a manufacturer or distributor with 10,000 products and 10,000 customers, that’s 100 million price points. And many companies have millions of products and tens of thousands of customers. Trying to manage these processes with people and Excel is simply not scalable, precise, or fast enough to respond to market changes and be a price agile enterprise. And to do this right, you also need to be realistic, reflecting the market environment(s) you are in, data-driven, and use willingness to pay to understand where to push price and where you can’t.

What’s the Answer

Proactive, strategic, and rapid price adjustments at scale are the “holy grail.” If your suppliers can do this and you aren’t, the question is not if you will experience margin compression, but how much, for how long, and if you will be able to survive in this new world.

Here is a quick Pricefx case study: a large retailer uses Pricefx to make over 100k price recommendations into over 1000 locations per day on an assortment of 300k active products, leveraging millions of rows of competitive and cost data, and 99.9% of these are automated. This allowed them to significantly grow and maintain market share and profits by responding to changing market conditions quickly and reducing margin compression.

What’s the Value

If you can do this right, the value is compelling. For a $1B company with a 5% annual increase in costs, and 4 weeks to process a price increase, this delay results in $4M in annual margin compression. Just passing along cost increases instantly creates more profit by maintaining the same margin on an increased cost basis. And then, there is the ability to buy into the increase to effectively stave it off while passing on price increases to your customers, and even creating float by predicting price increases before suppliers notify you. Over 90% of B2B buyers are willing to pay more for supply chain continuity, and now more than ever. So, the opportunities to get this right are massive.

Who You Gonna Call?

Pricefx, call us the “Compression Busters.” If you want to see how much this is costing your company every day and how you can make millions more in profit, contact us here.