Chemical Industry Companies: 3 Cool Ways to Increase Revenue

February 21st, 2024 | 9 min. read

By Garth Hoff

In a business environment where chemical industry companies face challenges such as evolving market dynamics, regulatory shifts, and persistent market uncertainties, maintaining agility and strategic pricing acumen is paramount. If your organization is still not prioritizing price in terms of its potential profit-building significance, it might be time opportune to reassess your approach. Position yourself as an industry trailblazer in innovative revenue-boosting strategies for chemical industry companies. While identifying the need to incorporate innovative technologies like pricing software is recognized as pivotal for competitiveness, delving deeper into more granular distinct and tailored strategies may unveil the unique business approach you may require to enhance revenue numbers for your chemical organization.

At Pricefx, we have dedicated more than a decade to collaborating with and assisting our partners and customers in the chemical industry, facilitating the establishment of automated, real-time, customer-specific pricing processes. Our goal is to optimize pricing strategies, empowering businesses to enhance profitability and fortify themselves for future success.

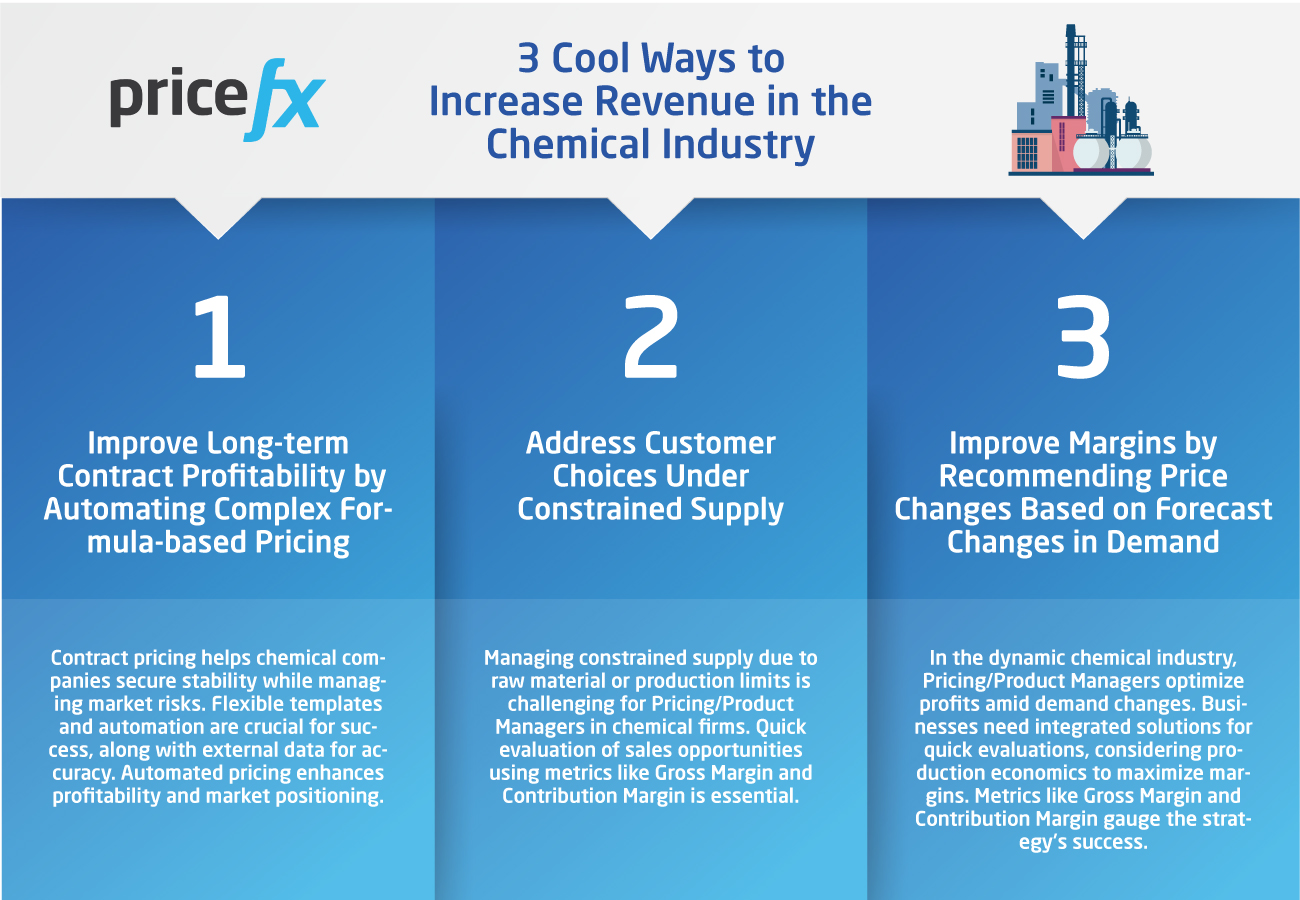

In this article, we will explore 3 compelling strategies and tactics (and show examples of their practical uses) that chemical industry companies can potentially leverage—tailoring their approach based on their specific set of business objectives—to elevate revenue and transform themselves into more lucrative, future-ready organizations.

3 Great Strategies to Increase Revenue for Chemical Companies

In navigating the labyrinth nature of the chemical industry and the tangle of inputs that can lead to a wide range of varying outputs, it is imperative to acknowledge the diverse array of businesses encompassed within this sector. Recognizing that there is no universal formula for achieving revenue growth, it becomes evident that several strategies have showcased considerable success across a wide spectrum of chemical companies. Leveraging our wealth of experience collaborating with entities in the chemical industry, Pricefx has identified 3 pivotal tactics renowned for their versatility and effectiveness.

It is paramount to bear in mind that each chemical company operates within its distinct context, and not every strategy may seamlessly align with a particular business model. Nevertheless, these tactics encapsulate common use cases, offering valuable insights into methods that have proven successful for numerous companies in the chemical sector.

While this is not intended as a complete list of all the different tactics that you can use as revenue-increasing strategies, we suggest that you view these few examples as guidelines and adaptable frameworks designed to inspire and guide your journey toward automated, data-driven, and forecastable revenue enhancement techniques in the dynamic landscape of the chemical industry.

