Profitable Formula-Based Chemical Pricing: How Pricefx Helps

April 22nd, 2024 | 7 min. read

By Garth Hoff

Contract pricing in the process and chemicals manufacturing industries presents several challenges. Formula pricing, commonly used for long-term agreements in these sectors, should consider a wide array of cost factors at once to be profitable, with market-driven and cost-to-serve costs among the hardest to pin down. And, to complicate things further, the formulas driving price often vary considerably across customer agreements and over time.

How, then, chemical pricing managers keep that many balls in the air while ensuring healthy margins?

At Pricefx, as a leading pricing software vendor with process and chemicals manufacturing among the core industries we serve, we’ve witnessed firsthand the complexities involved in managing formula pricing across diverse customer portfolios and amidst uncertainties in the global market. So much so, that we offer solutions that directly address these challenges.

In this article, we’ll explore how Pricefx supports chemical companies with more profitable contracts in the long term by automating complex formula-based pricing, ensuring sustainable growth even in the most volatile market conditions.

So, let’s dive in!

Why Is Formula-Based Pricing in the Chemical Industry Challenging?

In the chemical industry, pricing for long-term contracts relies on a formula, or index-based, system. When updating prices across agreements, pricing managers in this sector should consider the latest cost to serve, raw material indices, and other variable elements. To add a layer of complexity, each customer agreement can have a unique formula driving pricing, where the reference data for market rates is sourced, and from which period, are left to the discretion of each customer.

For instance, one customer could prefer its contracts to reflect the current month’s material cost index, pulled from a specific market report, while another may request the index from the past quarter, sourced from a mix of online platforms and government agencies. These requirements are rarely stable over time and can easily shift for renewals.

Variability in what drives price in contracts, across customers and over time, is difficult to tackle manually. Chemical companies have hundreds or even thousands of contracts, each requiring a distinct price update frequency and logic. To manage them successfully, pricing managers invest significant effort in calculating new prices, communicating them to customers, and keeping pricing formula libraries and reference data up to date – tasks that are slow going and frequently prone to error when managed with manual tools like Excel.

With various moving parts involved, the price setting and updating process for special contract agreements often gives way to inaccurate pricing in contracts, compromising their long-term profitability.

In the next section, we’ll delve into how Pricefx simplifies formula-based pricing for chemical companies using the power of automation.