1. Improve Long-term Contract Profitability by Automating Complex Formula-based Pricing

Contract pricing serves as a strategic tool for chemical companies aiming to secure long-term agreements while minimizing the impact of market fluctuations. This method involves the use of a formula that ties product costs or market prices to a fixed margin base, thereby mitigating risks and volatility for manufacturers. The challenge arises in managing the complexity associated with pricing formula libraries, accommodating variations requested by customers or product managers, and ensuring timely updates based on various triggers such as changes in raw materials or market indices.

To overcome these challenges, chemical companies need flexible contract pricing templates that can efficiently handle diverse formulas for multiple customers. Automation becomes crucial in generating new contract pricing triggered by changes in market conditions or costs. Additionally, connecting to a third-party market, cost, and cost-to-serve data enhances the accuracy and relevance of the pricing model.

By incorporating real-time updates and recalculation logic, companies can streamline the contract pricing process, reducing manual errors, and expediting negotiations.

A Practical Example in Automating New Contract Pricing

Consider a chemical manufacturer dealing with hundreds to thousands of contracts requiring frequent updates. By adopting a flexible contract pricing template, the company can use a single formula model to address the diverse needs of its customer base.

Automated processes ensure that contract pricing is promptly adjusted based on changing market dynamics or costs. This not only increases efficiency in the pricing creation and negotiation processes but also provides the company with contextual decision support and profitability forecast modeling.

The integration with ERP (Enterprise Resource Planning) systems facilitates seamless execution of updated customer contract pricing, resulting in improved margins and reduced margin compression.

The key performance indicators (KPIs) for this strategy include monitoring the recency of margin inputs and assessing efficiency and error reduction by evaluating the cost of manual errors and process costs associated with outdated or incorrect pricing inputs. Overall, automating complex formula-based pricing not only enhances profitability but also positions chemical companies for long-term success in the dynamic market landscape.

2. Address Customer Choices Under Constrained Supply

Navigating situations where the supply of a product is constrained due to limitations in raw materials or production capacity requires strategic decision-making, especially for Pricing or Product Managers in chemical companies. The challenge lies in identifying the best margin opportunities when selecting which customers to supply, particularly in scenarios involving spot or inventory-based sales. Calculating comparative economics in such situations can be arduous, and comparing assorted products utilizing the same raw materials or production facilities adds complexity to the analysis.

To address this challenge, businesses need a streamlined means of quickly evaluating the economics of specific sales opportunities in contrast to other spot business for the same product or unrelated products sharing common raw materials or production facilities. This entails the ability to pull together related information on product sales and customer importance swiftly.

Let’s consider a practical example: imagine a chemical company facing raw material shortages for two distinct products. By leveraging advanced pricing tools, the Pricing or Product Manager can swiftly assess the economic viability of supplying each product to different customers. This allows them to make data-driven decisions, ensuring the allocation of constrained supply to customers that yield the highest margins, thereby maximizing revenue for the business.

The resulting benefits are twofold: not only does this approach increase margins during periods of constrained supply, but it also empowers businesses to navigate complexities efficiently, enhancing overall profitability.

Key performance indicators (KPIs) such as Gross Margin or Contribution Margin become essential metrics in gauging the success of this strategy, providing a quantitative measure of the economic impact on the business. Gross Margin, calculated as Revenue minus rebates and cost, and Contribution Margin, derived from Revenue minus rebates and variable costs, offer insights into the financial health of specific sales opportunities and guide strategic decision-making in constrained supply scenarios.

3. Improve Margins by Recommending Price Changes Based on Forecast Changes in Demand

In the continually shifting sands of the chemical industry marketplace, where demand for products can undergo significant swings, Pricing or Product Managers play a crucial role in optimizing profitability through strategic pricing changes. Imagine a scenario where a chemical company, with Pricing or Product Managers at the helm, receives updated forecasts of market demand for various products. Once these forecasts are converted into an official demand forecast, the challenge lies in evaluating alternatives for utilizing common raw materials and production facilities for derivative products. In instances where demand is constrained due to limitations on raw materials or production capacity, determining optimal pricing levels for each affected product becomes imperative to maximize profitability.

To address this challenge, businesses require a quick and integrated solution that allows their team to evaluate updated demand scenarios across multiple products swiftly. This involves accessing valid demand forecasts for related products, integrating an understanding of production economics for derivative products utilizing the same resources, and translating future demand scenarios into pricing plans that optimize margins.

Let’s consider a practical example: when faced with a surge in demand for a particular chemical product, the Pricing or Product Manager can use advanced pricing tools to quickly analyze the impact on related products sharing common raw materials or production facilities, remembering that distinct market types may experience diverse levels of demand.

Imagine that the chemical company operates in both mature and emerging markets.

In North America, for example, where their market is well-established and demand is consistently high and has been for many years, they might be focused there on optimizing margins for profit.

On the flip side, in South America, where the company is looking to expand their recently introduced presence, the emphasis could be on gaining market share, and increasing demand and volume.

By recommending strategic price changes based on forecast changes in demand, based upon the company’s pricing strategy in each region, they can ensure that pricing aligns with market dynamics, ultimately improving gross margin or contribution margin.

Clearly, the divergent strategies and goals require nuanced pricing strategies, which can be precisely crafted and fine-tuned using data analytics.

The resulting benefits are significant, as this approach empowers businesses to proactively respond to shifts in demand, thereby enhancing overall margins. Key performance indicators (KPIs) such as Gross Margin or Contribution Margin become instrumental in gauging the success of this strategy, providing tangible metrics to measure the positive impact on the business’s financial health. Gross Margin, calculated as Revenue minus rebates and cost, and Contribution Margin, derived from Revenue minus rebates and variable costs, serve as benchmarks for the effectiveness of pricing changes in optimizing profitability.

To learn more about accurately forecasting a change in demand in the chemical industry and optimizing your business outcomes and getting it done in the Pricefx solution, check the useful article below:

Discover How to Use Pricefx to Manage Increasing Your Chemical Company’s Revenues

After reading this article and gaining 3 helpful insights into a diverse range of strategies to increase revenue for your chemical company, you may be interested into diving deeper to understand how an automated pricing software solution, such as Pricefx, can effectively address your persistent pricing challenges and bring these and other data-driven revenue busting tactics to fruition.

Check out the informative article below to discover the key features that Pricefx software offers, tailored specifically to cater to the needs of chemical companies like yours:

Meanwhile, Happy Pricing!