How Pricefx Streamlines Formula Pricing & How Chemical Companies Benefit

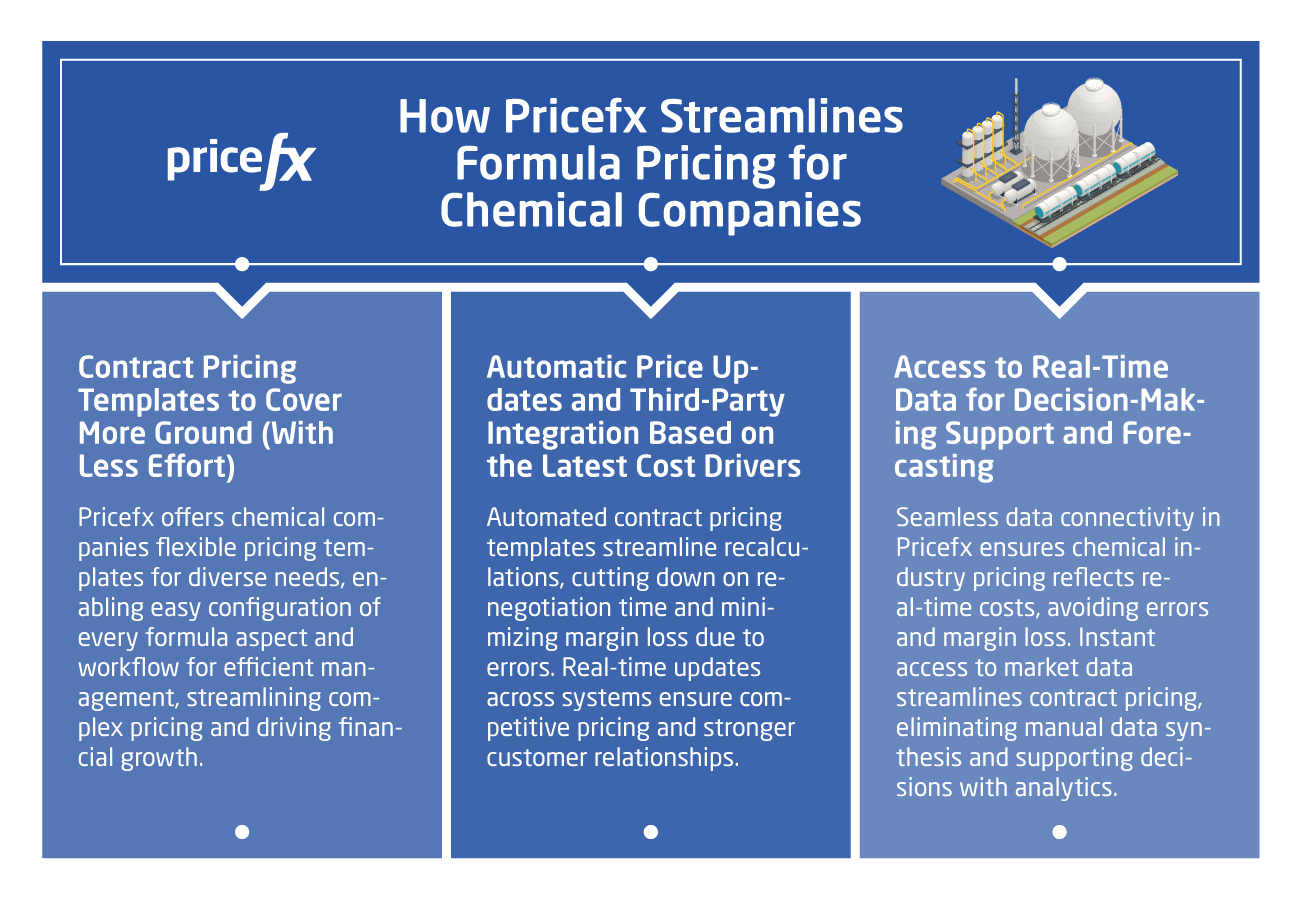

1. Contract Pricing Templates to Cover More Ground (With Less Effort)

To easily accommodate diverse customer needs in formula pricing, Pricefx equips chemical companies with flexible contract pricing templates. And by flexible, we mean that whether you’re starting from scratch or amending an existing template for renewal, every input parameter is configurable.

With input parameters in contract templates spanning customer, product, and formula specifics, the possibilities for configuration are vast enough to cover all initial bases with a few clicks.

In our contract pricing templates, users define every aspect of a pricing formula to suit their requirements and those of their customers – be it raw materials, market indexes and their weighting, base adders, and the formula’s re-calculation period and logic.

Users also input workflows here to support a streamlined approval process in the event of amendments in renewed contracts.

And, to cover a lot of ground with minimal effort, pricing managers have the option to create templates that serve customer segments with similar contract terms simultaneously.

With intuitive templates for streamlined formula pricing management, no matter the formula’s complexity or variability over time, chemical pricing managers can use the effort saved on time-consuming administrative tasks like formula library maintenance to focus on driving sustainable financial growth in their pricing.

2. Automatic Price Updates and Third-Party Integration Based on the Latest Cost Drivers

With contract pricing templates in place, prices will update automatically based on new costs, formula logic, or any other element that shifts over the year, in effect reducing weeks of re-negotiations and calculations to as little as a few minutes.

Bringing automation to the price recalculation process not only allows chemical pricing to stay competitive amidst market volatilities but also helps to reduce margin leakage resulting from manual errors in the long term.

And, with each customer requesting its own recalculation period, whether monthly, quarterly, or annually, as well as unique formula logic, manual contract price management can be a daunting task prone to inconsistencies and delays in invoicing. Automatic price adjustments reduce the effort required for maintaining contract pricing to a mere fraction of what manual processes previously demanded.

Additionally, our platform’s seamless connectivity to third-party systems, whether through APIs, dedicated connectors, or other integration methods, ensures that these price changes are quickly published across all relevant systems.

Our real-time price updating across platforms ensures that chemical companies safeguard margins by reflecting the latest cost inputs, be it raw material prices, market demand, or cost to serve elements. And, by streamlining contract operations to eliminate delays in billing, automated price adjustments in contracts also promote more durable and impactful customer relationships for the years to come.

3. Access to Real-Time Data for Decision-Making Support and Forecasting

Given the fast-paced nature of the chemical industry, where market-driven costs (e.g. for raw materials, such as crude oil) and cost-to-serve elements (e.g. freight) are in constant flux, seamless connectivity to data is key to making contract pricing decisions that are firmly grounded in the present.

And with manual tools, collecting and synthesizing these disparate elements is often time-consuming and error-prone, leading to prices that are either delayed in their delivery to customers or miss the mark on current costs, compressing margins as a result.

The same integration capabilities in Pricefx that allow price changes to appear instantaneously across all platforms also provide chemical pricing managers with instant access to third-party market, cost, and cost-to-serve data sources for their contract price setting and renewal process.

With reference data readily available to inform contract pricing decisions, pricing is kept up to date with the latest cost drivers, doing away with the need for pricing managers to spend hours poring through disparate data sources and updating the changes manually.

Additionally, the data-driven decision support afforded with real-time data integration, namely by way of built-in analytics and forecast profitability modeling, eliminates the need to make decisions in the dark when drafting new contracts or updating existing ones.

Empowered with data-driven pricing insights when drafting new contracts or updating existing ones, pricing managers no longer need to make best-guess pricing decisions that lack context. Instead, they can move forward with pricing proven to have the most impact, ensuring each customer agreement supports their long-term profitability goals.

Discover How Pricefx Solutions Pushes Your Chemical Business Forward

In this article, we’ve walked through a few key ways Pricefx supports companies in process and chemicals manufacturing to ensure long-term profitability by way of streamlining their formula pricing processes.

But wait – there’s more! Bringing automation to complex formula pricing is just a fraction of how our solutions enable companies in these industries to maintain healthy margins and profitability in the long term. Want to discover how our other capabilities help?

Dive into our comprehensive guide on how Pricefx serves process and chemical manufacturers below: